Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

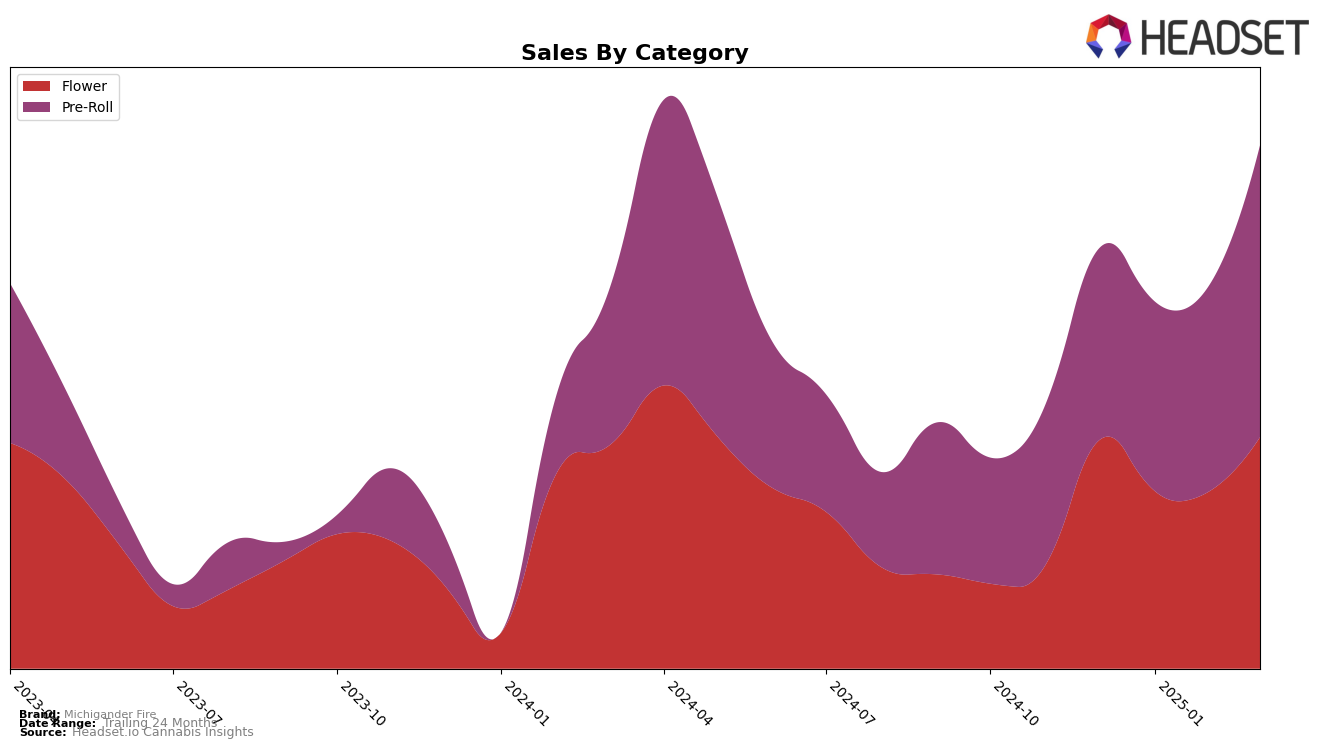

Michigander Fire has shown notable performance in the Michigan cannabis market, particularly in the Pre-Roll category. Over the first quarter of 2025, the brand has made significant strides, climbing from the 38th position in December 2024 to the 24th position by March 2025. This upward trend in ranking reflects a strong consumer preference and potentially effective marketing strategies or product improvements. Conversely, in the Flower category, Michigander Fire was not in the top 30 brands, as indicated by their absence from the rankings for December to February, although they reappeared at 91st in March. This suggests that while the brand is making headway in Pre-Rolls, there is room for growth in the Flower segment.

Despite not being a top 30 brand in the Flower category for most of the observed period, Michigander Fire's sales figures in this category remained relatively stable, with a slight increase from December to March. This indicates a consistent consumer base and potential for growth if the brand can leverage its strengths. The Pre-Roll category, however, has been a clear area of success, with sales increasing significantly from January to March. This boost in sales aligns with their improved ranking and suggests that Michigander Fire is effectively capitalizing on consumer trends in this category. The brand's ability to enhance its position in the competitive Michigan market, particularly in Pre-Rolls, highlights its potential to expand further if it can replicate this success across other categories.

Competitive Landscape

In the competitive landscape of the Michigan pre-roll category, Michigander Fire has demonstrated a promising upward trajectory from December 2024 to March 2025. Starting at rank 38 in December, Michigander Fire climbed to rank 24 by March, showcasing a consistent improvement in its market position. This upward movement is particularly noteworthy when compared to competitors like Peninsula Cannabis, which fell from rank 17 to 22 over the same period, and Presidential, which saw a significant drop from rank 13 to 23. Meanwhile, Redemption and Sapphire Farms have been gradually improving their ranks, yet Michigander Fire's sales growth outpaced these brands, indicating a robust market presence. This positive trend for Michigander Fire suggests a strengthening brand reputation and increasing consumer preference, positioning it as a formidable player in Michigan's pre-roll market.

Notable Products

In March 2025, the top-performing product for Michigander Fire was Permanent Marker Pre-Roll (1g) in the Pre-Roll category, maintaining its leading position from February 2025, with sales reaching 4,212 units. Cap N Kruntz Pre-Roll (1g) made a remarkable debut, securing the second rank with significant sales figures. Cherry Poppers Pre-Roll (1g) improved its standing from fourth to third place, showing a positive trend in sales growth. Miracle Marker Pre-Roll (1g) entered the rankings at fourth place, while Sharp Aliens Pre-Roll (1g) completed the top five. The rankings indicate a dynamic shift in consumer preferences, with new entries making a strong impact in March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.