Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

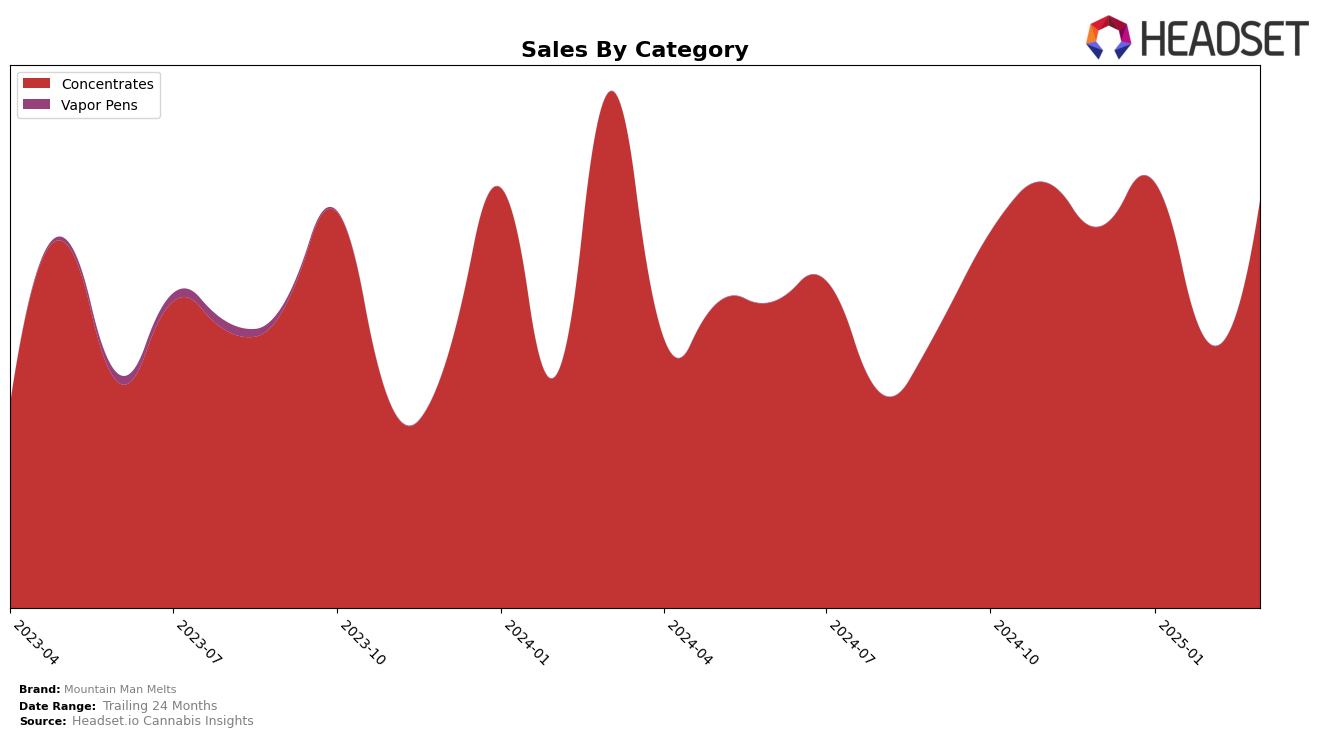

Mountain Man Melts has shown a varied performance across different states and categories over the recent months. In California, the brand has experienced notable fluctuations within the Concentrates category. Starting at the 30th position in December 2024, they climbed to 22nd in January 2025, then slipped out of the top 30 in February, before recovering back to 22nd in March. This pattern suggests some volatility, potentially influenced by market competition or seasonal factors. Despite the drop in February, the rebound in March indicates resilience and a potential strategy adjustment that successfully recaptured market share.

While the ranking movements in California provide a glimpse into the brand's performance, it is important to note that Mountain Man Melts was absent from the top 30 in February, which could be seen as a setback. This absence from the ranking highlights the competitive nature of the Concentrates category and the challenges brands face in maintaining a consistent presence. However, the subsequent recovery in March, alongside a sales figure of $135,041, demonstrates the brand's ability to rebound and suggests that they might have implemented effective strategies to regain their standing. Observing these trends can offer insights into the brand's market dynamics and potential future performance.

Competitive Landscape

In the competitive landscape of the California concentrates market, Mountain Man Melts has experienced notable fluctuations in its ranking over the past few months. Starting from a rank of 30 in December 2024, the brand improved to 22 in January 2025, only to drop to 37 in February, before recovering back to 22 in March. This volatility contrasts with the more stable performance of competitors like Globs, which maintained a relatively consistent presence in the top 20, and Rosin Tech, which showed a strong performance by climbing to rank 15 in February. Despite these challenges, Mountain Man Melts managed to increase its sales from January to March, suggesting a potential for recovery and growth. However, the brand faces stiff competition from Have Hash, which also showed a strong comeback in March, and Buddies, which has been steadily increasing its sales. These dynamics indicate that while Mountain Man Melts has the potential to reclaim and maintain a higher rank, it must strategize effectively to navigate the competitive pressures from these established brands.

Notable Products

In March 2025, the top-performing product from Mountain Man Melts was Apricot Octane Live Rosin (1g), which secured the first rank with sales of 452 units. Black Maple Live Rosin (1g) followed closely in second place, maintaining its position from the previous month. Hashburger Live Rosin (1g) showed a significant improvement, climbing from fifth in February to second in March, matching the sales figures of Black Maple Live Rosin (1g) at 413 units. Fruit Stripe Live Rosin (1g) held the third position, demonstrating consistent performance. Zealousy Rosin (1g), however, experienced a drop from first in February to fourth in March, indicating a shift in consumer preference.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.