Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

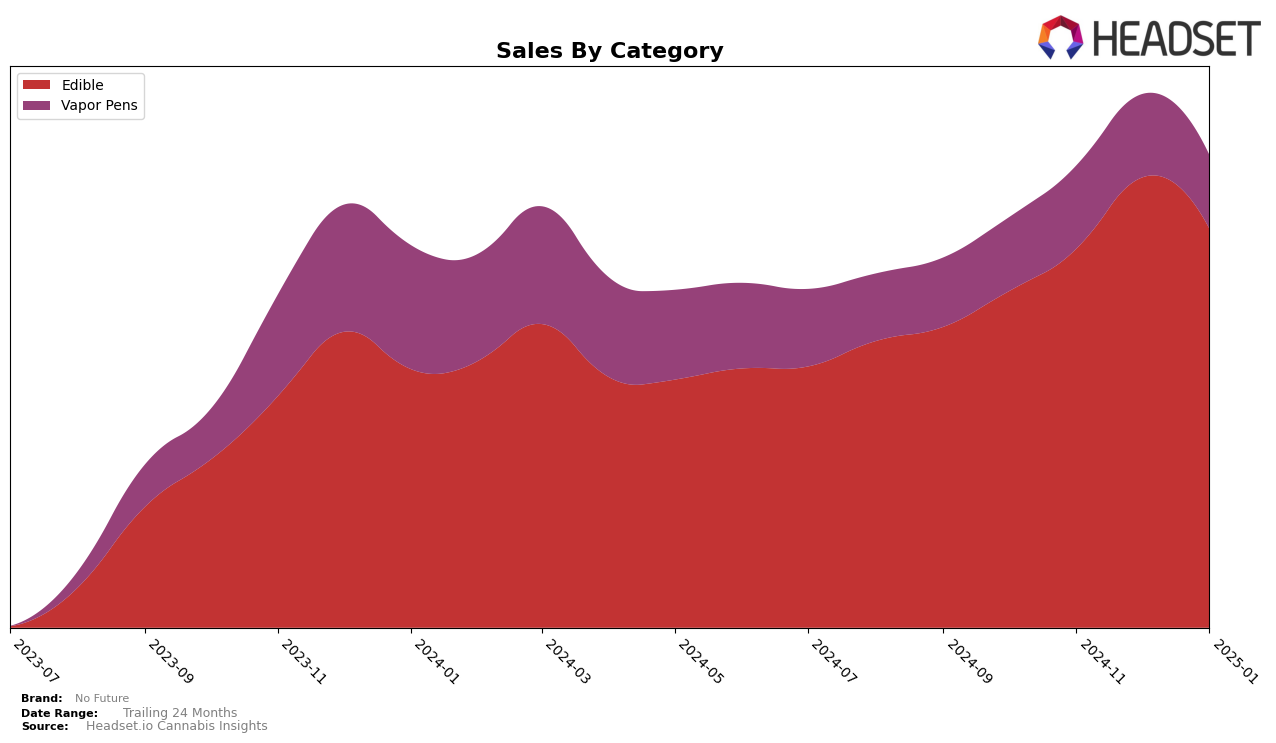

No Future has shown consistent performance in the Edible category across multiple provinces, maintaining stable rankings throughout the observed months. In Alberta, the brand held the 4th position from October 2024 to January 2025, demonstrating a steady presence in the top tier. Similarly, in British Columbia, No Future secured the 3rd rank consistently in the Edible category, reflecting strong consumer demand. Meanwhile, in Ontario, the brand maintained the 6th position across the same period, indicating a robust market presence. This stability in rankings suggests that No Future has successfully captured a loyal customer base in the Edible segment across these provinces.

Conversely, the performance of No Future in the Vapor Pens category reveals some challenges. In Alberta, the brand was not in the top 30 for the Vapor Pens category as of January 2025, indicating a potential area for improvement. In British Columbia, however, No Future showed a positive trend, moving from 25th to 22nd place by January 2025, suggesting gradual progress in this category. In Ontario, the brand faced a decline, slipping from 70th to 84th position, which could be a cause for concern. This mixed performance across provinces highlights the varying market dynamics and suggests that while No Future excels in the Edible category, there is room for strategic enhancement in Vapor Pens to improve its standings.

Competitive Landscape

In the competitive landscape of the Edible category in Ontario, No Future consistently maintained its position at rank 6 from October 2024 to January 2025, demonstrating stable performance amidst a dynamic market. Despite this stability, No Future faces stiff competition from brands like Foray, which held a steady rank of 7, and Chowie Wowie, which improved its rank from 11 to 8 over the same period. Notably, Shred dominated the category with a consistent rank of 3, indicating a significant lead in market presence. Although No Future's sales showed an upward trend, peaking in December 2024, the brand still trails behind Monjour, which maintained a rank of 5 with steady sales figures. This competitive environment suggests that while No Future is performing well, there is room for strategic initiatives to enhance its market position and close the gap with leading competitors.

Notable Products

In January 2025, No Future's top-performing product was The Blue One Sativa Bonbon Gummy (10mg) in the Edible category, maintaining its number one rank from previous months with a notable sales figure of 92,232 units. The Purple One Sativa Bonbon Gummy (10mg) also held steady in the second position, consistent with its ranking since October 2024. The Orange One Indica Gummy (10mg) rose to the third spot, up from fourth, indicating a positive shift in consumer preference. Meanwhile, The Red One Indica Gummy (10mg) climbed to fourth place, showing an improvement from its previous fifth rank. The Green One Indica Gummy (10mg) experienced a slight decline, moving down to fifth place from third in December 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.