Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

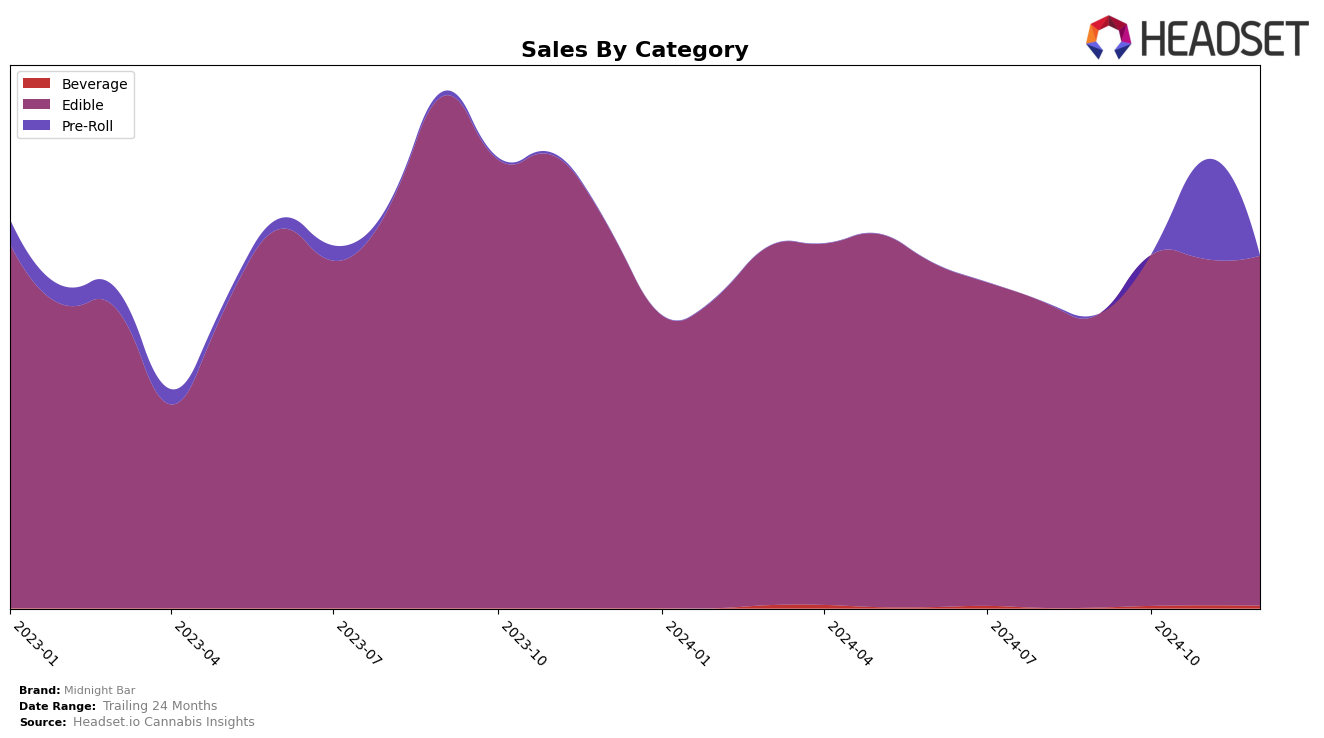

In the state of Michigan, Midnight Bar has experienced a fluctuating performance in the Edible category over the last few months of 2024. While the brand did not make it into the top 30 rankings from September through December, it showed a slight improvement from September to October, moving from the 40th to the 38th position. Despite a slight drop in November, Midnight Bar managed to regain its 39th position by December. This indicates a resilient presence in the market, although the brand still faces challenges in breaking into the top tier of the Edible category.

The sales figures for Midnight Bar in Michigan reflect a consistent demand, with a notable increase in sales from September to October. While there was a slight dip in November, the sales rebounded in December, approaching the October figures once again. This trend suggests that Midnight Bar has managed to maintain a steady consumer base, although it has yet to achieve a breakthrough that would propel it into the top 30 rankings. The brand's ability to sustain its performance despite not being in the top 30 highlights its potential for growth in the competitive Edible market.

Competitive Landscape

In the competitive landscape of the Michigan edible market, Midnight Bar has shown resilience, maintaining a relatively stable position with minor fluctuations in rank from September to December 2024. Midnight Bar's rank shifted from 40th in September to 39th in December, indicating a slight improvement, although it dipped to 41st in November. This stability is noteworthy given the dynamic movements of competitors such as Sauce Essentials, which saw a more significant decline from 29th to 38th over the same period, and Smokiez Edibles, which consistently ranked higher but experienced a downward trend from 36th to 42nd. Meanwhile, Galactic and Skymint displayed varied performances, with Galactic ending December at 35th and Skymint improving from 49th to 43rd. Despite the competitive pressures, Midnight Bar's sales figures remained robust, highlighting its ability to sustain consumer interest and suggesting potential for future growth in the Michigan edible market.

Notable Products

In December 2024, Midnight Bar's top-performing product was Full Moon - Thin Mint Dark Chocolate (200mg) in the Edible category, maintaining its first-place ranking from November with sales of 8,358 units. Full Moon - Strawberry Milkshake Chocolate Coin (200mg) held the second position, slightly dropping in sales compared to the previous month. The Sugar Free Milk Chocolate Bar 10-Pack (200mg) consistently ranked third since October, despite a decrease in sales. Strawberry Milkshake White Chocolate Bar (200mg) re-entered the rankings at fourth place, showing a significant increase in sales from earlier months. New to the rankings, the Creamy Milk Chocolate Bar 20-Pack (200mg) debuted at fifth place, indicating a strong market entry.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.