Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

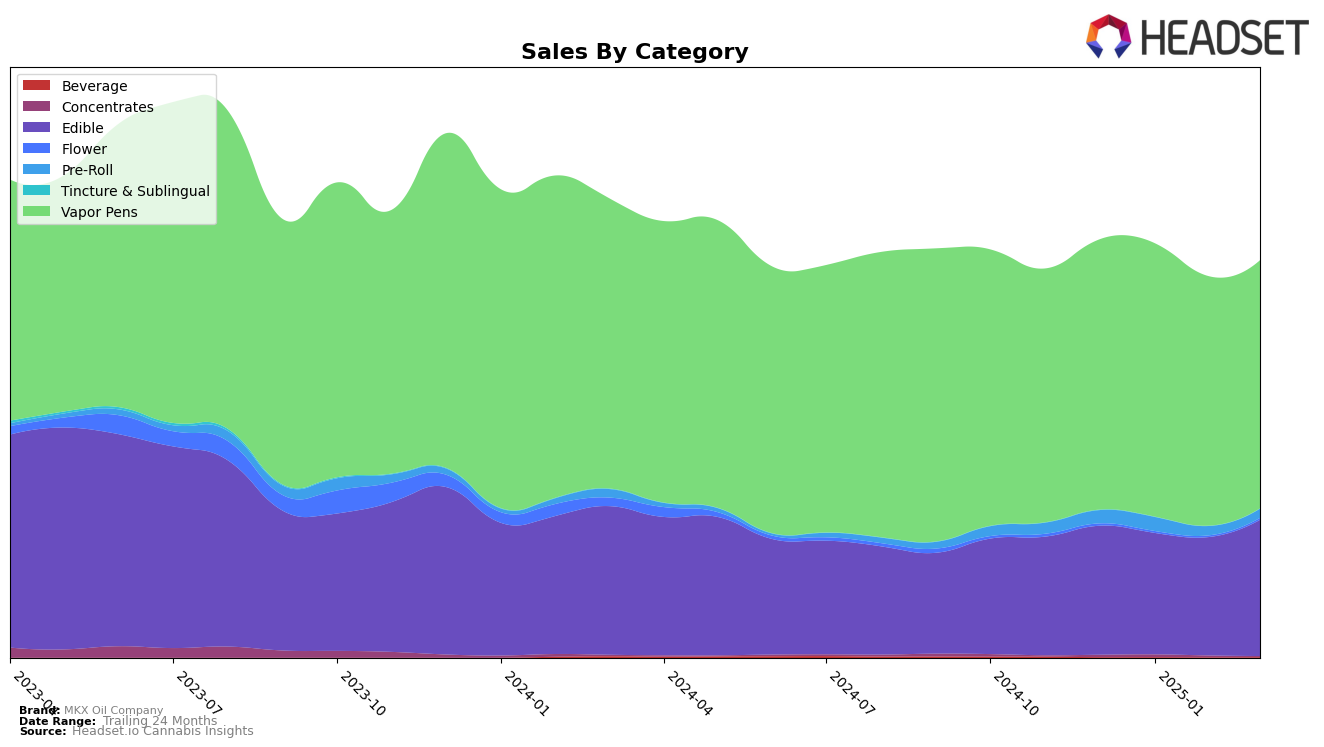

MKX Oil Company has demonstrated varied performance across different states and product categories. In Massachusetts, the brand's presence in the Vapor Pens category has seen a downward trend, as evidenced by their ranking slipping from 35th in December 2024 to 52nd by March 2025. This decline suggests increased competition or a decrease in consumer preference for their Vapor Pens in this state. The absence from the top 30 rankings in Massachusetts indicates a need for strategic adjustments to regain market share and improve brand visibility.

Conversely, in Michigan, MKX Oil Company has maintained a strong position in the Edible and Vapor Pens categories, consistently ranking 3rd from December 2024 through March 2025. This stability highlights the brand's strong foothold and consumer loyalty within these categories in Michigan. However, their performance in the Pre-Roll category is less robust, with rankings fluctuating and not breaking into the top 30, indicating potential areas for growth or reevaluation. The sustained high ranking in Vapor Pens, despite a slight sales dip, underscores the brand's resilience and market strength in this state.

Competitive Landscape

In the competitive landscape of vapor pens in Michigan, MKX Oil Company has maintained a strong position, consistently ranking third from January to March 2025, following a slight improvement from fourth place in December 2024. This stability in rank highlights MKX Oil Company's resilience and ability to hold its ground amidst fierce competition. The leading brand, Mitten Extracts, has consistently held the top position, with sales figures significantly surpassing those of MKX Oil Company, indicating a strong market presence. Meanwhile, Muha Meds has consistently secured the second rank, although its sales have shown a downward trend over the months, which could present an opportunity for MKX Oil Company to close the gap. Breeze Canna and Drip (MI) have fluctuated in their rankings, with Breeze Canna moving from third to fifth before climbing back to fourth, and Drip (MI) showing a similar pattern. These dynamics suggest that while MKX Oil Company is stable, there is potential for strategic maneuvers to improve its market position further.

Notable Products

In March 2025, the Pineapple Express Xxtra Strength Gummies 10-Pack (200mg) maintained its top position as the leading product from MKX Oil Company, with sales reaching $39,299. The Chronic Cherry Xxtra Strength Gummies 10-Pack (200mg) rose to second place, improving from its consistent third-place ranking in previous months, with notable sales growth. Ganja Grape Gummies 10-Pack (200mg) settled in third, having previously held the second position in January and February. Tangerine Dream Xxtra Strength Gummies 10-Pack (200mg) climbed to fourth place, recovering from a dip to fifth in the preceding months. The Blue Raspberry Xxtra Strength Gummies 10-Pack (200mg) made its debut in the rankings at fifth place, showcasing a strong entry into the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.