Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

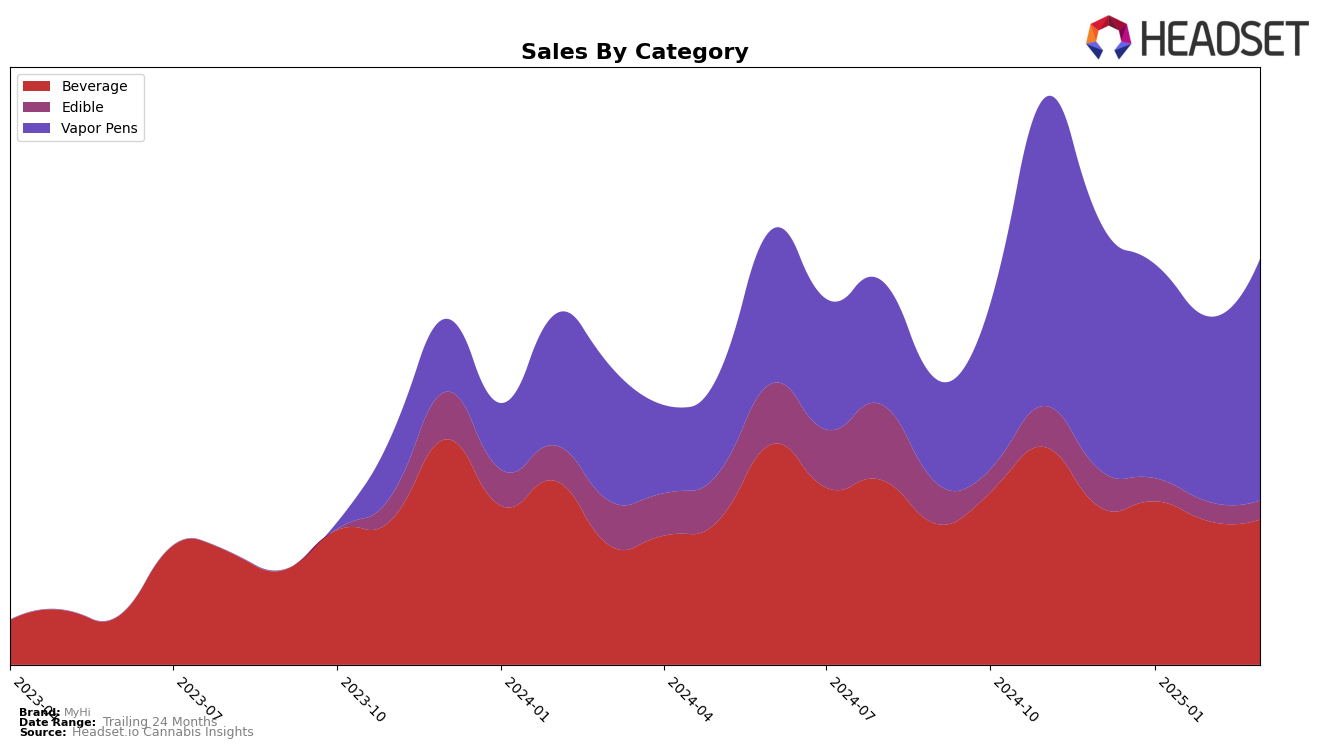

MyHi has shown a consistent performance in the Beverage category in New York, maintaining a steady rank of fourth place from December 2024 through March 2025. This stability indicates a strong foothold in the market, with sales figures reflecting a slight fluctuation but generally remaining robust. The brand's ability to maintain its rank suggests a loyal customer base and effective market strategies within this category. However, it's worth noting that MyHi did not make it to the top 30 in the Vapor Pens category during the same period, highlighting potential areas for growth or strategic shifts to improve its presence in that segment.

In the Vapor Pens category, MyHi's performance in New York has seen some variability, with rankings hovering around the 50th mark. Notably, the brand's rank improved from 53rd in February 2025 to 50th in March 2025, suggesting a positive trend that could be capitalized on with targeted efforts. Despite not breaking into the top 30, the recent uptick in ranking could signify a potential upward trajectory. This movement, coupled with the sales figures, may indicate that MyHi is beginning to gain traction in a highly competitive market, which could lead to future opportunities for growth and expansion within the state.

Competitive Landscape

In the competitive landscape of vapor pens in New York, MyHi has shown a dynamic performance over the past few months. Starting from December 2024, MyHi was ranked 52nd and experienced a slight improvement to 50th in January 2025, though it dipped to 53rd in February before recovering to 50th in March. This fluctuation in rank suggests a volatile market presence, potentially impacted by competitors such as OMO - Open Minded Organics, which maintained a more stable ranking in the low 40s, and Theory Wellness, which entered the top 20 by March. Despite these challenges, MyHi's sales rebounded in March, indicating a positive trend that could be leveraged for future growth. Meanwhile, brands like Kingsroad and Beboe have shown less consistent sales performance, suggesting potential opportunities for MyHi to capitalize on market share in the coming months.

Notable Products

In March 2025, the Simply Flavorless Stir Stick 10-Pack (100mg) maintained its position as the top-performing product for MyHi, consistently holding the number one rank since December 2024 with notable sales of 511 units. The Dreamy - Blue Raz Live Rosin Disposable (1g) emerged as a new contender, securing the second position, though it was not ranked in the previous months. The Lively Lemon Stir Stick 10-Pack (100mg) improved its rank to third place, moving up from fifth in February. The Boisterous Berry Stir Stick 10-Pack (100mg) held steady in fourth place, while the Boisterous Berry Stir Stick (10mg) dropped from second to fifth place since February. This shift in rankings highlights a dynamic change in consumer preferences within MyHi's product lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.