Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

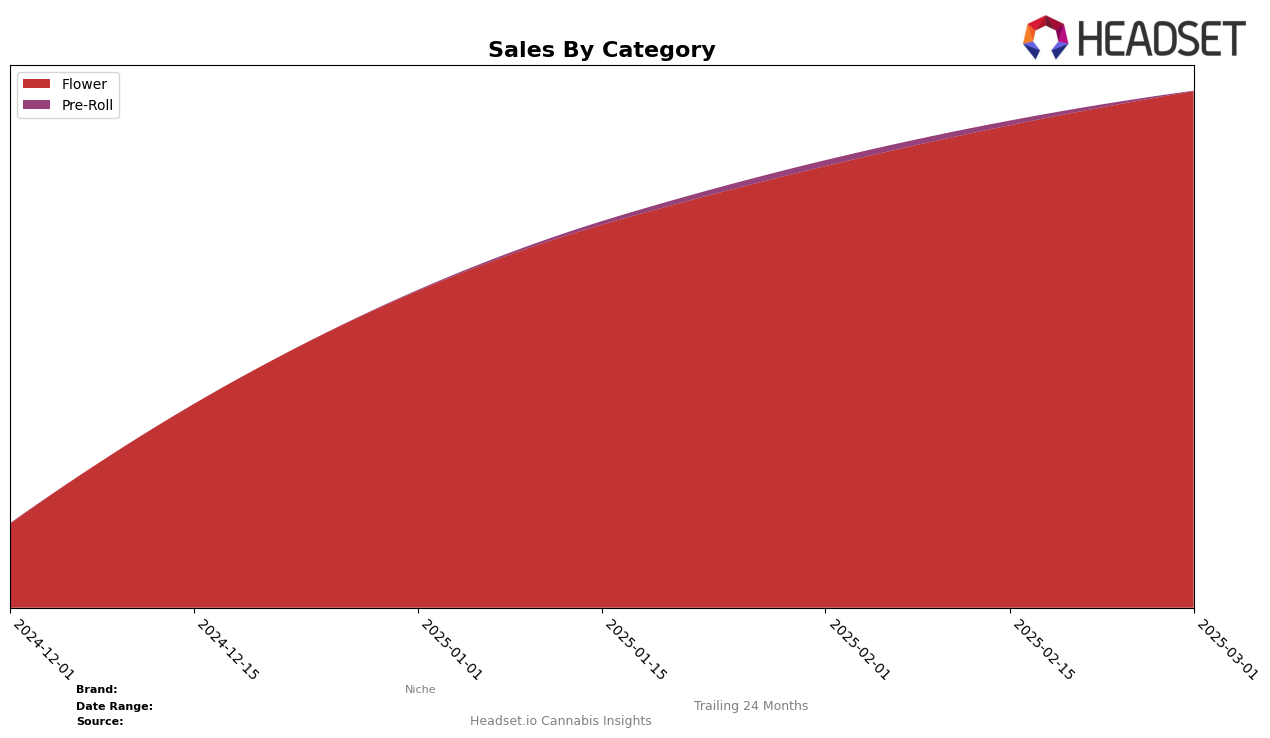

In the state of New Jersey, Niche has demonstrated a noteworthy upward trajectory in the Flower category. Starting from a rank of 42 in December 2024, Niche made a significant leap to 26 in January 2025, and continued to climb to the 19th position by February and March 2025. This consistent upward movement indicates a strengthening market presence and suggests that Niche is effectively capturing consumer interest and market share in the New Jersey Flower category. The brand's ability to break into the top 30 from a position outside it is a positive indicator of its growth potential and competitive strategy in the region.

While Niche's ascent in New Jersey's Flower category is promising, it is important to note that the brand did not appear in the top 30 rankings in other states or categories during the same period. This absence suggests that while Niche is gaining traction in New Jersey, there may be opportunities for improvement or expansion in other markets. The brand's performance in New Jersey could serve as a model for strategic initiatives in other states, potentially leveraging successful elements of their approach to replicate this performance elsewhere. Understanding the factors contributing to their success in New Jersey could provide valuable insights for broader market penetration.

Competitive Landscape

In the competitive landscape of the New Jersey flower category, Niche has demonstrated a remarkable upward trajectory in rank and sales over the past few months. Starting from a rank of 42 in December 2024, Niche climbed to 19 by February 2025, maintaining this position in March 2025. This significant improvement highlights Niche's growing market presence and consumer preference. In contrast, Cookies experienced a decline, dropping from rank 13 in December 2024 to 18 in March 2025, indicating potential challenges in sustaining its market share. Meanwhile, Old Pal showed a positive trend, improving from rank 25 in December 2024 to 17 in March 2025, suggesting a competitive edge in the market. The Botanist and Find. displayed fluctuations in their rankings, with both brands not maintaining a consistent upward or downward trend. These dynamics suggest that while Niche has successfully capitalized on market opportunities to enhance its position, other brands are facing varied challenges and opportunities in the New Jersey flower market.

Notable Products

In March 2025, Spritzer (3.5g) from Niche emerged as the top-performing product, leading the sales chart with a notable figure of 1552 units sold. Zkittles Marker #8 (3.5g) secured the second position with 1148 units, showing a strong performance. Yellow Mermaid (3.5g) followed closely in third place with 1006 units sold. Peelz (3.5g) ranked fourth, maintaining a consistent presence in the top tier since December 2024 when it ranked third. Oishii III (3.5g) dropped to the fifth position, a notable change from its second-place ranking in both December 2024 and January 2025.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.