Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

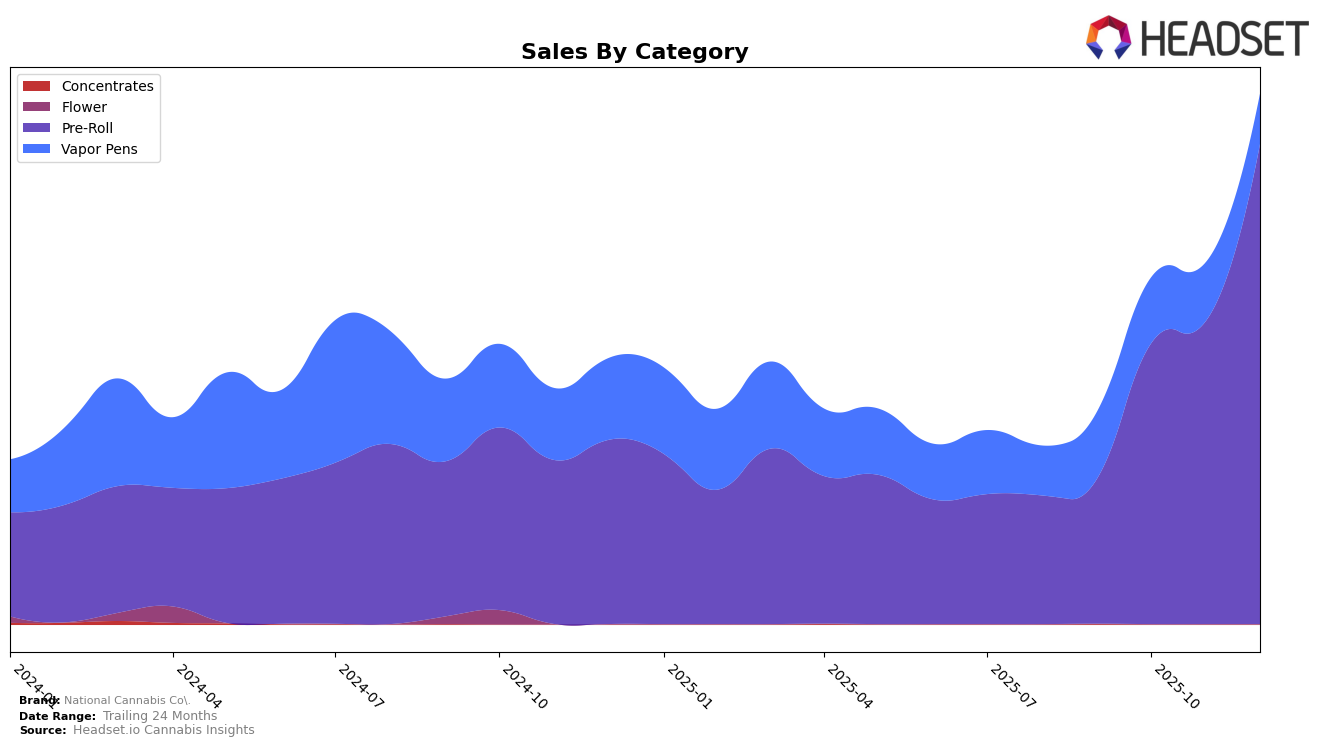

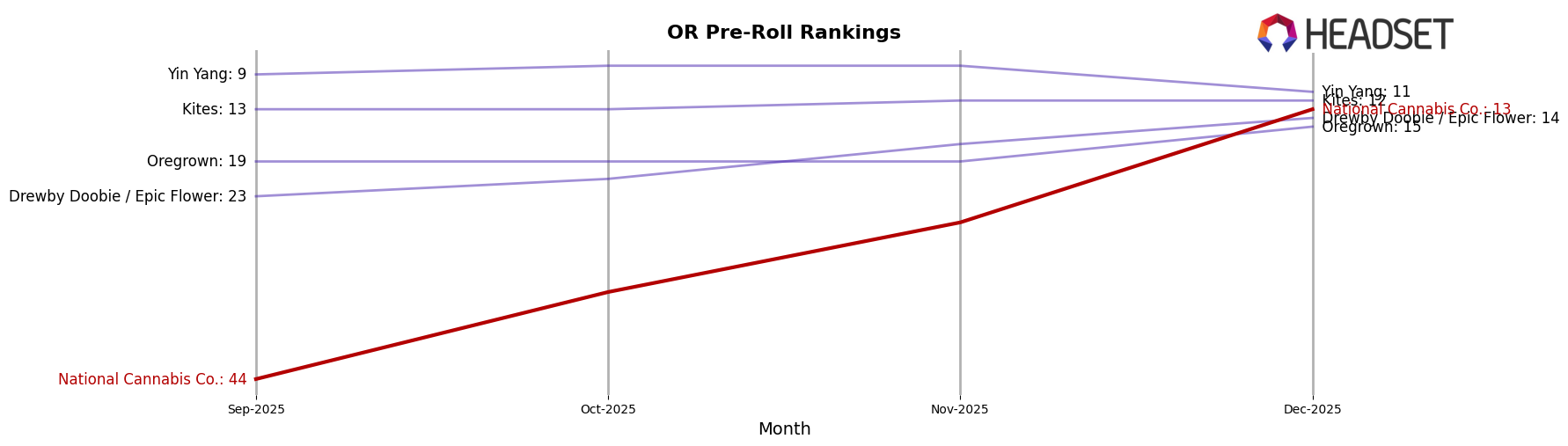

In Oregon, National Cannabis Co. has shown a remarkable upward trajectory in the Pre-Roll category. Starting from a rank of 44 in September 2025, the brand climbed to 13 by December 2025. This impressive rise indicates a strong consumer preference and effective market strategies in this category. The increase in rank is complemented by a notable increase in sales, highlighting the brand's growing dominance in the Oregon Pre-Roll market. Conversely, the Vapor Pens category tells a different story. Despite maintaining a stable presence in the 60s rank range, the brand did not break into the top 30, suggesting a need for strategic adjustments to enhance competitiveness in this segment.

The contrasting performance of National Cannabis Co. in Oregon's Pre-Roll and Vapor Pens categories underscores the brand's varied success across product lines. While the Pre-Roll category shows promising growth and market penetration, the Vapor Pens category reflects stagnation, with the brand failing to make a significant impact. This disparity could be attributed to differences in consumer preferences, product quality, or marketing efforts. As the brand continues to expand, understanding these dynamics will be crucial for optimizing performance across all categories and maintaining a competitive edge in the evolving cannabis market landscape.

Competitive Landscape

In the competitive landscape of Oregon's Pre-Roll category, National Cannabis Co. has demonstrated a remarkable upward trajectory in brand rank, climbing from 44th in September 2025 to an impressive 13th by December 2025. This significant rise in rank is indicative of a strong increase in sales, suggesting that National Cannabis Co. is gaining traction and market share. In comparison, Oregrown maintained a stable position at 19th for three months before jumping to 15th in December, while Drewby Doobie / Epic Flower showed a consistent climb from 23rd to 14th. Meanwhile, Kites held steady around the 12th position, and Yin Yang experienced a slight dip from 8th to 11th. The data suggests that National Cannabis Co.'s strategic initiatives are effectively enhancing its market position, particularly as it surpasses several competitors who have either maintained or slightly improved their ranks.

Notable Products

In December 2025, National Cannabis Co.'s top-performing product was the CBD/THC 1:1 Watermelon Wonder Infused Pre-Roll (1g), maintaining its top rank from October and showing impressive sales of 5352 units. The CBD/THC 1:1 Raspberry Skywalker Infused Pre-Roll (1g) climbed to the second position, up from its consistent third-place standing in the previous months. The Guava Botanical Infused Pre-Roll (1g) dropped to third place after leading in September and November. Oregon Apple Infused Pre-Roll (1g) consistently held the fourth position from October through December. The CBD/THC 1:1 Blueberry Pie Infused Pre-Roll (1g) re-entered the rankings in fifth place for December, after being absent in November.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.