Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

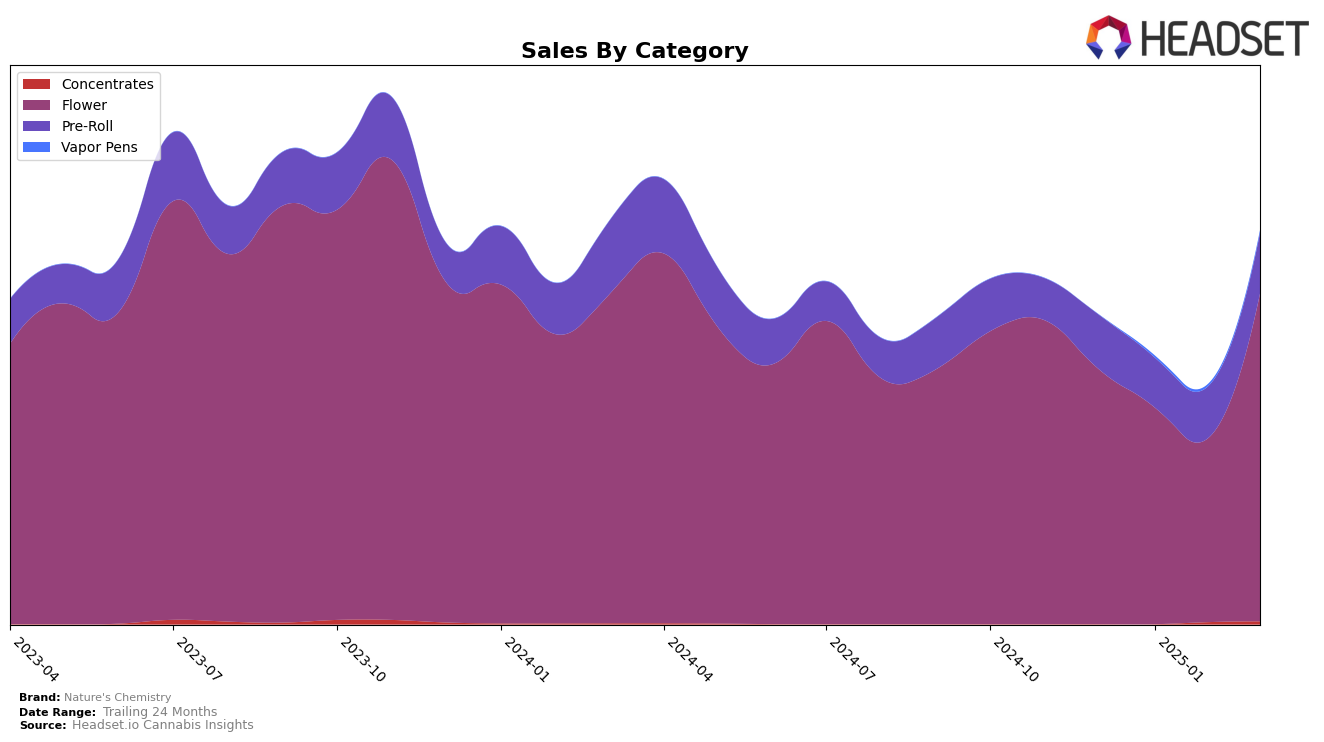

Nature's Chemistry has shown notable performance fluctuations across different categories and states. In the Nevada market, the brand's Flower category experienced a dynamic shift, moving from the 7th position in December 2024 to the 6th position by March 2025. This upward trend is significant, especially considering the competitive nature of the Flower category. However, the brand's Pre-Roll category in Nevada also exhibited an interesting trajectory, initially ranking 11th in December 2024, then dropping to 14th in January 2025, before climbing back up to 9th by March 2025. Such movements indicate a robust recovery and adaptability in their Pre-Roll offerings, suggesting potential strategic adjustments by the brand.

Despite the positive trends in Nevada, it's important to acknowledge that Nature's Chemistry was not present in the top 30 brands in other states or provinces across these categories, which could be seen as a limitation in their market reach or influence outside Nevada. This absence highlights an opportunity for the brand to explore new markets or enhance its presence beyond its current stronghold. The Flower category's sales in Nevada, which increased significantly from January to March 2025, underscore the brand's potential for growth if similar strategies are employed in other regions. The brand's ability to maintain and improve its ranking in a competitive market like Nevada is commendable, but expanding this success to other areas could be pivotal for future growth.

Competitive Landscape

In the Nevada flower category, Nature's Chemistry has demonstrated notable fluctuations in its market position over the past few months. Starting from December 2024, the brand ranked 7th, but experienced a dip to 9th and 10th in January and February 2025, respectively. However, by March 2025, Nature's Chemistry rebounded to 6th place, showcasing a strong recovery. This upward trend in March is particularly significant given the competitive landscape. For instance, Green Life Productions showed inconsistent performance, dropping out of the top 10 in January before climbing back to 8th place in March. Meanwhile, Medizin consistently held a top 4 position, indicating a stable market presence. Lavi maintained a steady 5th rank, while Hustler's Ambition showed a similar recovery pattern to Nature's Chemistry, moving from 10th in December to 7th in March. These dynamics highlight Nature's Chemistry's resilience and adaptability in a competitive market, suggesting potential opportunities for strategic growth and increased market share.

Notable Products

In March 2025, Garlic Cookies (3.5g) from Nature's Chemistry regained its top position in the Flower category with impressive sales of 2703 units. Ghost Train Haze (3.5g) climbed back to the second spot after being unranked in February, achieving notable sales figures. Onion Ring (3.5g) maintained its position at rank three, showing consistency in performance since its debut in February. Modified Banana (3.5g) moved up to fourth place, improving from its previous unranked status in February. Face on Fire Pre-Roll (1g) made its first appearance in the rankings, securing the fifth position in March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.