Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

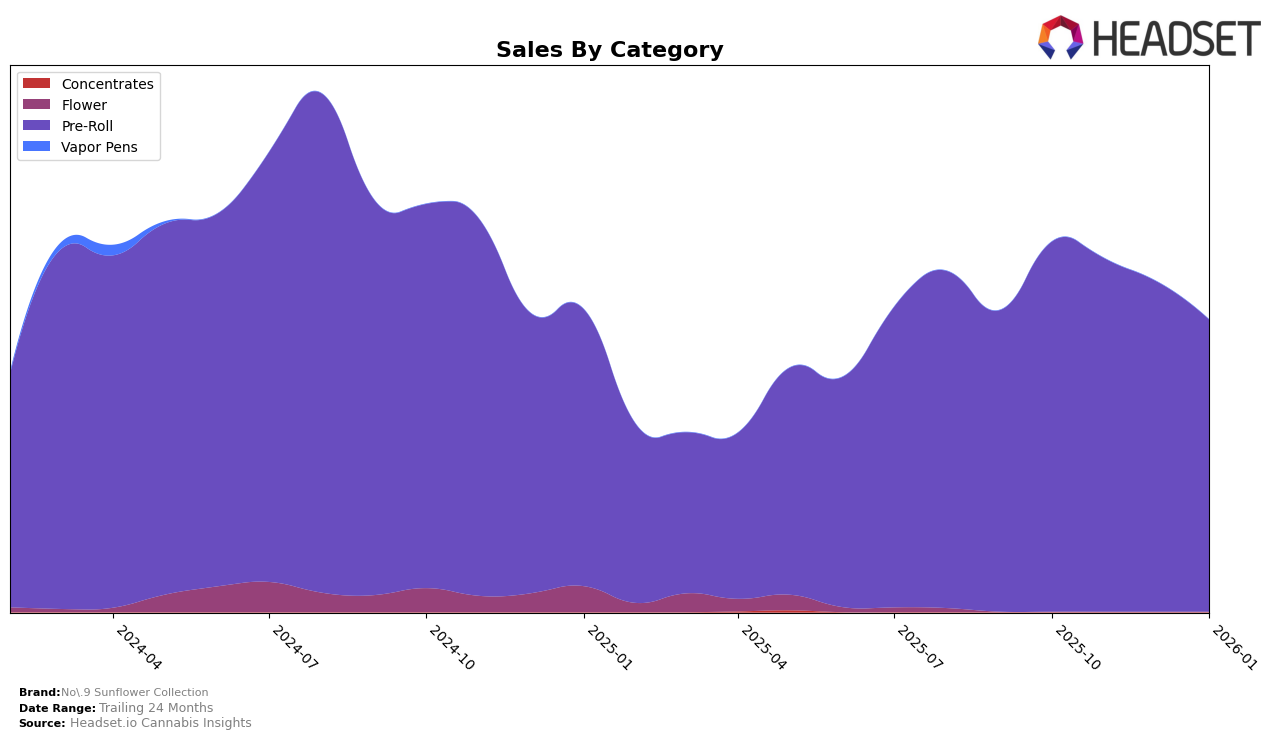

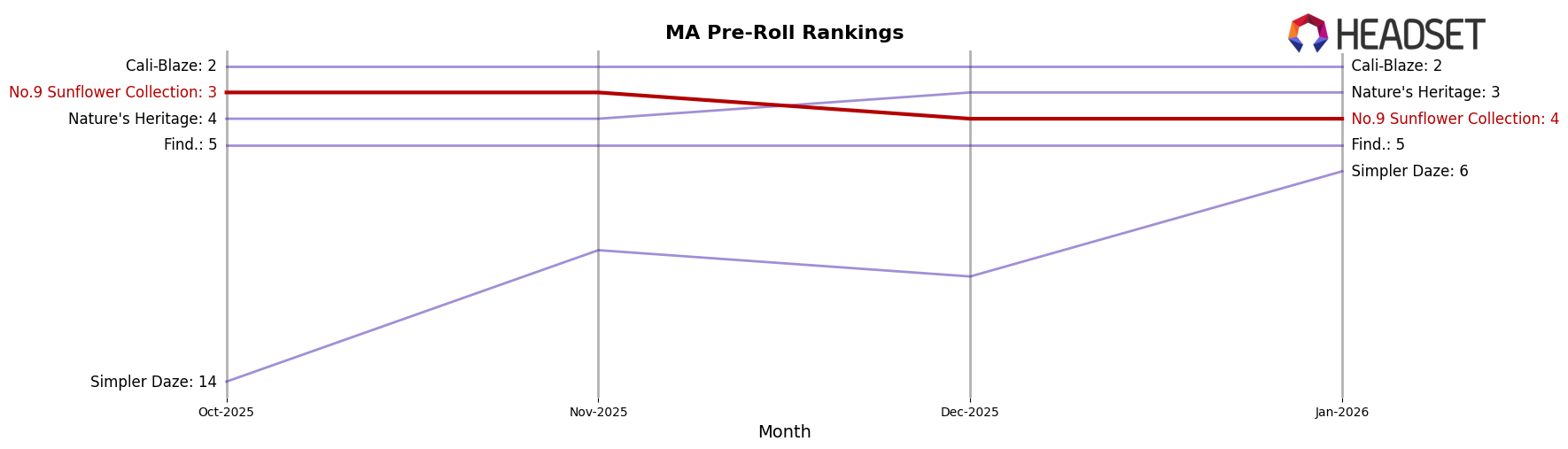

In the Massachusetts market, No.9 Sunflower Collection has shown a consistent yet slightly declining performance in the Pre-Roll category. The brand maintained a strong position, ranking 3rd in both October and November 2025, before slipping to 4th place in December 2025 and January 2026. This slight drop in ranking is accompanied by a consistent decrease in sales figures, with a notable decline from $828,474 in October 2025 to $653,565 in January 2026. While the brand remains a key player in this category, the downward trend in sales and rankings suggests a need for strategic adjustments to maintain its competitive edge.

Despite the challenges in Massachusetts, No.9 Sunflower Collection's absence from the top 30 rankings in other states or provinces may indicate either a limited market presence or a focus on specific regions. This lack of visibility in other markets could be seen as a missed opportunity for expansion, especially if the brand aims to diversify its market influence. The data suggests that while No.9 Sunflower Collection is a recognized name in the Massachusetts Pre-Roll category, its potential for growth could be significantly enhanced by exploring and penetrating additional markets. This strategic expansion could help mitigate the risk of over-reliance on a single market and provide a buffer against localized sales fluctuations.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Massachusetts, No.9 Sunflower Collection has experienced a notable shift in its market position over the past few months. As of October 2025, No.9 Sunflower Collection was ranked third, but by December 2025 and January 2026, it had slipped to fourth place. This change in rank is primarily due to the consistent performance of Cali-Blaze, which maintained its stronghold at the second position throughout the period, and Nature's Heritage, which improved its rank from fourth to third by December 2025. Despite a decline in sales from October 2025 to January 2026, No.9 Sunflower Collection remains a significant player, though it faces increasing competition from brands like Simpler Daze, which has shown a positive upward trend, moving from 14th to 6th place within the same timeframe. This competitive pressure highlights the need for No.9 Sunflower Collection to strategize effectively to regain its higher ranking and stabilize its sales trajectory.

Notable Products

In January 2026, the top-performing product from No.9 Sunflower Collection was the Doob Cube Mini - Variety Pre-Roll 20-Pack (7g) in the Pre-Roll category, maintaining its number one rank from December 2025 with sales of 3630 units. The Doob Cube Micro - Variety Pre-Roll 14-Pack (7g) held steady at the second position, consistent with its ranking in December. The Lemon Fatman Pre-Roll (1g) remained in third place, unchanged from the previous month. The Variety Pre-Roll 5-Pack (3.5g) experienced a slight drop in rank from third in December to fourth in January. A new entrant, the Blueberry Cupcake Pre-Roll (1g), debuted at fifth place, showing promising potential in the sales lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.