Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

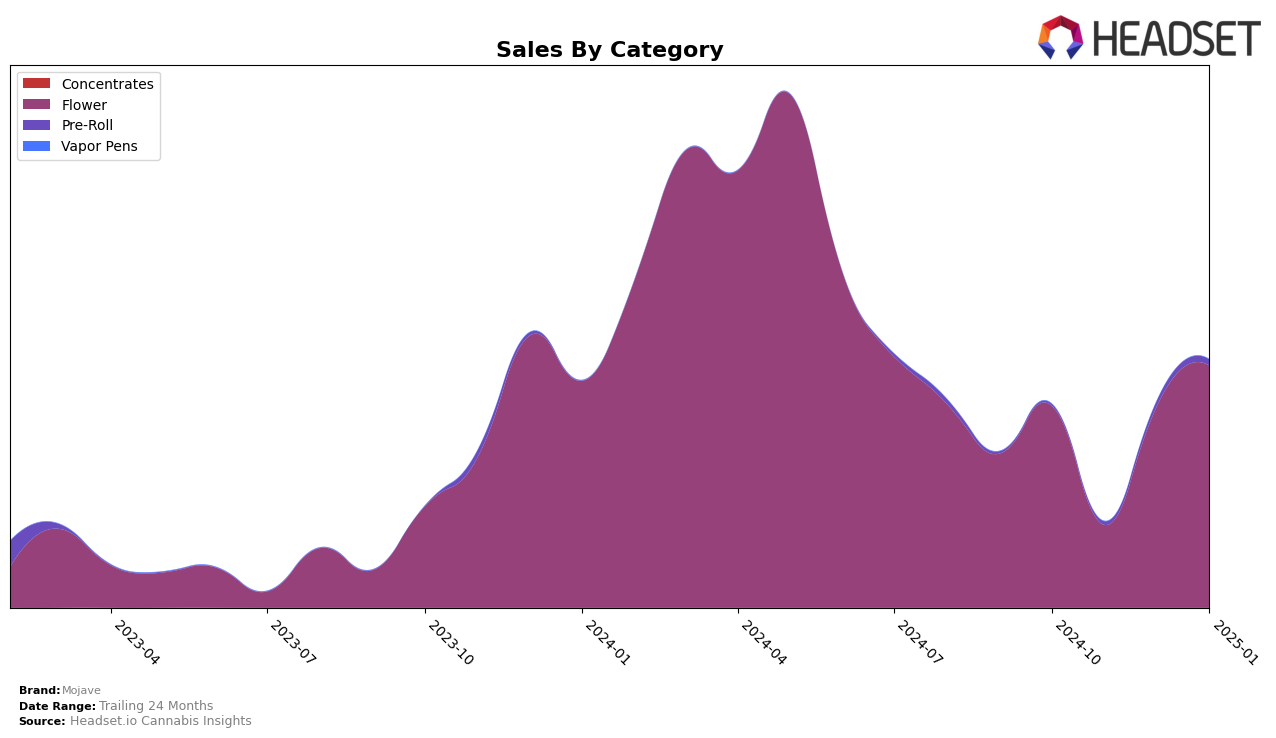

In the state of Nevada, Mojave has shown a notable upward trajectory in the Flower category. Starting from a rank of 35 in October 2024, the brand experienced a dip in November, falling outside the top 30 to rank 60. However, Mojave quickly rebounded in December, climbing back to 36, and continued its positive momentum into January 2025, achieving a rank of 26. This fluctuation indicates a resilience and ability to recover in a competitive market, suggesting strategic adjustments or successful marketing efforts that resonated well with consumers during this period.

The sales figures for Mojave in Nevada also reflect this dynamic performance, with a significant increase in January 2025 compared to previous months. Despite the dip in November, where sales were noticeably lower, the brand managed to recover and even surpass its October sales by January. This recovery and growth in sales volume hint at a strengthening brand presence and possibly expanding consumer base. The absence of Mojave in the top 30 during November highlights a temporary challenge, yet the subsequent recovery underscores a potential for sustained growth if the brand continues to leverage its strengths effectively.

Competitive Landscape

In the competitive landscape of the Nevada flower category, Mojave has demonstrated a notable fluctuation in its rankings over the past few months, indicating a dynamic market presence. Starting from October 2024, Mojave was ranked 35th, but experienced a drop to 60th in November, before rebounding to 36th in December, and further improving to 26th by January 2025. This upward trend in the latest month suggests a positive momentum in sales performance. In comparison, Bohemian Bros showed a more stable climb, moving from 58th in October to 27th by January, with consistently increasing sales figures. Meanwhile, Safety Meeting maintained a competitive edge, consistently ranking within the top 30, and Khalifa Kush experienced a slight dip in January despite a strong November performance. Super Good consistently outperformed Mojave, maintaining a top 30 position throughout, with a peak at 14th in December. The competitive dynamics suggest that while Mojave is gaining ground, it faces stiff competition from brands like Super Good and Safety Meeting, which have maintained stronger sales and higher rankings over the same period.

Notable Products

In January 2025, Mandarin Cookies (3.5g) emerged as the top-performing product for Mojave, leading the sales with a notable figure of 492 units. Monkey Berries (3.5g) climbed to the second position, marking a significant increase from its fourth place in December 2024. Cherry Log (3.5g) secured the third rank, a new entry in the top ranks for the specified period. Caramel Cream (14g) and Caramel Cream (3.5g) both maintained a presence in the top five, with the former dropping one position to fourth place. These shifts indicate a dynamic change in consumer preferences, with Mandarin Cookies and Monkey Berries gaining momentum over the months.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.