Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

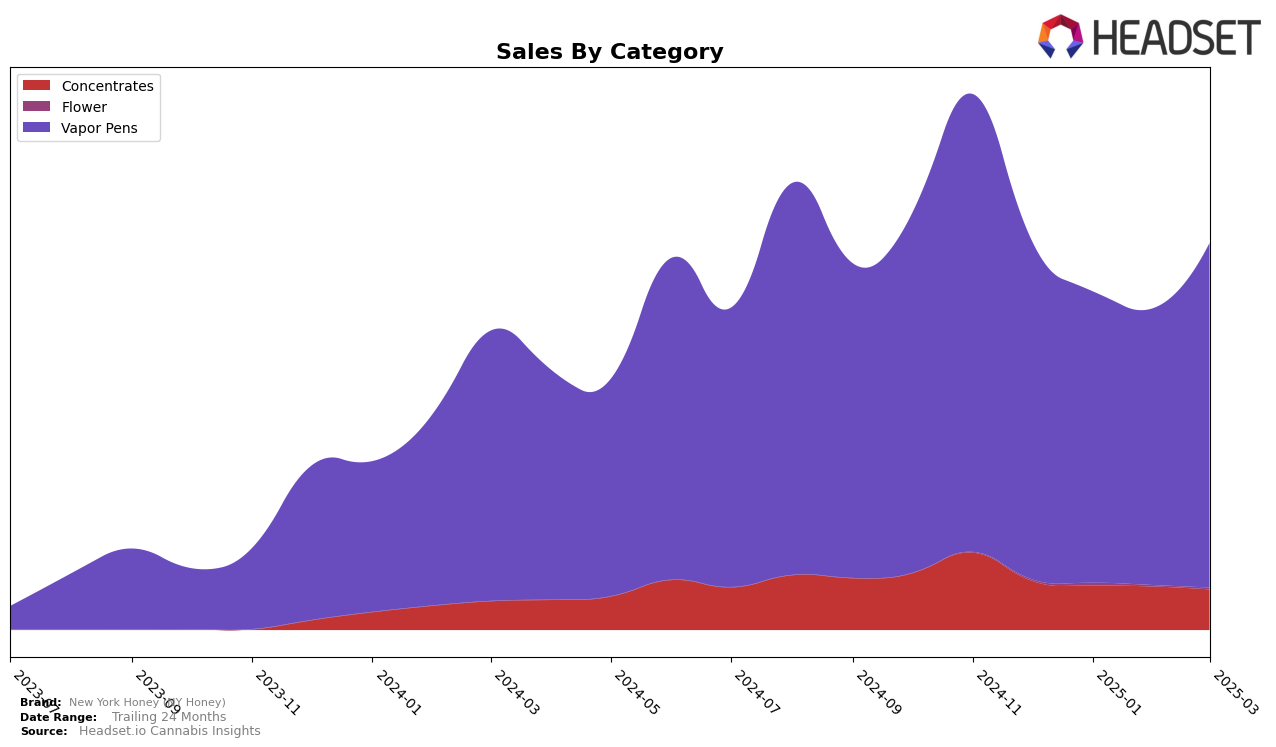

New York Honey (NY Honey) has shown a consistent presence in the New York concentrates category, maintaining a steady ranking at 9th place from January to March 2025, after starting at 7th in December 2024. This indicates a slight decline but reflects stability in the top 10, suggesting a solid foothold in this segment. The decrease in monthly sales from December to March could point to seasonal fluctuations or increased competition within the market. However, the brand's ability to stay in the top 10 highlights its resilience and potential for future growth in the concentrates category.

In the New York vapor pens category, New York Honey (NY Honey) experienced more dynamic movement, starting at 10th place in December 2024 and dropping to 14th in February 2025, before climbing back to 11th in March. This fluctuation suggests a competitive landscape where the brand is actively vying for a stronger position. Notably, the brand saw a significant increase in sales from February to March, indicating a successful strategy or product launch that helped regain some lost ground. The absence of rankings outside the top 30 in any mentioned category demonstrates the brand's consistent performance and relevance in the New York market.

Competitive Landscape

In the competitive landscape of vapor pens in New York, New York Honey (NY Honey) has experienced fluctuating rankings over the past few months, indicating a dynamic market presence. In December 2024, NY Honey was ranked 10th, but it slipped to 13th in January 2025 and further to 14th in February, before rebounding to 11th in March. This volatility contrasts with the steadier performance of competitors like Magnitude, which consistently maintained a top 10 position, ranking 8th for three consecutive months before dropping slightly to 9th in March. Meanwhile, Brass Knuckles improved its standing from 15th in January to 10th by March, showcasing a positive trend in sales momentum. Similarly, PAX showed resilience, climbing from 15th in December to 12th by March. Cannabals also demonstrated competitive strength, peaking at 10th in February before settling at 13th in March. These shifts highlight the competitive pressures NY Honey faces, necessitating strategic adjustments to regain and sustain higher rankings in the New York vapor pen market.

Notable Products

In March 2025, the top-performing product for New York Honey (NY Honey) was Blue Dream Distillate Cartridge (1g) in the Vapor Pens category, maintaining its consistent first-place rank from previous months with sales reaching 2614 units. Barry White Distillate Cartridge (1g) also held steady in second place, showing a slight increase in sales figures from prior months. Lemon OG Distillate Cartridge (1g) made a significant leap, climbing to the third position from fifth in February, indicating a rising popularity. Ice Cream Cake Distillate Cartridge (1g) experienced a slight drop, moving from third in February to fourth in March. Mimosa Distillate Cartridge (1g) entered the rankings for the first time in March, securing the fifth spot, which highlights its emerging presence in the market.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.