Jun-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

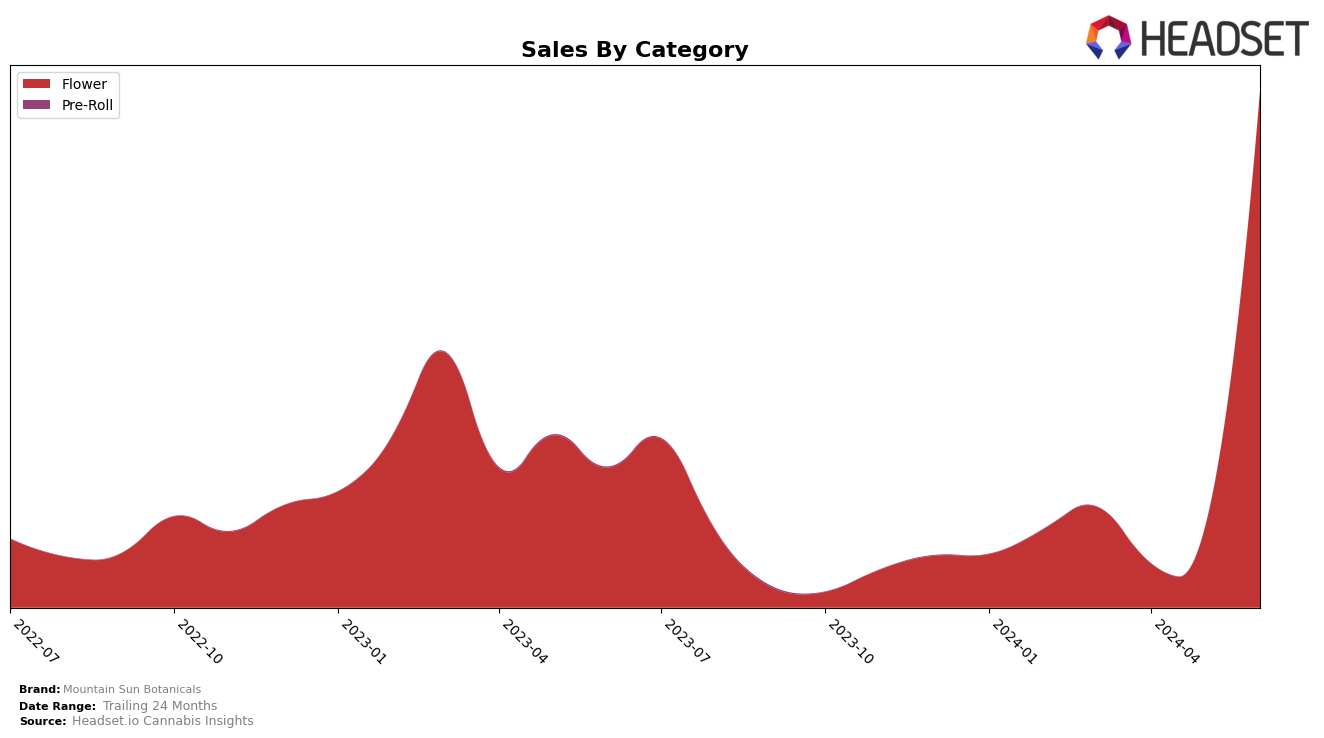

Mountain Sun Botanicals has shown a significant upward trajectory in the Oregon market, particularly within the Flower category. While the brand did not appear in the top 30 rankings for March, April, or May, it made a notable leap to rank 13th in June. This jump indicates a strong performance and growing popularity among consumers, reflecting effective market strategies and possibly an increase in product availability or quality. The sales data for June also supports this trend, with a notable rise compared to previous months, suggesting that Mountain Sun Botanicals is gaining traction in the competitive Oregon market.

However, the absence of Mountain Sun Botanicals from the top 30 rankings in the preceding months across categories and states highlights areas where the brand may need to improve or focus its efforts. The lack of presence in other states could be seen as a missed opportunity or a strategic decision to concentrate on solidifying their market position in Oregon first. This performance analysis suggests that while the brand is making significant strides in Oregon, there is still considerable room for growth and expansion into other states and categories. To fully capitalize on their potential, Mountain Sun Botanicals may need to explore new markets and diversify their product offerings.

Competitive Landscape

In the competitive landscape of the Oregon flower category, Mountain Sun Botanicals experienced a notable shift in its market presence. Despite not ranking in the top 20 for March, April, or May 2024, Mountain Sun Botanicals made a significant entry in June 2024, securing the 13th position. This upward movement is particularly impressive given the fluctuating ranks of competitors such as Oregon Roots, which saw a rise from 12th to 7th in April before dropping to 15th in May and recovering to 11th in June, and Otis Garden, which peaked at 7th in May but fell back to 15th by June. Meanwhile, Earl Baker and Kaprikorn showed more stable yet modest rankings. Mountain Sun Botanicals' entry into the rankings suggests a positive trajectory in sales and market recognition, positioning it as a rising contender in the Oregon flower market.

Notable Products

In June 2024, the top-performing product for Mountain Sun Botanicals was Coconut Milk (3.5g) in the Flower category, which jumped to the first rank with impressive sales of $1,286. Zoap (7g) secured the second position, followed by Concrete Jungle (7g) in third place. Fish Scale (7g) and Purple Push Pop (7g) both tied for the fourth rank. Notably, Coconut Milk (3.5g) experienced a significant surge from its fifth rank in May 2024. This upward movement highlights a remarkable increase in consumer demand for this specific product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.