Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

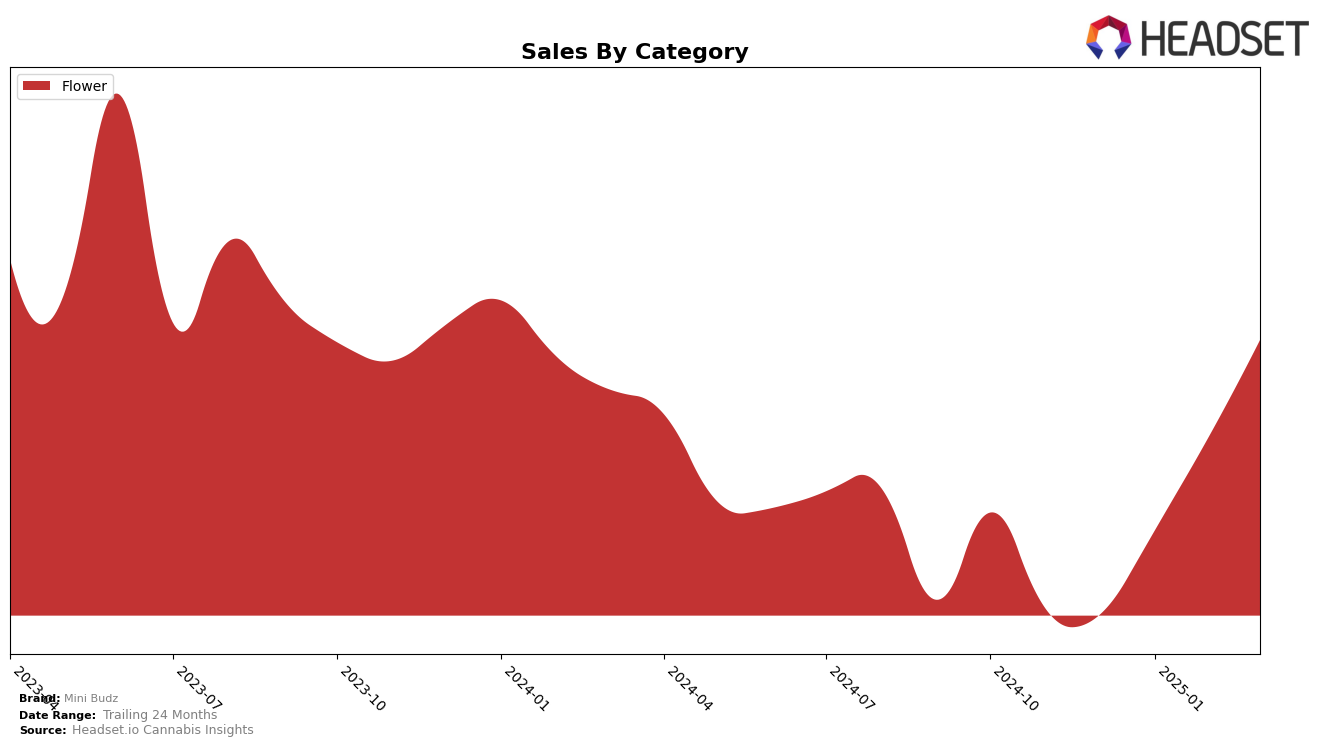

Mini Budz has demonstrated notable performance in the Flower category across several states, showing significant upward movement in both Illinois and Massachusetts. In Illinois, the brand made a remarkable leap from being outside the top 30 in December 2024 to securing the 36th position by February 2025, before slightly dropping to 37th in March. This progression is mirrored by a substantial increase in sales, indicating growing consumer interest and market penetration. Similarly, in Massachusetts, Mini Budz climbed from an unranked position in December to reach 36th by March 2025, showcasing a consistent upward trajectory in a highly competitive market.

Meanwhile, in Washington, Mini Budz has maintained a strong presence within the top 20 throughout the observed period. Despite a slight dip in February 2025, the brand bounced back to 17th place by March, reflecting resilience and stable consumer demand. This consistent ranking in Washington suggests a solid market foothold, contrasting with the more fluctuating performances seen in Illinois and Massachusetts. The ability to sustain a top-tier position in Washington, despite the competitive landscape, highlights Mini Budz's strategic market positioning and brand strength in the Flower category.

Competitive Landscape

In the competitive landscape of the Flower category in Illinois, Mini Budz has shown a remarkable upward trajectory in its rankings and sales over the past few months. Starting from a rank of 66 in December 2024, Mini Budz climbed to 37 by March 2025, indicating a significant improvement in market presence. This upward movement is noteworthy when compared to competitors like Triple Seven (777), which fluctuated in rank, peaking at 39 in March 2025. Meanwhile, nuEra maintained a relatively stable position, slightly ahead of Mini Budz, ending at rank 36 in March 2025. Despite TwentyTwenty (IL) holding a stronger position throughout, Mini Budz's sales growth from January to March 2025 surpassed the sales of Blaze Craft Cannabis Flower (IL), which saw a decline in rank to 38 by March 2025. This trend underscores Mini Budz's growing appeal and competitive edge in the Illinois Flower market.

Notable Products

In March 2025, Mini Budz saw Washington Apple Popcorn (7g) rise to the top spot in sales, marking a significant leap from its previous fourth-place ranking in February. Washington Apple Mini Budz (3.5g) secured the second position, maintaining a consistent presence in the top three over recent months, with sales reaching 2073 units. Georgia Pie Popcorn (3.5g) slipped from its leading position in February to third place in March. Hot Tropic (3.5g) entered the rankings for the first time in March, taking fourth place. Super Boof Popcorn (3.5g) saw a drop, moving from an unranked position in February to fifth place in March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.