Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

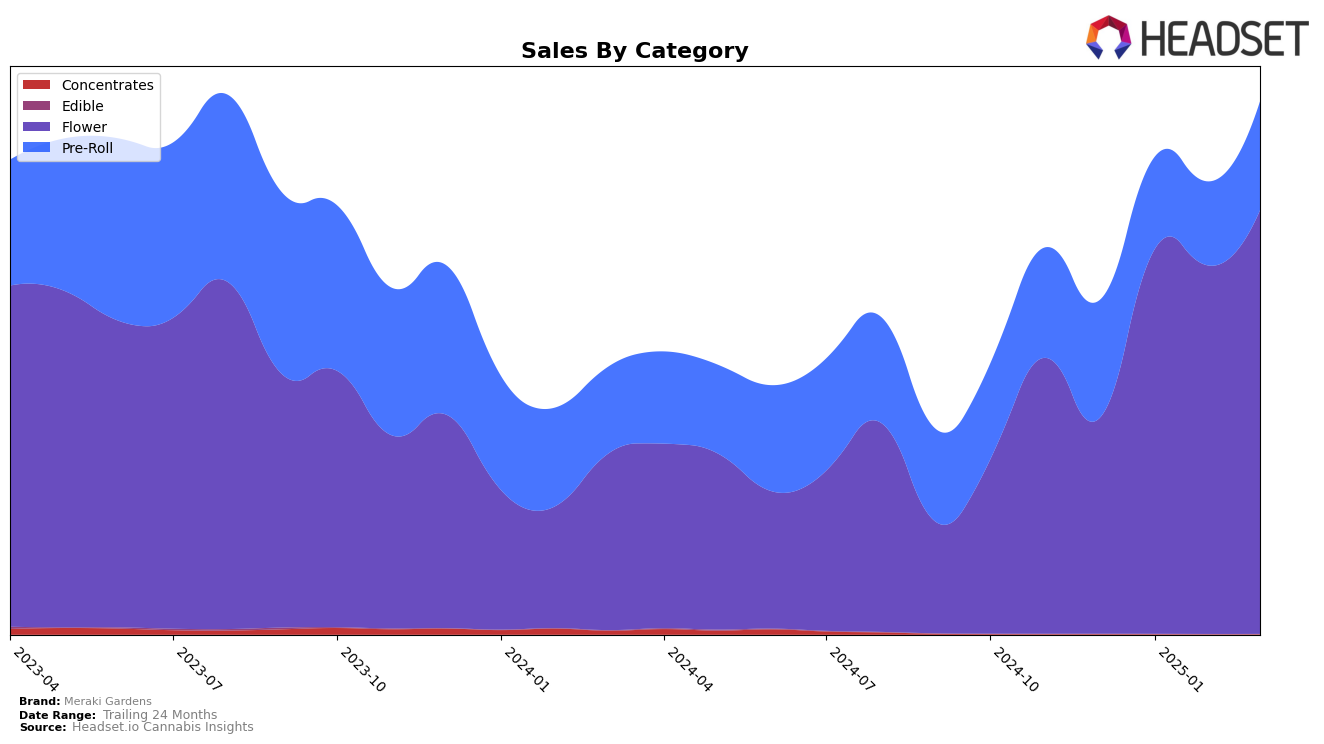

Meraki Gardens has shown a notable performance across different states and categories, particularly in the Oregon market. In the Flower category, the brand has consistently improved its ranking from 12th in December 2024 to 2nd by March 2025, indicating a strong upward trend. This rise in ranking is accompanied by a significant increase in sales, reaching $743,745 by March 2025. In contrast, the Colorado market presents a different picture, where Meraki Gardens did not make it into the top 30 brands in the Flower category until December 2024. However, they have shown a slight improvement, moving from 87th to 71st by March 2025, which suggests a gradual but positive trend.

In the Pre-Roll category within Oregon, Meraki Gardens has experienced fluctuating rankings, moving from 15th in December 2024 to 14th by March 2025. Despite the minor drop in rank in January and February, the brand managed to recover and slightly improve its position. This category shows a more stable sales pattern compared to the Flower category, with sales figures showing some variability but maintaining a level of consistency. The absence of Meraki Gardens in the top 30 for Pre-Roll in Colorado highlights an area where the brand might focus on improving its market presence. This disparity between the two states suggests that while Meraki Gardens has established a strong foothold in Oregon, there are opportunities for growth and development in Colorado.

Competitive Landscape

In the competitive landscape of the Oregon flower category, Meraki Gardens has demonstrated a remarkable upward trajectory in rank and sales over the first quarter of 2025. Starting from a rank of 12 in December 2024, Meraki Gardens climbed to the second position by March 2025, showcasing a significant improvement in market presence. This ascent is particularly notable given the consistent dominance of PRUF Cultivar / PRŪF Cultivar, which maintained the top rank throughout the period. Meraki Gardens' sales growth is impressive, although it still trails behind PRUF Cultivar's substantial lead. Meanwhile, Gud Gardens and Bald Peak also showed strong performances, with Gud Gardens peaking at rank 2 in February before settling at rank 4 in March, and Bald Peak consistently improving to reach rank 3 by March. The competitive dynamics indicate a robust market where Meraki Gardens is rapidly gaining ground, potentially challenging the long-standing leader if the trend continues.

Notable Products

In March 2025, Strawberry Tek (7g) emerged as the top-performing product for Meraki Gardens, moving up from its third-place position in February to claim the number one spot. Strawberry Tek (Bulk) maintained a strong presence, holding steady in the second position, despite a notable decrease in sales to 2662 units. Mango (Bulk) debuted in third place, showcasing a strong performance in its first recorded month. Kush Mints (Bulk) followed closely behind in fourth place, while Gorilla Glue #4 Pre-Roll (1g) rounded out the top five. This month marked a significant reshuffling in rankings, with new entries like Mango (Bulk) and Kush Mints (Bulk) making a strong impact.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.