Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

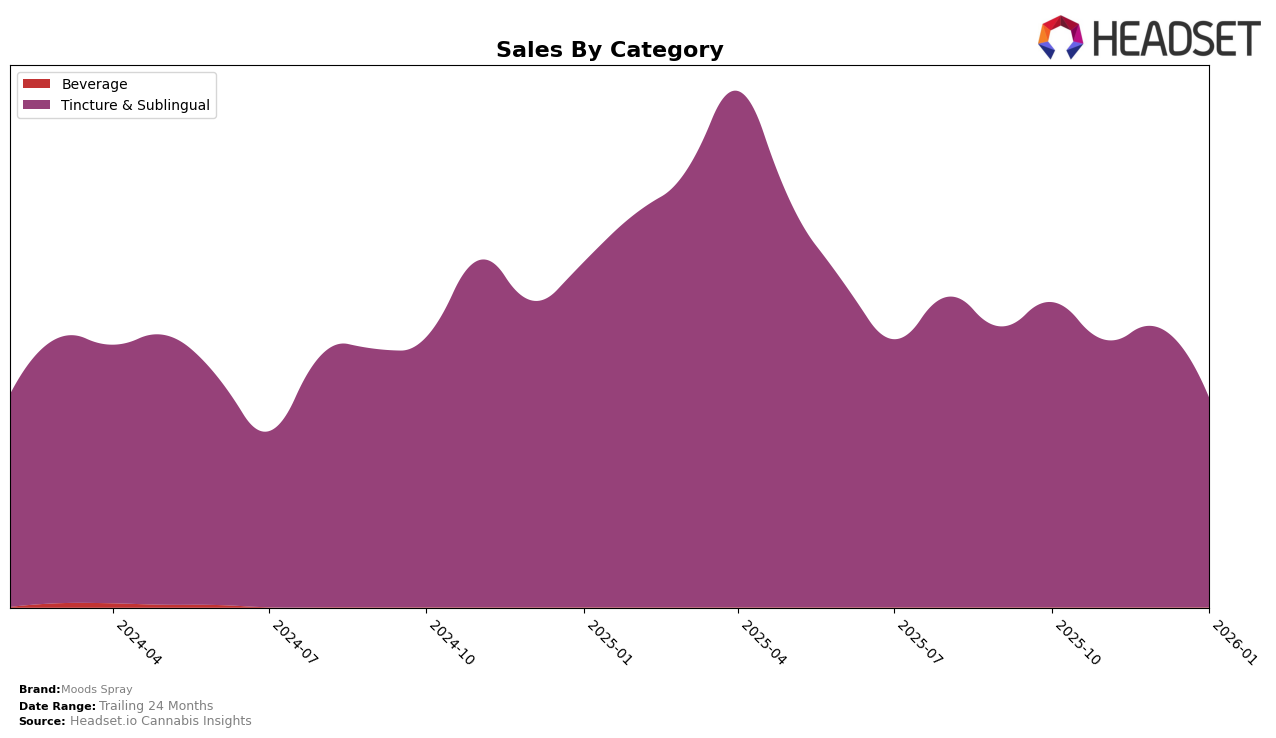

Moods Spray has experienced notable fluctuations in its category rankings across different states, particularly within the Tincture & Sublingual category. In California, the brand maintained a steady position at rank 13 from October through December 2025, before slipping to rank 15 in January 2026. This slight decline in ranking corresponds with a reduction in sales, which dropped from $61,355 in October to $42,022 by January. The consistent presence in the top 15 highlights the brand's strong foothold in California, although the recent decline suggests potential challenges or increased competition that may need to be addressed.

In other states, Moods Spray's performance has varied, with some areas not listing the brand in the top 30, indicating either a lack of market penetration or intense competition. The absence from the top 30 in these regions could be seen as a significant opportunity for growth if the brand can strategize effectively to improve its market presence. Monitoring these trends can provide valuable insights into regional market dynamics and consumer preferences, which are crucial for tailoring marketing strategies and product offerings to enhance performance and capture a larger market share.

Competitive Landscape

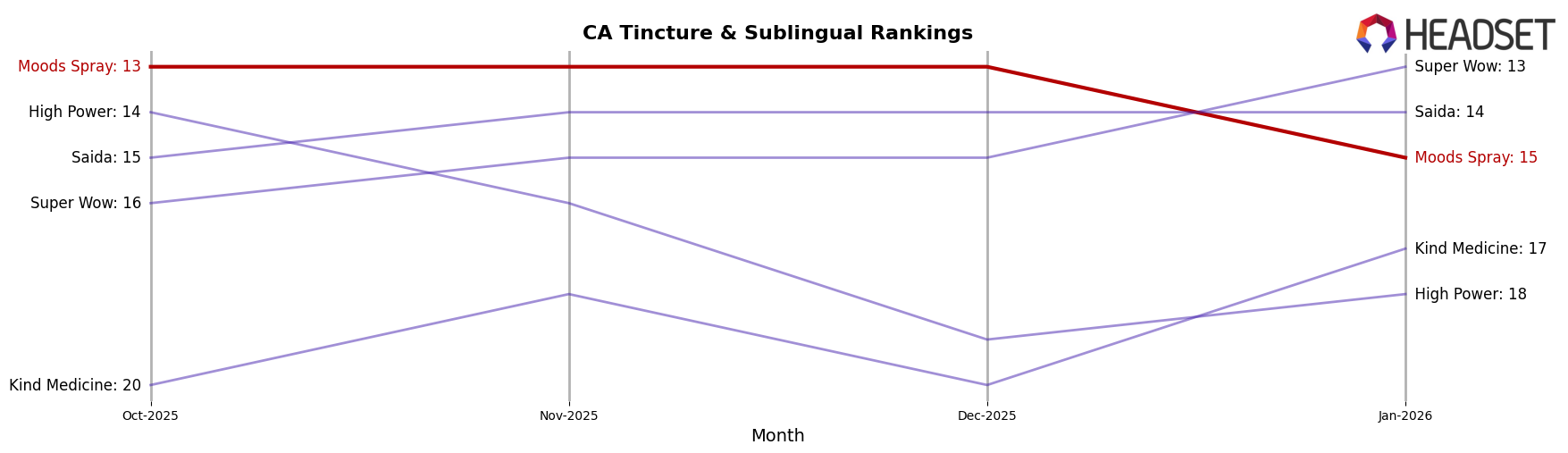

In the competitive landscape of the Tincture & Sublingual category in California, Moods Spray has experienced a slight decline in its ranking, moving from 13th place in the last quarter of 2025 to 15th in January 2026. This shift is notable as competitors like Super Wow have shown a significant upward trajectory, climbing from 16th to 13th place over the same period, with sales increasing substantially from October 2025 to January 2026. Meanwhile, Saida has maintained a steady position, consistently ranking 14th, yet showing a strong sales growth trend, which could pose a threat to Moods Spray's market share if the trend continues. Additionally, Kind Medicine and High Power have fluctuated in rankings but have not surpassed Moods Spray in sales, indicating that while Moods Spray's sales have decreased, it still holds a competitive edge in terms of revenue compared to these brands. The overall dynamics suggest that Moods Spray needs to address its declining sales to maintain its competitive position amidst the rising performance of its rivals.

Notable Products

In January 2026, the top-performing product for Moods Spray was Watermelon Z High Sublingual Oral Spray, reclaiming its number one rank from December with sales of 275 units. Blueberry Kush High Sublingual Oral Spray made a significant leap to the second position, improving from fifth place in December. Peppermint High Sublingual Oral Spray dropped to third place after leading in December, while Strawberry Bliss High Sublingual Oral Spray fell to fourth. Pineapple Fanta High Sublingual Oral Spray consistently maintained the fifth position from December. The shifts in rankings highlight a dynamic market where consumer preferences are continuously evolving.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.