Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

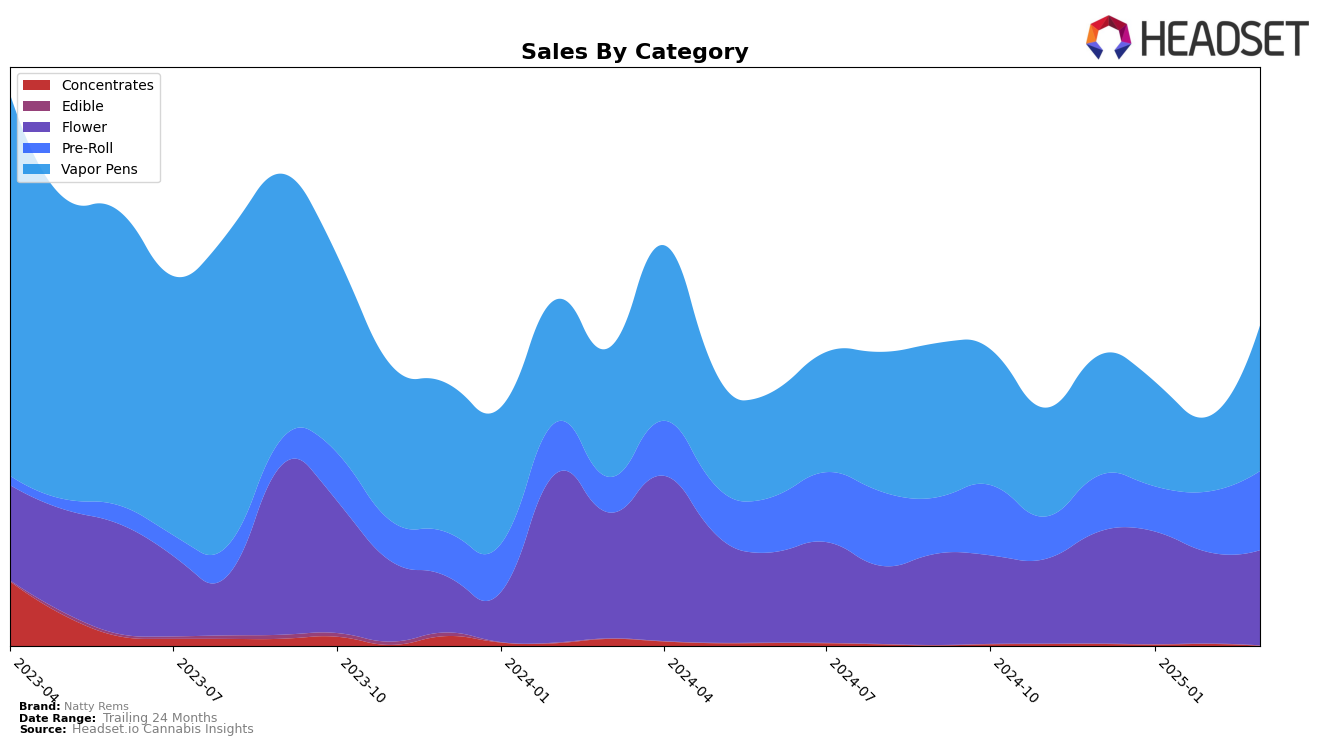

In the state of Colorado, Natty Rems has demonstrated varied performance across different product categories. In the Flower category, Natty Rems maintained a presence within the top 30, although there was a slight downward trend from a rank of 19 in December 2024 to 25 by March 2025. This is indicative of a competitive market where Natty Rems may need to strategize to regain its earlier position. In contrast, their performance in the Pre-Roll category has been more promising, with a steady improvement from a rank of 14 in December to breaking into the top 10 by March. This upward movement suggests a growing consumer preference or successful marketing efforts in this specific segment.

The Vapor Pens category tells a different story for Natty Rems in Colorado. The brand experienced fluctuations, starting at rank 21 in December, dipping to 29 in February, and then climbing back to 16 by March. Such volatility might reflect changes in consumer preferences or competitive dynamics within the vapor pen market. Notably, the sales figures for March show a significant rebound, indicating potential growth opportunities if the brand can maintain or improve its ranking. The absence of rankings in other states suggests that Natty Rems' focus or market presence is primarily concentrated in Colorado, which could be a strategic decision or a limitation in their market expansion efforts.

Competitive Landscape

In the competitive landscape of vapor pens in Colorado, Natty Rems experienced a notable fluctuation in its market position from December 2024 to March 2025. Initially ranked 21st in December, Natty Rems saw a decline to 24th in January and further to 29th in February, before making a significant recovery to 16th place in March. This rebound in March is particularly impressive given the competitive environment, where brands like Olio consistently maintained higher ranks, fluctuating between 11th and 14th place, and Seed and Smith (LBW Consulting) held steady between 12th and 15th. Despite the challenges, Natty Rems' March sales surpassed those of The Colorado Cannabis Co., which ranked between 15th and 19th during the same period. This suggests that while Natty Rems faced a temporary dip, its ability to bounce back indicates resilience and potential for further growth in the competitive Colorado vapor pen market.

Notable Products

In March 2025, the top-performing product for Natty Rems was the Runtz Pre-Roll 1g, which secured the number one rank with notable sales of 6386 units. Following closely, the Lunar Haze Pre-Roll 1g held the second spot while Peach Crescendo Bulk ranked third. Kurple Fantasy Pre-Roll 1g and Space Cat Pre-Roll 1g occupied the fourth and fifth positions respectively. Compared to previous months, Runtz Pre-Roll 1g maintained its strong presence, consistently leading the pre-roll category. Products like Lunar Haze Pre-Roll 1g and Peach Crescendo Bulk showed a significant rise in rankings, indicating increased consumer preference and demand over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.