Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

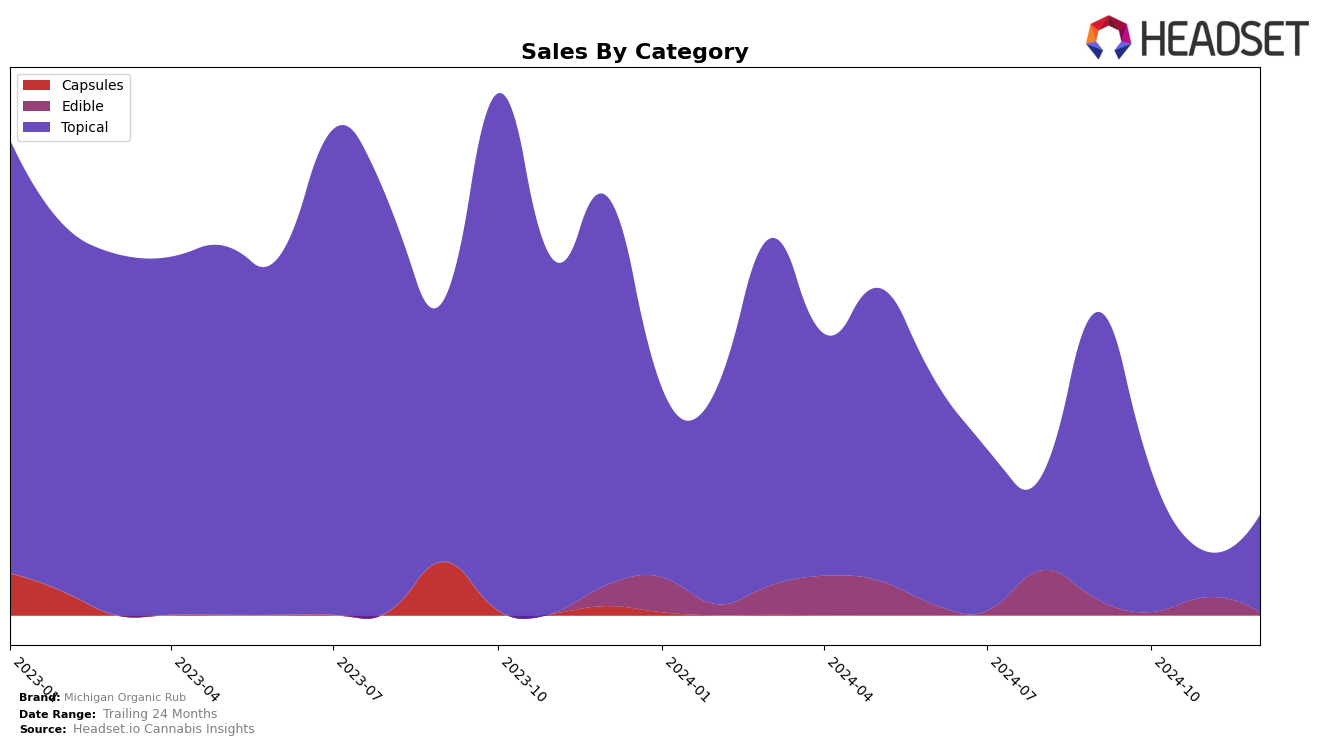

Michigan Organic Rub has shown a fluctuating performance in the Topical category within the state of Michigan. In September 2024, the brand held a strong position at rank 6, but experienced a slight drop to rank 7 in October. Interestingly, the brand did not appear in the top 30 rankings for November, which could be a point of concern or an indication of market dynamics affecting their placement. By December, Michigan Organic Rub managed to regain some ground, securing the 9th position. This movement suggests that while the brand faces challenges, it also has the potential to recover and remain competitive in the Michigan market.

While the sales figures reveal a downward trend from September to December, with a notable drop from $30,684 in September to $10,363 in December, it is crucial to consider other factors that might be influencing these numbers. The absence from the top 30 in November could be attributed to seasonal fluctuations or increased competition within the Topical category. The brand's ability to re-enter the rankings in December, albeit at a lower position, indicates resilience. Observing these trends can provide insights into the brand's strategies and market presence, but further data would be necessary to fully understand the underlying causes and potential future movements.

Competitive Landscape

In the competitive landscape of the Michigan Topical cannabis market, Michigan Organic Rub has experienced fluctuations in its ranking and sales over the last few months of 2024. Starting strong in September with a rank of 6th, the brand saw a decline to 7th in October, and notably, it fell out of the top 20 in November, before recovering slightly to 9th place in December. This downward trend in rank is mirrored by a significant drop in sales, particularly between September and October. In contrast, Primitiv entered the top 20 in November with a 7th place ranking, suggesting a strong market entry or resurgence. Meanwhile, Made By A Farmer and Northern Connections have shown competitive strength, with Made By A Farmer securing the 7th spot in December and Northern Connections ranking 8th in the same month. These shifts indicate a dynamic market environment where Michigan Organic Rub faces increasing competition, urging the brand to strategize effectively to regain its earlier momentum and improve its standing in the Michigan Topical category.

Notable Products

In December 2024, the top-performing product for Michigan Organic Rub was the CBD/THC 1:1 Tangafruit Extra Relief Balm (400mg CBD, 400mg THC, 3oz), which climbed to the number one rank with sales reaching 162 units. Following closely, the CBD/THC 1:5 Coconut Chapstick (10mg CBD, 50mg THC) held the second position, a slight dip from its top rank in October. The CBD/THC 5:1 Lavender Woods Extra Releaf Rub (920mg CBD, 219mg THC) entered the rankings at third place, marking its first appearance in the top ranks. Both the Tangafruit Extra Relief Salve (750mg THC, 3oz) and Vanilla Mint Extra Relief Salve (750mg THC, 3oz) shared the fourth position, showing a consistent performance compared to previous months. Overall, December saw a reshuffling of ranks with new entries and changes in top positions, reflecting dynamic consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.