Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

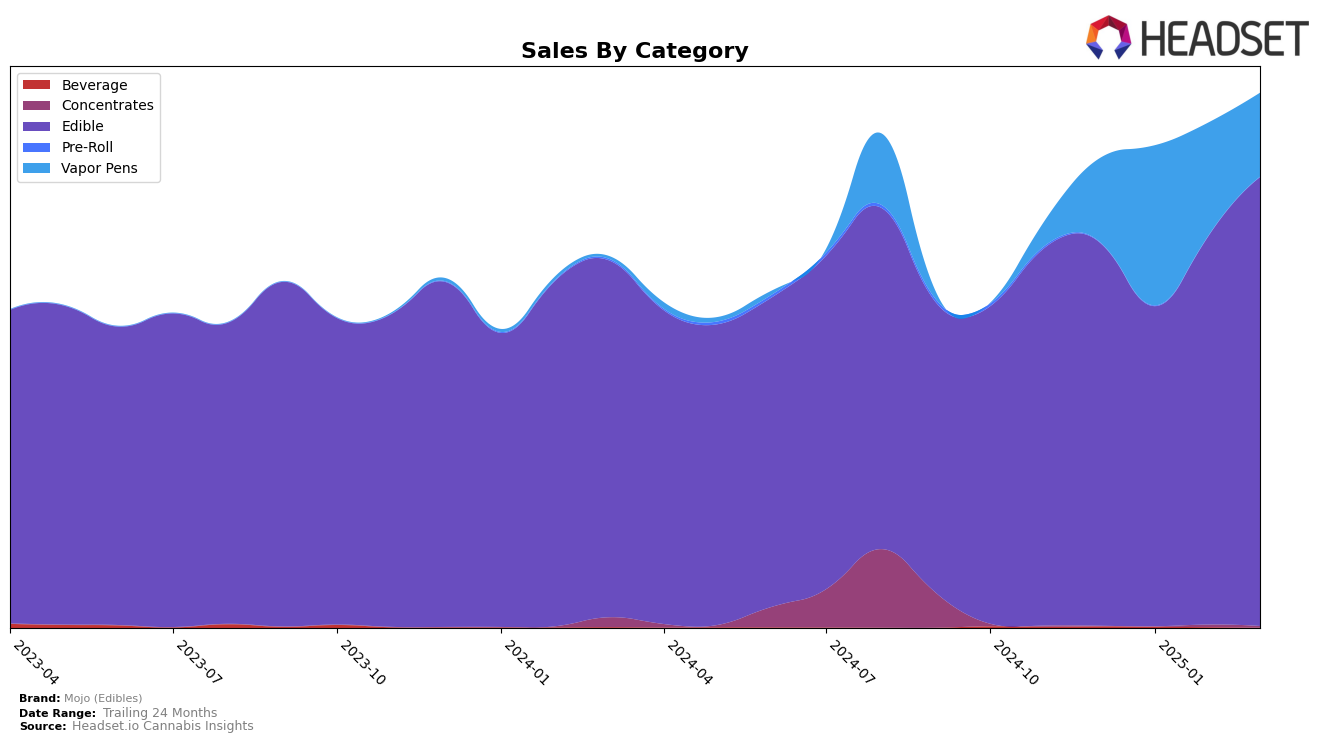

Mojo (Edibles) has shown notable performance in the Michigan edibles market over recent months. Despite a slight dip in January 2025, where they ranked 19th, the brand rebounded strongly in February and March, maintaining a steady 15th position. This resurgence is reflected in their sales figures, which increased from $411,744 in January to $577,511 by March. The brand's ability to climb back up the rankings and sustain a top 15 position indicates a solid foothold in the Michigan market, which could suggest a growing consumer preference for their products.

In contrast, Mojo (Edibles) experienced fluctuating performance in the Nevada vapor pens category. The brand peaked at 18th place in January and February 2025, but by March, it had dropped to 24th. This decline in ranking coincided with a decrease in sales from $205,642 in January to $107,615 in March. The inconsistency in their rankings and sales figures in Nevada may highlight challenges the brand faces in maintaining a competitive edge in the vapor pens category. It is crucial for Mojo (Edibles) to address these fluctuations to ensure sustained growth and market presence in Nevada.

Competitive Landscape

In the competitive landscape of the Michigan edibles market, Mojo (Edibles) has shown a notable improvement in its ranking over the first quarter of 2025. Starting from a rank of 19 in January, Mojo (Edibles) climbed to 15 by March, indicating a positive trend in consumer preference and market penetration. This upward movement is particularly significant when compared to competitors like NOBO, which saw a decline from rank 10 in December 2024 to 13 in March 2025, and Banned Cannabis Edible Co., which maintained a steady rank of 14 in February and March despite a drop from 10 in January. Meanwhile, Cannalicious Labs and PC Pure have shown minor fluctuations, with Cannalicious Labs improving from 20 to 16 and PC Pure remaining relatively stable. Mojo's sales figures also reflect this positive trajectory, with a significant increase from January to March, contrasting with the sales decline observed in some competitors. This data suggests that Mojo (Edibles) is gaining a stronger foothold in the Michigan edibles market, likely due to strategic marketing efforts and product offerings that resonate well with consumers.

Notable Products

In March 2025, Mojo (Edibles) saw its Peanut Butter Chocolate Mini Bites 10-Pack (200mg) continue to dominate as the top-performing product, maintaining its number one rank with a notable sales figure of 11,450. The Nuggy Caramel Peanut Bites Chocolates 10-Pack (200mg) held steady in the second position for the fourth consecutive month. Cookies & Cream Chocolate Bites (200mg) improved its standing from fourth in January to third in March, showing a consistent upward trend in sales. Caramel Filled Chocolate Bites 10-Pack (200mg) remained in fourth place, having dropped from third in January. Crispy Wafer High Dose Chocolate Bites (200mg) consistently ranked fifth, despite fluctuations in sales figures over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.