Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

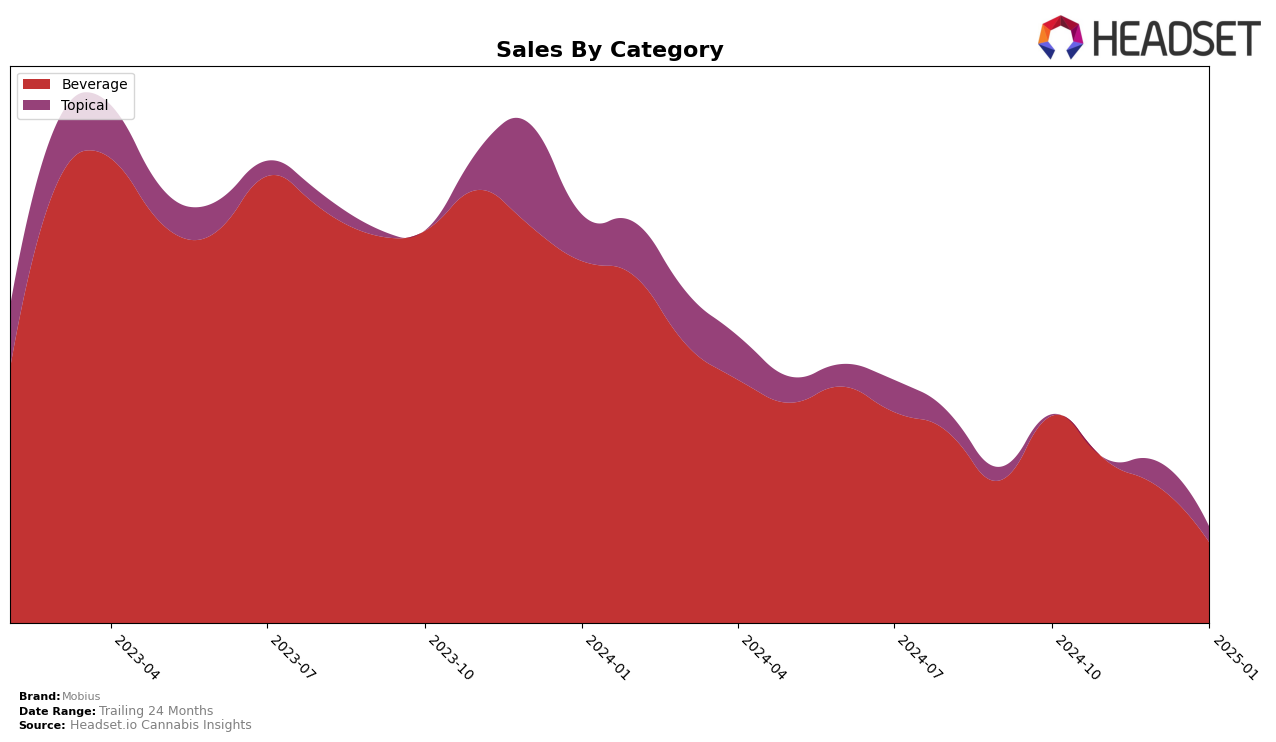

Mobius has shown a consistent presence in the Beverage category within Washington, maintaining a rank of 12th in both October and November of 2024. However, the brand experienced a slight decline in its ranking, moving to 14th place in December 2024 and maintaining that position into January 2025. This downward trend in rankings coincides with a steady decrease in sales figures, suggesting that Mobius may be facing increased competition or shifting consumer preferences in the state. Despite these challenges, the fact that Mobius has remained within the top 15 brands in the Beverage category indicates a degree of resilience in its market presence.

Interestingly, Mobius's absence from the top 30 brands in other states and categories during this period might suggest a more localized strategy focused primarily on Washington. This could be seen as both an opportunity and a limitation; while the brand has a strong foothold in one market, it may be missing out on potential growth in other regions. The absence from other rankings might also highlight the challenges Mobius faces in expanding its market share beyond its current stronghold. This focused yet limited presence provides a nuanced view of Mobius's market strategy and performance.

Competitive Landscape

In the competitive landscape of the beverage category in Washington, Mobius has experienced notable fluctuations in its market position over recent months. Initially ranked 12th in October and November 2024, Mobius saw a decline to 14th place by December 2024 and January 2025. This downward trend in rank is mirrored by a significant drop in sales, from a high in October 2024 to a notable decrease by January 2025. Meanwhile, CQ (Cannabis Quencher) has shown a consistent upward trajectory, improving its rank from 14th to 12th while increasing its sales figures. Similarly, Swell Edibles maintained a relatively stable position, with minor fluctuations but overall steady sales. In contrast, Soulshine Cannabis remained static at 15th place, with declining sales leading to its absence from the top 20 in January 2025. The entry of Cormorant in January 2025, debuting at 15th place, further intensifies competition, suggesting a dynamic market where Mobius must strategize to regain its competitive edge.

Notable Products

In January 2025, the top-performing product from Mobius was the CBD /THC 1:1 Tropical Punch Lemonade (100mg CBD, 100mg THC, 8.5oz) in the Beverage category, climbing to the number one rank with sales of 735 units. The CBD/THC 1:1 Blood Orange Drink maintained its second-place position from December 2024, despite a decrease in sales to 421 units. The CBD/THC 1:1 Mango Infused Beverage ranked third, dropping from its previous fourth position, with sales continuing to decline. The Pineapple Delta-9 Beverage improved its standing, moving up to fourth place, marking its best ranking since October 2024. A new entry, the CBD/THC 1:1 Happy Transdermal Patch, entered the rankings for the first time in January, securing the fifth spot in the Topical category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.