Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

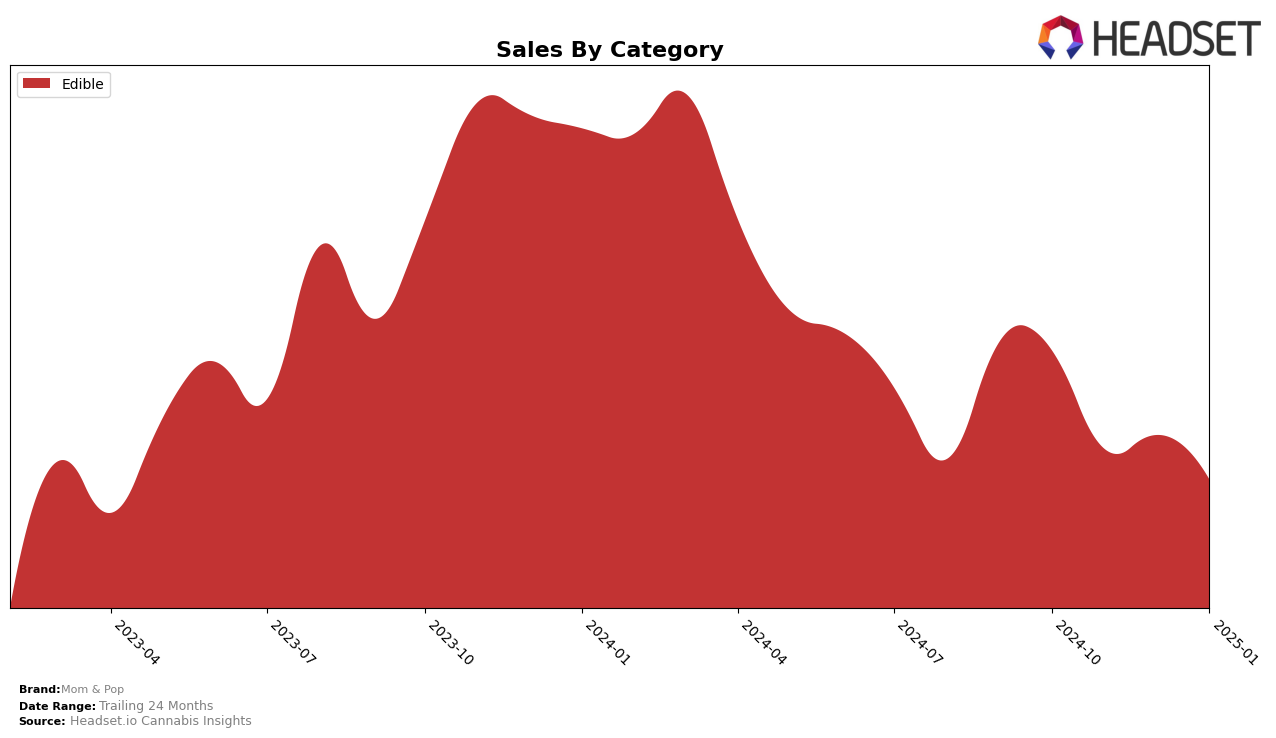

Mom & Pop has shown fluctuating performance in the Edible category across Arizona over the past few months. In October 2024, the brand held the 20th position, but it slipped to 22nd in November before climbing back to 19th in December. However, by January 2025, Mom & Pop had dropped again to 23rd place. This volatility in rankings could suggest challenges in maintaining consistent market traction or possibly increased competition within the Edible category in Arizona. The brand's sales figures also reflect this inconsistency, with a noticeable decrease from October to January, indicating a potential area for strategic improvement.

Notably, Mom & Pop did not make it to the top 30 brands in any other states or categories, which can be seen as a significant area for growth and expansion. This absence highlights the brand's limited reach beyond Arizona's Edible market and suggests that there may be untapped opportunities in other states or product categories. Focusing on diversification and exploring new markets could be beneficial for Mom & Pop to enhance its brand presence and capture a larger share of the cannabis market. Such strategic moves might help stabilize their rankings and sales performance in the future.

Competitive Landscape

In the competitive landscape of the Arizona edible cannabis market, Mom & Pop experienced notable fluctuations in rank and sales from October 2024 to January 2025. Starting at rank 20 in October, Mom & Pop saw a slight dip to 22 in November, before climbing to 19 in December, only to fall back to 23 in January. This volatility in ranking reflects a dynamic market where competitors such as Tru Infusion consistently maintained a higher rank, peaking at 19 in November and January. Meanwhile, Grow Sciences showed a strong upward trend, moving from 28 in November to 22 in January, potentially posing a growing threat to Mom & Pop's market position. Despite these challenges, Mom & Pop's sales figures remained robust, consistently outperforming competitors like Mellow Vibes (formerly Head Trip) and RR Brothers, indicating a resilient brand presence in the Arizona edible market.

Notable Products

In January 2025, the top-performing product for Mom & Pop was the THC/CBN 2:1 Sleep Dark Chocolate Bar 10-Pack (100mg THC, 50mg CBN) in the Edible category, rising to the number 1 rank with sales of 482 units. The Sugar Free Dark Chocolate Bar 10-Pack (100mg) maintained a strong presence, ranking second, although its sales slightly decreased from the previous month. The Milk Chocolate Bar Single (1000mg) secured the third position, showing a consistent performance. Meanwhile, the Milk Chocolate Bar 10-Pack (100mg) climbed to fourth place, marking a steady increase in sales over the months. The Dark Chocolate Bar (1000mg) entered the rankings at fifth place, indicating a new interest in higher dosage products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.