Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

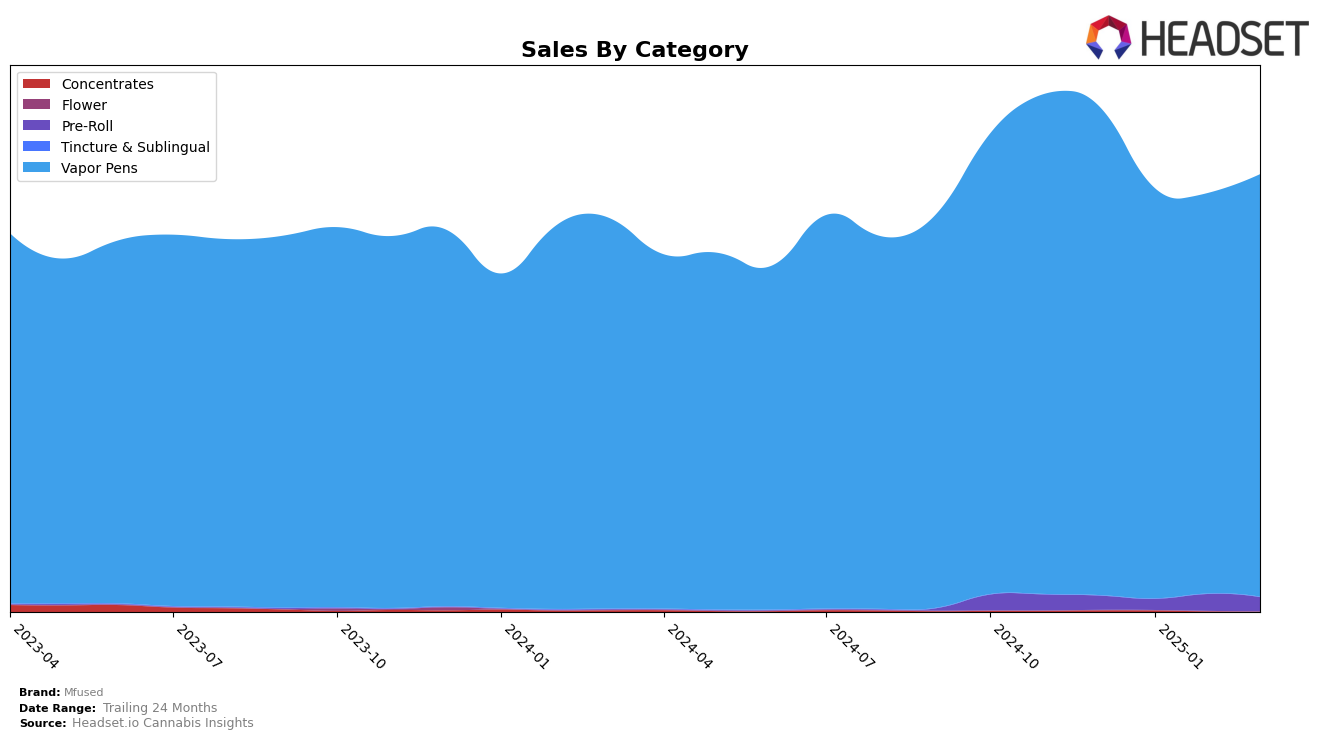

Mfused has shown a notable performance in the Arizona market, particularly in the Vapor Pens category. Consistently maintaining a top-three position, Mfused ranked third in December 2024, climbed to second in February 2025, and returned to third in March 2025. This stability is reflected in their sales, which saw a steady increase over the months, culminating in a significant sales figure in March. On the other hand, their presence in the Pre-Roll category is intermittent, with a notable appearance in February 2025 at the tenth rank, while missing from the top 30 in other months, indicating potential areas for growth or strategic focus.

In contrast, the Washington market demonstrates Mfused's dominance in the Vapor Pens category, where it has maintained the top position consistently from December 2024 through March 2025. Despite fluctuations in sales figures, their leadership in this category remains unchallenged. Meanwhile, in New York, Mfused holds a solid position within the top ten for Vapor Pens, though there was a slight dip from fourth place in December 2024 to sixth place in subsequent months. This indicates a competitive landscape in New York, where maintaining or improving rank will require strategic marketing and product differentiation efforts.

Competitive Landscape

In the competitive landscape of vapor pens in Arizona, Mfused has maintained a strong presence, consistently ranking within the top three brands from December 2024 to March 2025. Despite facing stiff competition from leading brands like Select and STIIIZY, Mfused has demonstrated resilience, climbing to the second position in February 2025 before returning to third in March. This fluctuation suggests a dynamic market where consumer preferences are actively shifting. Notably, Select has maintained its top position throughout this period, with sales consistently outpacing those of Mfused, indicating a strong brand loyalty or superior market penetration. Meanwhile, STIIIZY has shown a similar sales trajectory to Mfused, with a notable spike in March 2025, reclaiming its second position. Brands like Dime Industries and Abstrakt trail behind but have shown potential for growth, as seen in their fluctuating ranks and sales figures. For Mfused, the challenge remains to leverage its current market position to close the sales gap with the leading brands and capitalize on the growing consumer interest in vapor pens in Arizona.

Notable Products

In March 2025, the top-performing product from Mfused was Super Fog - Twisted - Blue Magic Natural Terpene Liquid Diamonds Disposable (2g) in the Vapor Pens category, maintaining its first-place rank from January and February, with sales reaching 9377. Super Fog - Fire - DJ Short Blueberry Liquid Diamonds Disposable (2g) climbed to the second position from fourth in February, showing a notable increase in sales. The Super Fog - Fire - Tropical Sapphire Kush Liquid Diamonds Disposable (2g) debuted at third place, marking its first appearance in the rankings. Super Fog - Loud - Notorious THC Live Resin HTE Disposable (2g) dropped one rank to fourth, despite a sales increase. Lastly, Super Fog - Twisted - Baja Blazed Natural Terpene Liquid Diamonds Disposable (1g) held steady at fifth place, having previously been unranked in February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.