Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

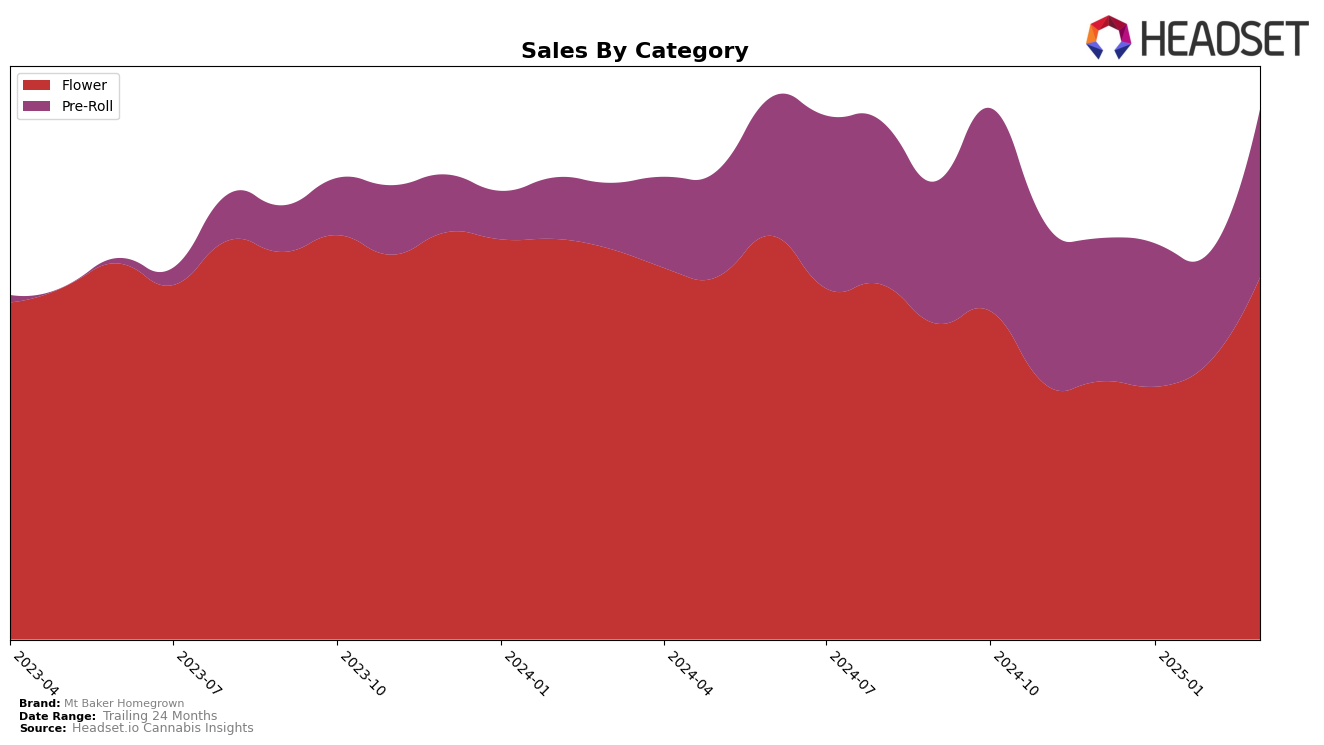

In Washington, Mt Baker Homegrown has shown a notable upward trajectory in the Flower category. Starting from a rank of 48 in December 2024, the brand climbed to 29 by March 2025. This improvement suggests a growing consumer preference for their products in this category. The rise in rank is accompanied by a significant increase in sales, from $162,562 in December 2024 to $225,289 in March 2025, indicating strong market performance. However, it's worth noting that while they are making strides in the Flower category, they were not in the top 30 brands at the beginning of this period, which highlights both their progress and the competitive nature of the market.

When examining the Pre-Roll category in Washington, Mt Baker Homegrown has experienced more fluctuation. The brand started at rank 43 in December 2024, moved slightly up to 40 in January 2025, and then saw a dip to 42 in February, before achieving a rank of 34 in March. This indicates a somewhat volatile performance in this category. Despite the fluctuations, the sales figures demonstrate a recovery from the dip, with an increase from $73,070 in February to $108,280 in March. Such data points suggest that while the brand is not yet dominant in the Pre-Roll market, it is making headway, though they have not yet broken into the top 30, which could be a target for future growth.

Competitive Landscape

In the competitive landscape of the flower category in Washington, Mt Baker Homegrown has shown a notable upward trajectory in its rankings from December 2024 to March 2025. Starting at a rank of 48 in December, Mt Baker Homegrown climbed to 29 by March, indicating a strong improvement in market presence. This positive trend is particularly significant when compared to competitors like Sky High Gardens and Snickle Fritz, who experienced more fluctuating ranks during the same period. For instance, Sky High Gardens ended March at rank 30, while Snickle Fritz saw a decline to rank 34. Furthermore, Mt Baker Homegrown's sales in March surpassed those of Sky High Gardens and Snickle Fritz, highlighting its growing consumer preference. Meanwhile, Withit Weed and Bodega Buds maintained stronger sales figures, yet Mt Baker Homegrown's consistent rank improvement suggests a closing gap. This upward momentum positions Mt Baker Homegrown as a rising contender in the Washington flower market.

Notable Products

In March 2025, Gelato 33 Pre-Roll 10-Pack (5g) maintained its top position for Mt Baker Homegrown, continuing its reign as the best-selling product since December 2024, with sales reaching 1622 units. GG #4 Pre-Roll 10-Pack (5g) emerged as a strong contender, securing the second spot, despite not being ranked in previous months. Garlic Grapes Pre-Roll 10-Pack (5g) experienced a slight decline, moving from second to third place compared to February 2025. Blueberry Pre-Roll 10-Pack (5g) improved its position, climbing from fifth to fourth place, indicating a positive trend in sales. Gelato #33 (3.5g) rounded out the top five, showing a steady performance and consistent demand in the flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.