Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

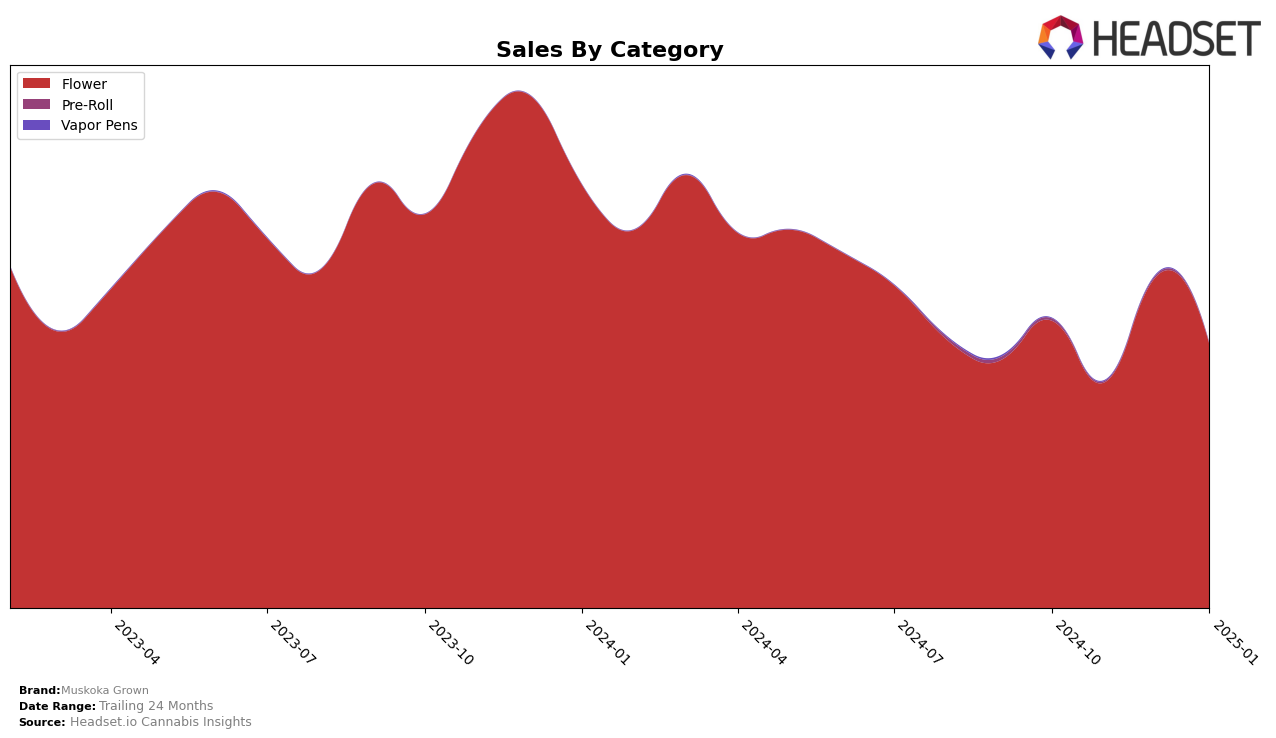

Muskoka Grown's performance in the flower category across various Canadian provinces has shown some noteworthy fluctuations. In Alberta, the brand experienced a slight dip in rankings, moving from 37th in December 2024 to 43rd in January 2025, despite a notable increase in sales during December. This suggests a competitive market environment where sales growth does not always translate into better rankings. Meanwhile, in Ontario, Muskoka Grown maintained a relatively stable position, oscillating between the 30th and 32nd ranks over the four-month period. This stability, coupled with fluctuating sales figures, indicates a consistent presence in the market, albeit with room for improvement in climbing the ranks.

In Saskatchewan, Muskoka Grown's presence in the flower category is quite interesting. The brand was ranked 20th in October 2024 but dropped out of the top 30 in November, only to reappear at 27th in December and improve slightly to 24th in January 2025. This re-entry into the top 30 could be seen as a positive sign of resilience and adaptability in a competitive market. However, the absence from the rankings in November highlights the challenges the brand faces in maintaining a consistent position. Such fluctuations suggest that while Muskoka Grown has the potential to perform well, there are underlying factors that may affect its stability in the rankings.

Competitive Landscape

In the competitive landscape of the Ontario flower category, Muskoka Grown has experienced fluctuations in its market position, ranking 30th in October 2024, dropping slightly to 32nd in November, rebounding to 30th in December, and then falling back to 32nd in January 2025. This pattern indicates a relatively stable yet slightly volatile presence in the market. In comparison, Potluck has shown a more consistent upward trend, moving from 31st in October to 27th in December, before slightly dropping to 31st in January. Meanwhile, Endgame consistently outperformed Muskoka Grown, maintaining a rank within the top 30 throughout the same period. Despite these challenges, Muskoka Grown's sales figures reveal a robust performance, particularly in December 2024, where it saw a significant sales increase, surpassing competitors like San Rafael '71 and EastCann, both of which did not make it into the top 30 rankings during this timeframe. This suggests that while Muskoka Grown faces stiff competition, its sales strategies and product offerings resonate well with consumers, maintaining its relevance in the Ontario flower market.

Notable Products

In January 2025, the top-performing product from Muskoka Grown was Sugar Cookies (3.5g) in the Flower category, which rose to the number one rank with sales of 1044 units. Following closely, Sugar Cookies (28g) maintained a strong position at rank two, despite a slight decrease from December 2024. Berry Smasher (28g) improved its standing to third place, indicating a positive trend from its debut in December. Meanwhile, Berry Smasher (14g) experienced a slight drop to fourth place, and Berry Smasher (3.5g) rounded out the top five, maintaining its position from the previous month. Overall, the rankings show a dynamic shift in consumer preferences, with Sugar Cookies (3.5g) gaining significant traction since its initial appearance in November 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.