Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

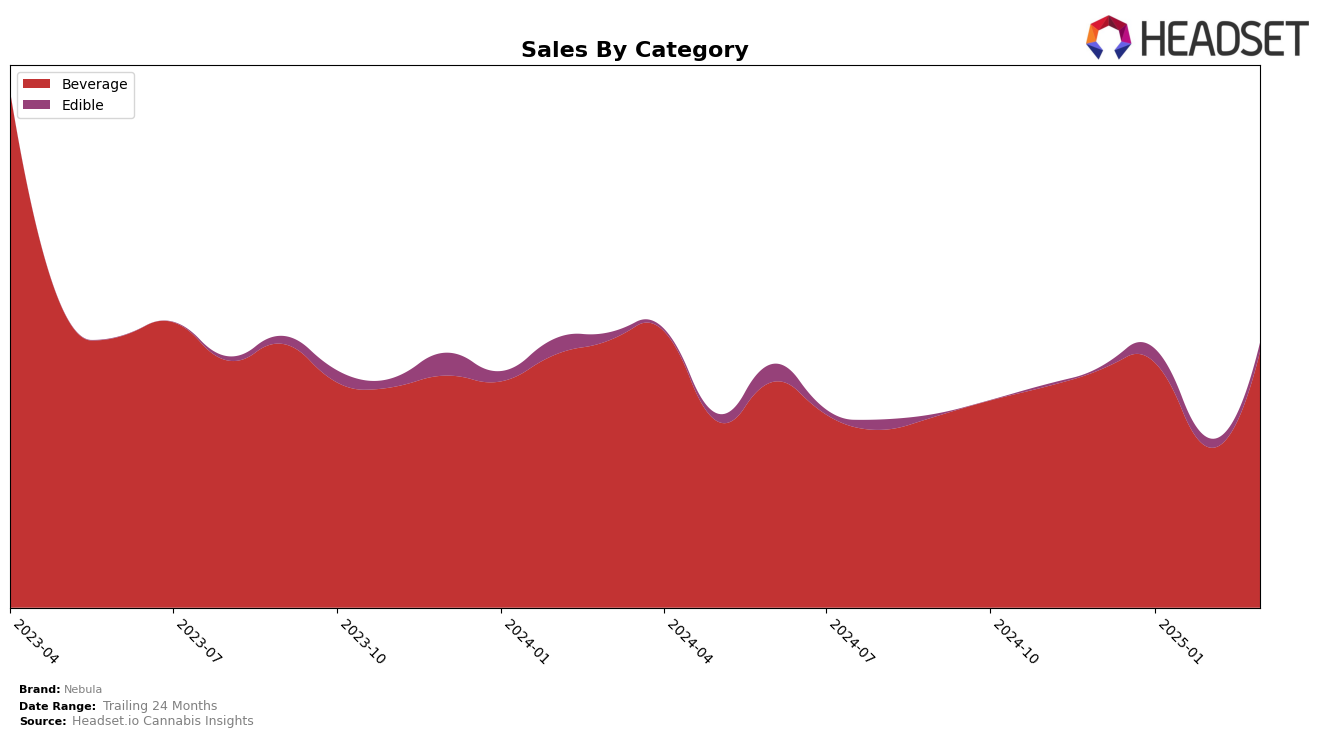

Nebula has shown a consistent performance in the Beverage category within Arizona. Over the months from December 2024 to March 2025, Nebula maintained a strong presence, starting and ending at rank 4, with a slight dip to rank 5 in February. This indicates a stable demand for their products in this category, despite a noticeable drop in sales in February. The quick rebound in March suggests effective strategies to regain market position or perhaps a seasonal demand that Nebula has capitalized on effectively.

While Nebula's performance in Arizona's Beverage category is commendable, it is noteworthy that the brand's presence in other states or categories is not highlighted in the top 30 rankings. This absence points to potential areas for growth or challenges that Nebula might be facing outside of Arizona's Beverage market. The focus on maintaining a stronghold in Arizona might be strategic, but exploring expansion opportunities in other regions or categories could be beneficial for long-term growth. Understanding these dynamics can provide insights into Nebula's market strategies and potential future directions.

Competitive Landscape

In the Arizona beverage category, Nebula has maintained a relatively stable position, consistently ranking 4th in December 2024, January 2025, and March 2025, with a slight dip to 5th place in February 2025. This stability is notable given the competitive landscape, where brands like Sip Elixirs and High Tide have dominated the top ranks, consistently holding 2nd and 3rd positions respectively. Despite Nebula's steady rank, its sales figures experienced a significant fluctuation, particularly in February 2025, when sales dropped, potentially impacting its rank. Meanwhile, tonic showed a remarkable recovery in March 2025, climbing from 9th to 5th place, indicating a potential threat to Nebula's position if this trend continues. The consistent performance of Pure & Simple in the 7th position suggests a stable, albeit less competitive presence in the market. For Nebula, maintaining its current rank amidst these dynamics will require strategic initiatives to boost sales and counter the upward momentum of competitors like tonic.

Notable Products

In March 2025, Nebula's top-performing product was Nectar - Pure Unflavored Syrup (100mg, 1oz) in the Beverage category, maintaining its top rank from the previous month with sales of 655 units. Tigers Blood Nectar Syrup (100mg) secured the second position, consistent with its ranking in February, with a notable increase in sales. Wild Strawberry Nectar Syrup (100mg) dropped from its previous first-place tie to third, despite a slight decrease in sales figures. Blue Razz Nectar Syrup (100mg) improved its position from fifth in February to fourth in March. Vanilla Nectar Syrup (100mg) saw a decline in ranking from third in February to fifth in March, reflecting a decrease in sales performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.