Jun-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

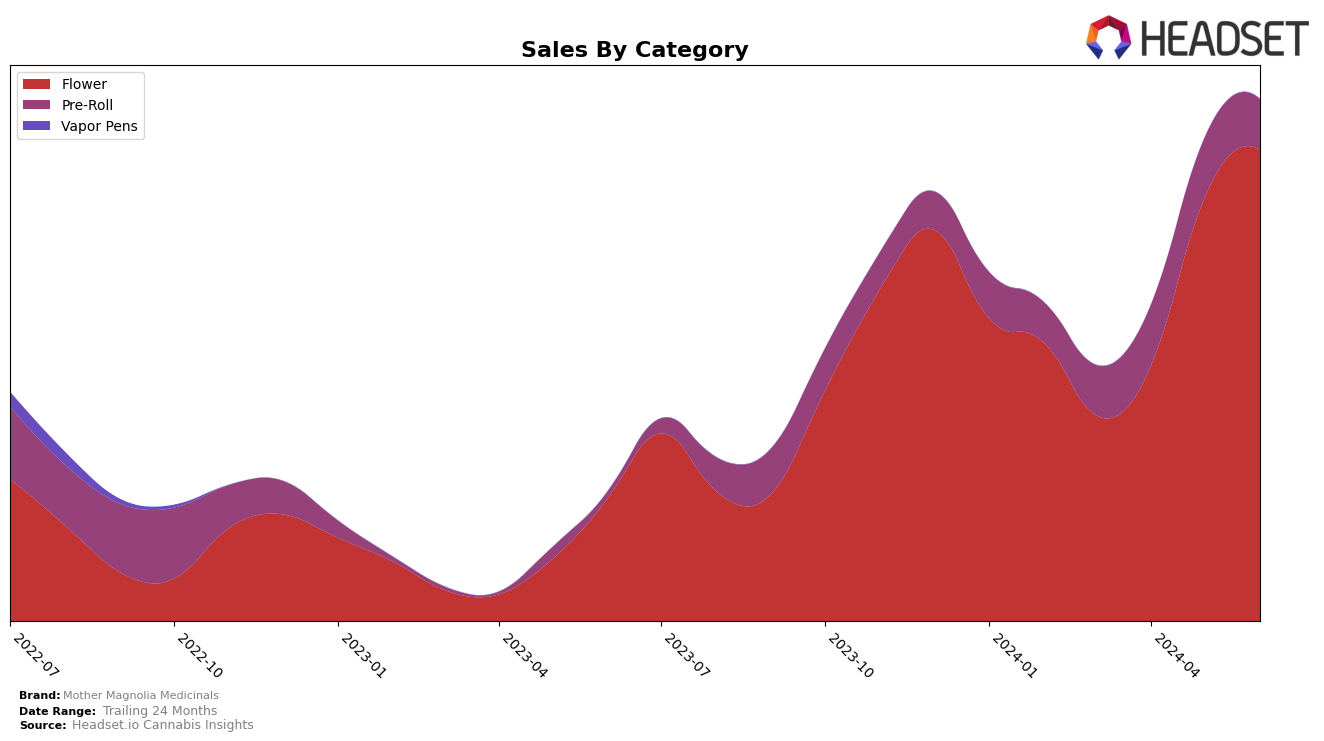

Mother Magnolia Medicinals has shown a notable upward trend in the Flower category in Oregon. Starting from a rank of 85 in March 2024, the brand climbed steadily to reach the 30th position by June 2024. This significant improvement indicates a growing market presence and increasing consumer preference for their products. The sales figures support this upward trajectory, with sales rising from $98,576 in March to $225,823 in June. This positive movement in the Flower category highlights the brand's successful strategies and product acceptance in the Oregon market.

In contrast, the performance of Mother Magnolia Medicinals in the Pre-Roll category in Oregon has been less impressive. Despite an initial improvement from 72nd rank in March to 63rd in May, the brand slipped to 74th position by June 2024. This decline is concerning, especially since it indicates that they are not in the top 30 brands, which could be a signal of stiff competition or potential issues in this product line. The sales figures for Pre-Rolls have fluctuated, with a peak in April followed by a drop in June, suggesting inconsistency in consumer demand or market challenges.

Competitive Landscape

In the competitive landscape of the Oregon flower category, Mother Magnolia Medicinals has shown a significant upward trend in rank and sales over the past few months. Starting from a rank of 85 in March 2024, the brand has impressively climbed to rank 30 by June 2024, indicating a strong market presence and increasing consumer preference. This rise is notable when compared to competitors like Meraki Gardens, which experienced a decline from rank 23 in March to 32 in June, and Derby's Farm, which dropped from rank 16 in March to 34 in June. Meanwhile, Tao Gardens and Hazy Valley Horticulture have maintained relatively stable positions, with slight fluctuations. The consistent increase in sales for Mother Magnolia Medicinals, reaching $225,823 in June, underscores its growing influence in the market, contrasting with the declining sales of some competitors. This upward trajectory suggests that Mother Magnolia Medicinals is effectively capturing market share and could continue to rise in rank if current trends persist.

Notable Products

In June 2024, the top-performing product for Mother Magnolia Medicinals was Alpha Blue (Bulk) in the Flower category, maintaining its number one rank from previous months and achieving sales of 2543 units. Mendo Oranges (Bulk), another Flower product, held the second position consistently since its debut in May 2024. Lil Rippers - Blackberry Kush Infused Pre-Roll 2-Pack (2g) ranked third, showing steady performance since its introduction. Durban Pomegranate (Bulk) in the Flower category moved up to fourth place from its previous fifth position in April 2024. Lastly, Lil Rippers - Gorilla Haze Infused Pre-Roll 2-Pack (2g) entered the rankings at fifth place in June 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.