Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

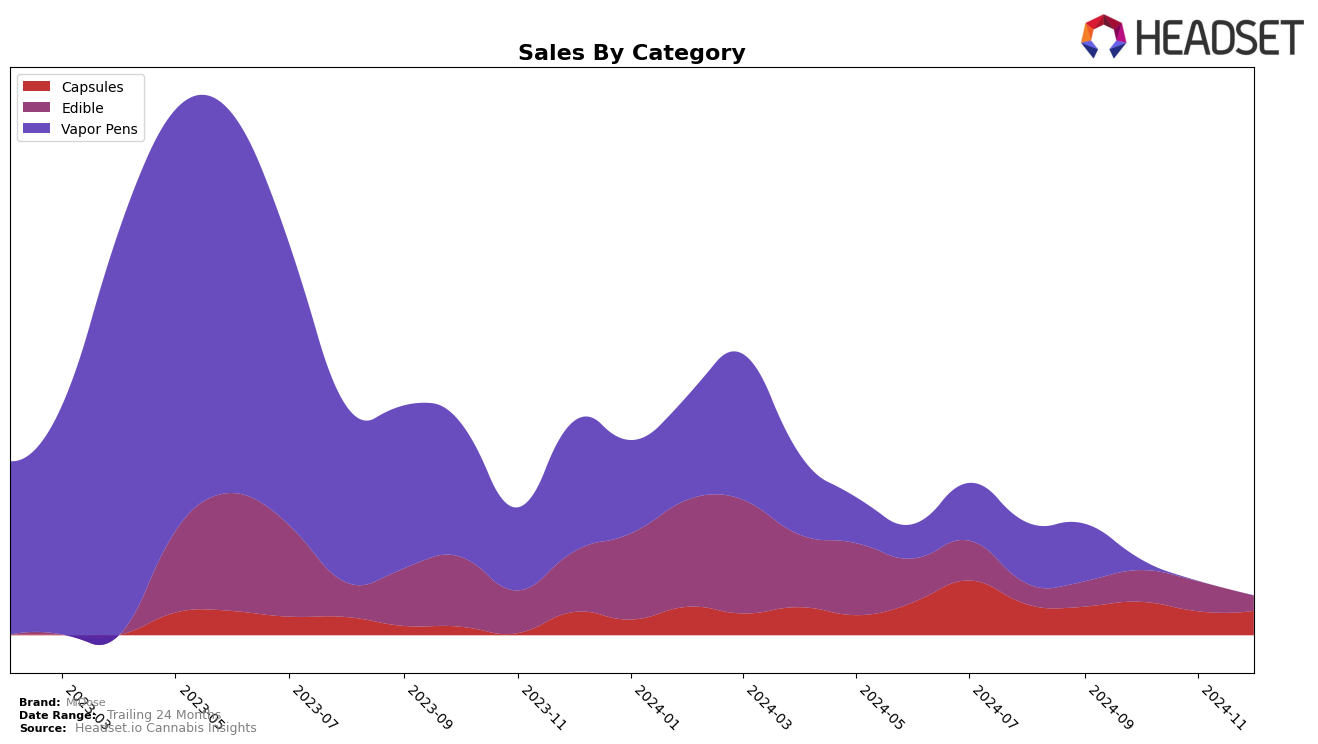

MiDose's performance in the Vapor Pens category within the state of Missouri has shown some interesting dynamics in the latter part of 2024. Despite not breaking into the top 30 rankings from September to December, MiDose recorded sales of $12,914 in September. This suggests a presence in the market that, while not yet competitive with the top brands, indicates potential for growth if strategic adjustments are made. The absence of MiDose from the top 30 rankings in subsequent months highlights a challenge in gaining traction or possibly an increase in competition within the state. This scenario could suggest either a need for increased marketing efforts or a reevaluation of their product offerings to better align with consumer preferences.

Across different states and categories, MiDose's absence from the top 30 rankings may serve as both a challenge and an opportunity. While missing from the rankings in Missouri's Vapor Pens category, this also implies that there is significant room for growth and potential market penetration. The brand might benefit from analyzing the competitive landscape and identifying key differentiators that could elevate its position. Additionally, exploring performance in other states or categories could uncover untapped opportunities. Understanding these dynamics can guide MiDose in tailoring its strategies to improve its market position and capitalize on emerging trends in the cannabis industry.

Competitive Landscape

In the competitive landscape of vapor pens in Missouri, MiDose has faced significant challenges in maintaining its market presence, as evidenced by its absence from the top 20 rankings from October to December 2024. This contrasts with competitors like Flora Farms, which consistently held a position within the top 50, showing a strong performance with a peak rank of 37 in September and maintaining a presence through November. Meanwhile, Sundro Cannabis and Tyson 2.0 have also shown resilience, with Sundro Cannabis improving its rank slightly from 60 to 59 between September and October, and Tyson 2.0 maintaining a presence in the top 100. The data suggests that MiDose needs to strategize effectively to regain its competitive edge, as the market is dominated by brands that are not only sustaining but also improving their positions, potentially affecting MiDose's sales and market share in the long term.

Notable Products

In December 2024, the top-performing product for MiDose was the CBD/CBN/THC 2:1:2 Hush Melts Dissolvable Tablets 2-Pack, which climbed to the number one rank with sales reaching 184 units. The CBD/THC/CBG 1:5:2 Chill Melts Mints 20-Pack held the second spot, although its sales decreased from the previous month. The CBD/THC 1:2 Verve Melts Dissolvable Tablets 10-Pack ranked third, showing a slight recovery from its fifth position in November. The CBD/THC/CBG 1:2:5 Chill Melts Dissolvable Tablets 10-Pack made a notable entry at fourth place, while the CBD/CBG/THC 1:2:5 Chill Melts Dissolvable Tablets 2-Pack debuted at fifth. Compared to previous months, there was a significant reshuffling in product rankings, with the Hush Melts showing the most impressive improvement.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.