Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

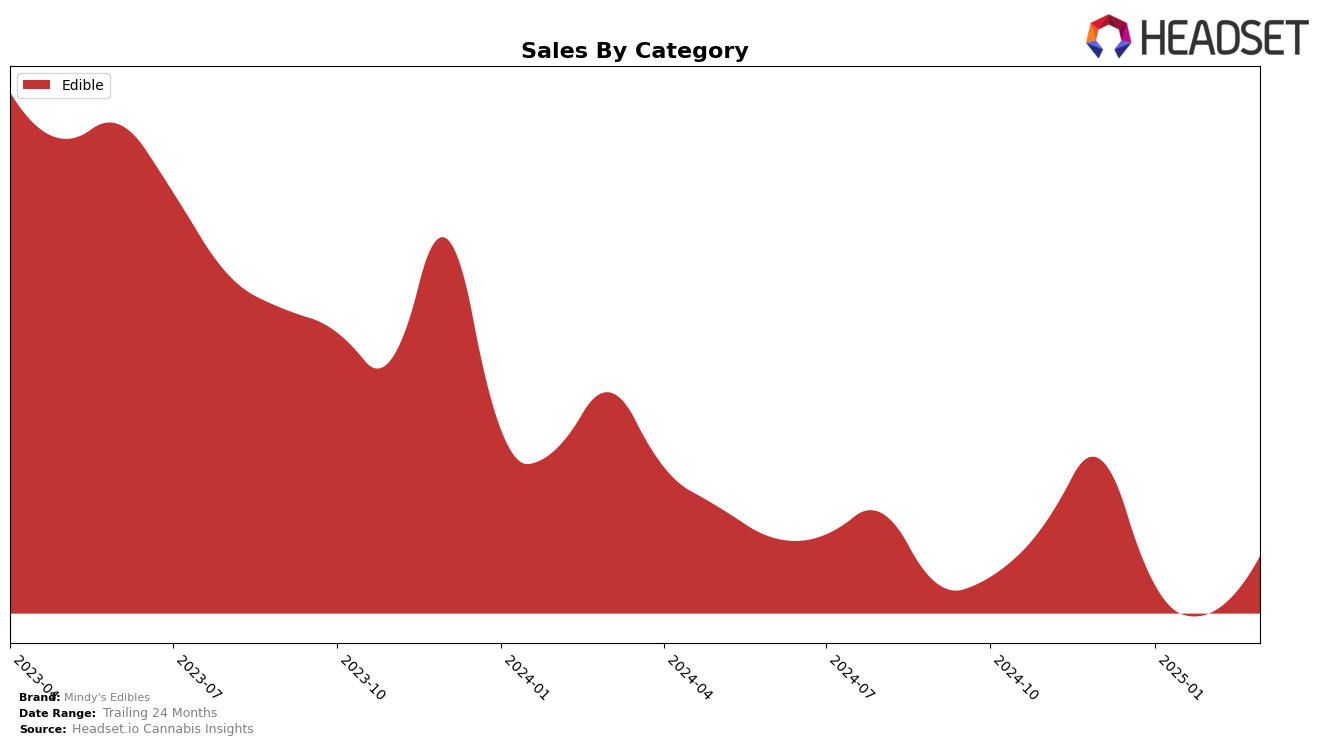

Mindy's Edibles has shown a consistent presence in the Illinois market, with its ranking in the Edible category experiencing slight fluctuations. Starting at the 9th position in December 2024, the brand saw a drop to 13th in January 2025 and maintained this position through February before slipping to 14th in March. Despite this downward trend in ranking, the brand's sales in March 2025 showed an uptick compared to February, indicating resilience in consumer demand. The fact that Mindy's Edibles remained within the top 15 suggests a stable foothold in the Illinois market, though the competitive landscape seems to be intensifying.

In Massachusetts, Mindy's Edibles also maintained a steady presence, starting at 12th place in December 2024 and holding this position in January 2025. The brand experienced a minor decline to 13th place in February, which persisted into March. This consistency in ranking, despite not breaking into the top 10, highlights a stable market position in Massachusetts. However, the sales figures indicate a more volatile performance, with a noticeable dip in February followed by a recovery in March. This suggests that while Mindy's Edibles maintains a reliable presence, there are opportunities for growth and improvement in market strategy to enhance their standing.

Competitive Landscape

In the competitive landscape of the Illinois edible cannabis market, Mindy's Edibles has experienced some fluctuations in its ranking and sales performance from December 2024 to March 2025. Initially ranked 9th in December 2024, Mindy's Edibles dropped to 13th in January and February 2025, and further to 14th in March 2025. This downward trend in ranking coincides with a decrease in sales, although there was a slight recovery in March. In contrast, Nature's Grace and Wellness maintained a more stable performance, ranking 9th in January and February, before dropping to 13th in March, with sales showing a consistent decline. Meanwhile, Good News held steady at the 12th position throughout the period, with sales experiencing a slight dip in February but recovering by March. The competitive pressure from brands like Nature's Grace and Wellness and Good News, both of which have shown resilience in rankings and sales, suggests that Mindy's Edibles may need to strategize effectively to regain its footing in the Illinois market.

Notable Products

In March 2025, the top-performing product for Mindy's Edibles was the CBD/THC 1:1 Lush Black Cherry Gummies 20-Pack, maintaining its first-place rank since December 2024 with sales of 15,400 units. The Glazed Clementine Orange Gummies 20-Pack held steady in second place, consistently following the leader in both rank and sales performance. Freshly Picked Berries Gummies 20-Pack continued its streak in third place, showing a slight increase in sales compared to the previous month. The CBD/THC 1:1 Honey Sweet Melon Gummies 20-Pack rose to fourth place, overtaking the Cool Keylime Kiwi Gummies, which dropped to fifth place. Overall, Mindy's Edibles products demonstrated stability in their rankings, with only minor shifts between the fourth and fifth positions.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.