Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

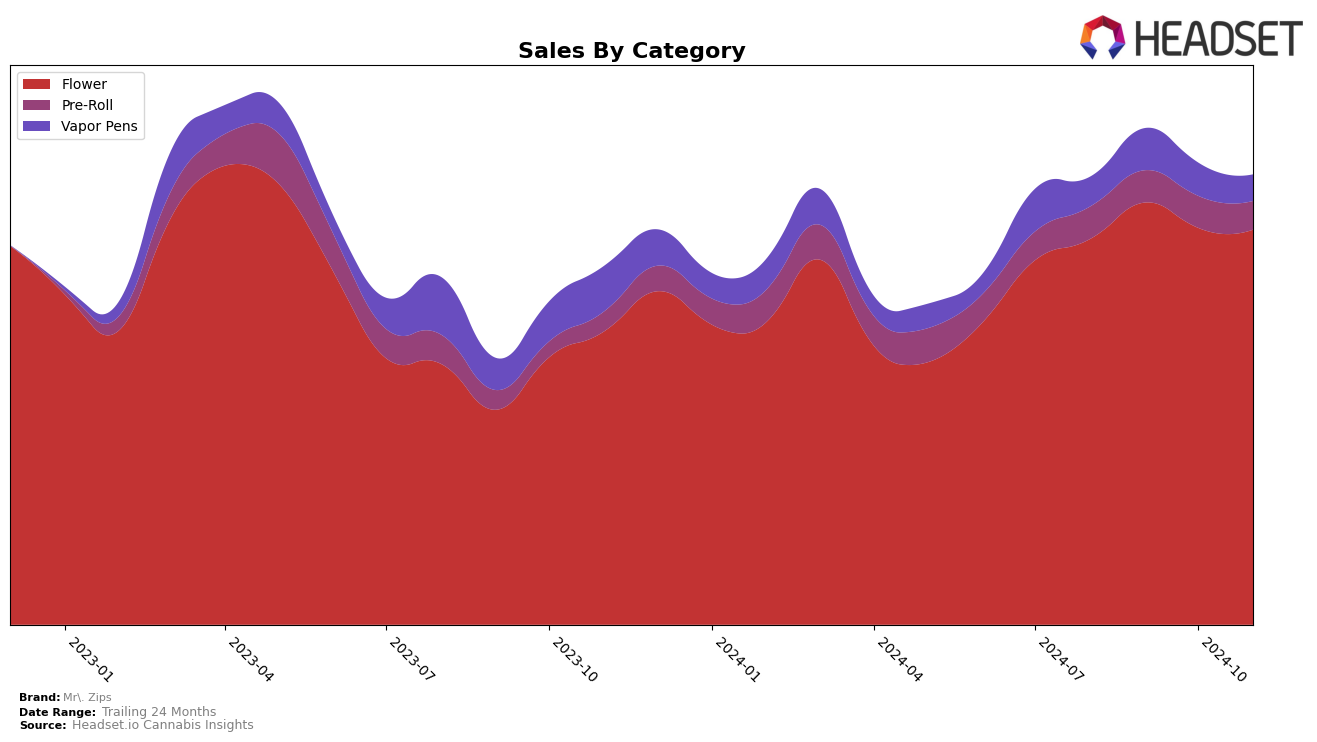

In the competitive cannabis market of California, Mr. Zips has shown a steady presence in the Flower category, maintaining a position within the top 30 brands from August to November 2024. Although their rank slightly fluctuated from 27th in August to 30th in November, the brand managed to sustain its sales figures, indicating resilience in a challenging market. However, Mr. Zips did not make it to the top 30 in the Pre-Roll category until October, where they debuted at 96th place, a sign that they might be expanding their footprint in this segment. This suggests a strategic move to diversify their product offerings and capture a broader audience, though there is still significant room for growth.

Interestingly, Mr. Zips also appeared in the Vapor Pens category in September, albeit at a low 99th rank, and did not maintain a top 30 presence in subsequent months. This could be interpreted as a testing phase for the brand in this category, where they are yet to establish a strong foothold. The absence of Mr. Zips in the top 30 for both Pre-Rolls and Vapor Pens in previous months highlights a potential area for improvement or a strategic pivot. These movements across categories reflect the brand's ongoing efforts to explore and possibly penetrate new market segments within California, which could be pivotal for their long-term growth strategy.

Competitive Landscape

In the competitive landscape of the California flower market, Mr. Zips has experienced fluctuations in its rank over the past few months, moving from 27th in August 2024 to 30th by November 2024. This slight decline in rank suggests increased competition, particularly from brands like A Golden State, which maintained a steady rank of 29th in both September and November, and West Coast Treez, which despite a drop from 23rd to 28th, still poses a competitive threat with consistently high sales figures. Meanwhile, Cream Of The Crop (COTC) and Henry's Original have shown more volatility in their rankings, indicating potential opportunities for Mr. Zips to reclaim a stronger position. The overall trend for Mr. Zips shows stable sales, but the brand must strategize to improve its competitive standing amidst these dynamic market shifts.

Notable Products

In November 2024, Sunshine Punch (3.5g) emerged as the top-performing product for Mr. Zips, climbing from a rank of 3 in October to the top spot with sales of 3258 units. Space Rocks (3.5g) slipped to the second position, despite maintaining the top rank in both September and October. Elektra Ice (3.5g) consistently performed well, securing the third position after a slight drop from its second rank in October. Ice Cream Pie (3.5g) held steady in fourth place for two consecutive months. Notably, Space Rocks (14g) entered the top five in November, indicating a resurgence in popularity after not ranking in October.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.