Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

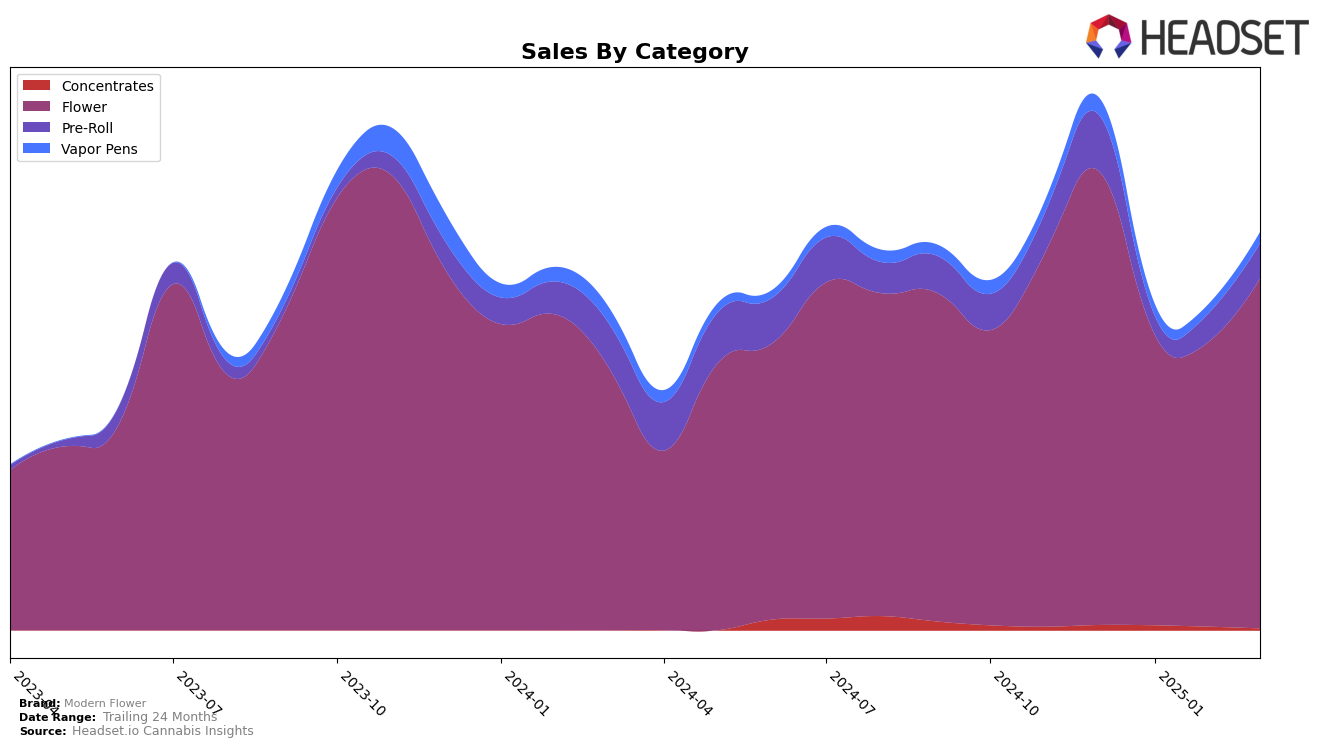

Modern Flower has shown a varied performance across different categories in Maryland. In the Flower category, the brand experienced a drop from the 7th position in December 2024 to the 15th in January 2025, before gradually climbing back to the 12th spot by March 2025. This suggests a recovery trend after an initial dip at the start of the year. On the other hand, their performance in the Pre-Roll category saw a more consistent improvement, moving from the 29th position in January 2025 to the 20th by March. However, it's worth noting that Modern Flower did not rank within the top 30 for Vapor Pens during the same period, indicating a potential area for growth or a shift in consumer preference away from this product line.

While the Flower and Pre-Roll categories show promising signs of improvement for Modern Flower in Maryland, the Vapor Pen category remains a challenge. The brand's position outside the top 30 in Vapor Pens could signal either a lack of market penetration or a strategic focus away from this category. Despite this, the overall sales figures for Flower indicate a positive trajectory, with March 2025 sales reaching over 1.5 million dollars. This upward movement in sales for the Flower category may reflect a strengthening brand presence and consumer loyalty in Maryland. Such trends are crucial for understanding where Modern Flower might focus its efforts to bolster its market position further.

Competitive Landscape

In the competitive landscape of the Maryland flower category, Modern Flower has experienced notable fluctuations in its ranking and sales performance from December 2024 to March 2025. Initially ranked 7th in December 2024, Modern Flower saw a dip to 15th place in January 2025, before gradually recovering to 12th by March 2025. This period of volatility coincided with a decrease in sales from December to February, followed by a rebound in March. Competitors such as Kind Tree Cannabis and Roll One have shown more consistent performance, with Kind Tree Cannabis peaking at 9th in January and Roll One climbing to 10th by March. Meanwhile, Garcia Hand Picked and Grow West Cannabis Company maintained relatively stable positions, suggesting that Modern Flower faces stiff competition in retaining its market share. As Modern Flower aims to solidify its standing, understanding these competitive dynamics is crucial for strategic adjustments and potential growth opportunities.

Notable Products

In March 2025, the top-performing product for Modern Flower was Suit & Tie (3.5g) in the Flower category, which secured the number one rank with sales of 5,584 units. Gush Mints (3.5g) climbed to the second position, showing a notable increase from the third rank in February 2025. Cold Snap (3.5g) debuted strongly in March, capturing the third spot. White 99 (3.5g) maintained a consistent presence in the top five, improving from fifth in February to fourth in March. Buffalo Soldier (3.5g) experienced a slight drop, moving from second in February to fifth in March, highlighting a competitive sales landscape among the top products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.