Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

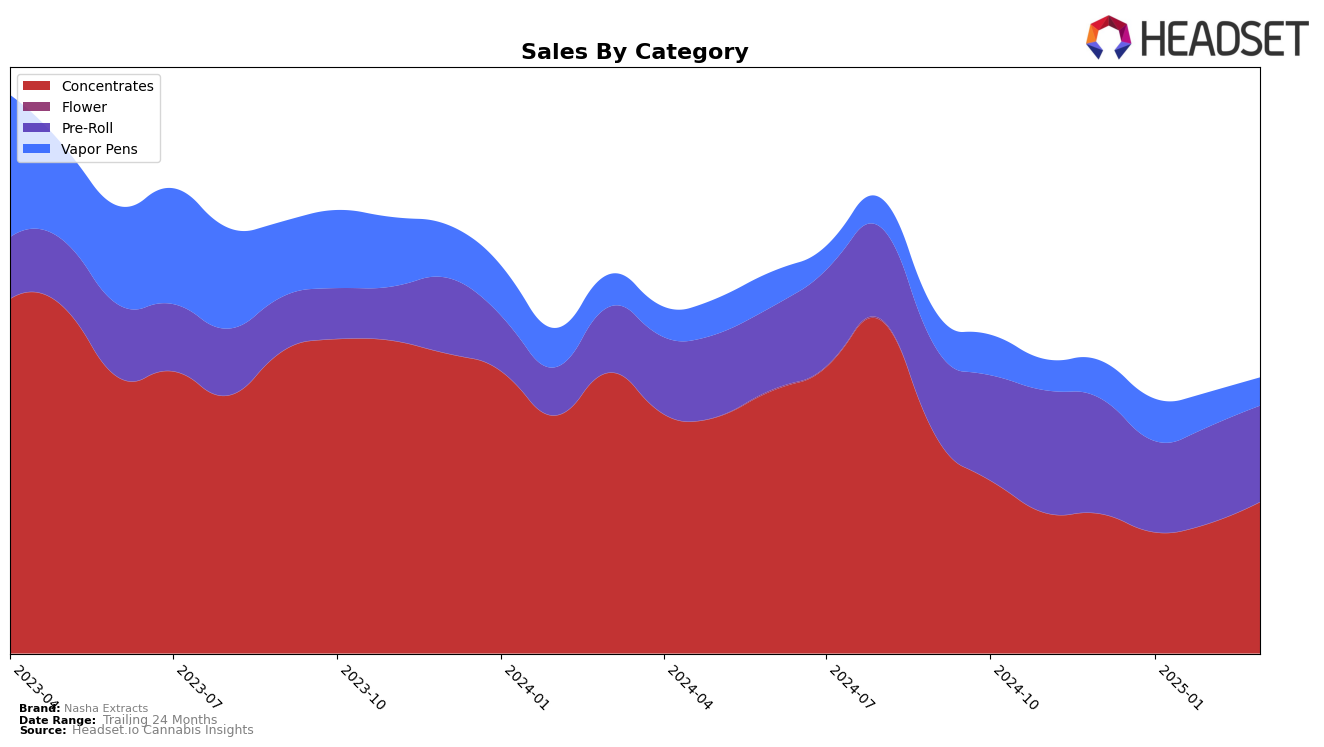

Nasha Extracts has shown a notable upward trajectory in the Concentrates category within California. Starting from a rank of 25 in December 2024, the brand improved its position to 19 by March 2025. This positive movement suggests a strengthening presence in the market, likely driven by increasing consumer preference or effective distribution strategies. The brand's sales figures also reflect this upward trend, with a significant increase from January to March 2025, indicating a successful quarter for Nasha Extracts in the Concentrates segment.

Conversely, Nasha Extracts faces challenges in the Pre-Roll category in California, where it has not managed to break into the top 30 rankings. Despite maintaining a relatively stable position, fluctuating between ranks 76 and 79 from December 2024 to March 2025, the brand has not seen the same level of success as in Concentrates. This highlights an area where Nasha Extracts could potentially focus on improving either product offerings or marketing strategies to boost its presence and competitiveness in the Pre-Roll market.

Competitive Landscape

In the competitive landscape of the California concentrates market, Nasha Extracts has shown a promising upward trend in rankings from December 2024 to March 2025. Starting at 25th place in December, Nasha Extracts improved its position to 19th by March, indicating a positive trajectory in market presence. Despite this progress, competitors like Greenline Organics and Pistil Whip consistently maintained higher rankings, with Greenline Organics moving from 20th to 17th and Pistil Whip, although dropping slightly, remaining in the top 20. Meanwhile, Globs experienced fluctuations but ended March just one rank below Nasha Extracts. Notably, Have Hash showed a significant recovery from a drop to 40th in January to 21st by March. These dynamics suggest that while Nasha Extracts is gaining ground, the brand still faces stiff competition from established players who have shown resilience and adaptability in the market.

Notable Products

In March 2025, Nasha Extracts' top-performing product was Topper Bubble Hash (1g) in the Concentrates category, maintaining its consistent first-place ranking from previous months with a notable sales figure of 2594 units. The Altitude - Madd Fruit x Moroccan Peaches Infused Pre-Roll (1g) debuted impressively at second place in the Pre-Roll category. Submerge Infused Pre-Roll (1g) rose to third place, up from fifth in February, demonstrating a positive sales trend. Altitude Infused Pre-Roll (1g) held steady in fourth place, showing slight fluctuations but remaining within the top five. Ice Cream Cake Red Pressed Hash (1.2g) entered the rankings at fifth place, indicating a promising new entry in the Concentrates category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.