Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

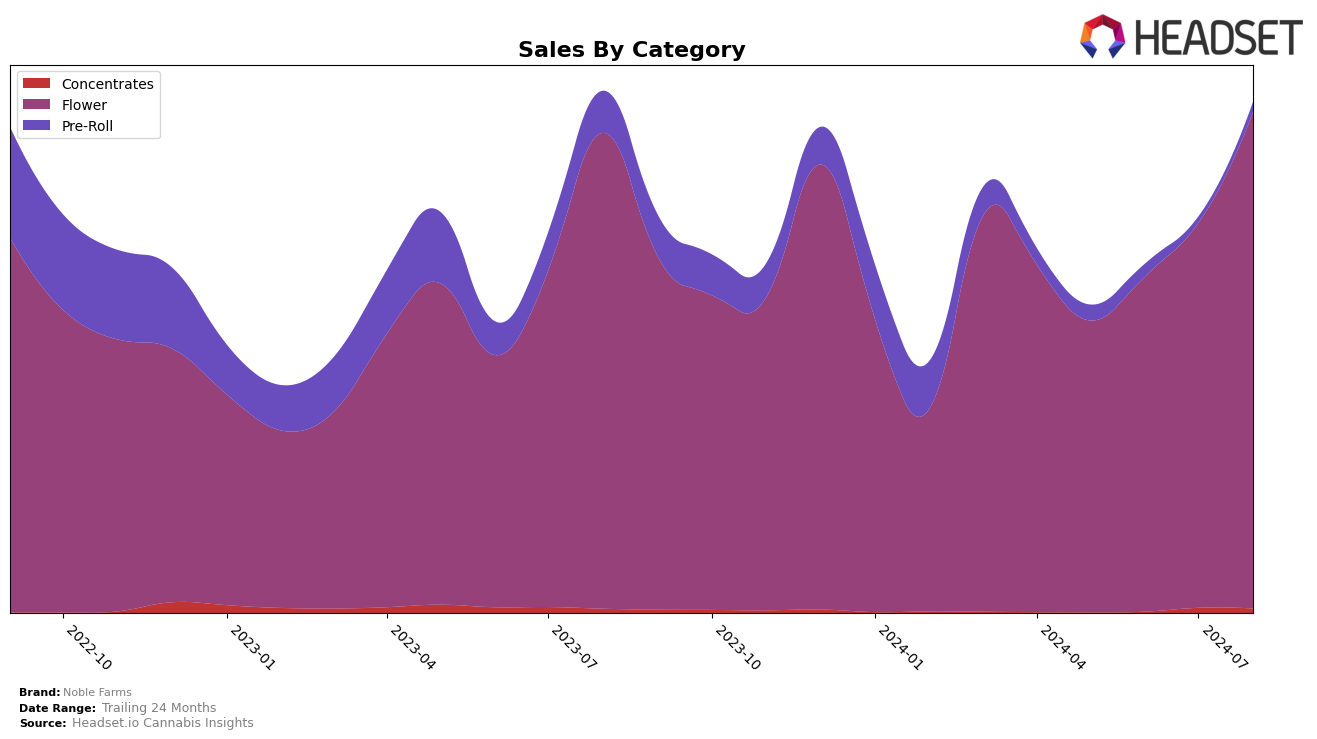

Noble Farms has shown notable performance improvements in the Oregon cannabis market, particularly in the Flower category. Over the span of four months from May to August 2024, the brand has climbed significantly in the rankings. Starting from a position outside the top 30 in May, Noble Farms moved up to 38th in June, 27th in July, and finally reached 23rd in August. This upward trajectory indicates a strong and consistent growth pattern, suggesting that the brand's strategies in product quality and market penetration are paying off. The increase in sales figures corroborates this trend, reflecting a positive reception among consumers in Oregon.

While Noble Farms has made impressive strides in Oregon, it's important to note that the brand did not appear in the top 30 rankings in the initial month of May, which could be seen as a slow start in a competitive market. However, their rapid ascent in subsequent months highlights their ability to quickly adapt and gain market share. This performance in Oregon's Flower category could be a bellwether for potential expansion into other states or categories. Observing how Noble Farms continues to perform in the coming months will be crucial for understanding their long-term viability and growth potential in a dynamic industry.

Competitive Landscape

In the competitive landscape of the Oregon Flower category, Noble Farms has demonstrated a notable upward trajectory in rank and sales over the past few months. Starting from a rank of 43 in May 2024, Noble Farms has climbed steadily to reach the 23rd position by August 2024. This consistent improvement is indicative of growing consumer preference and effective marketing strategies. In comparison, Meraki Gardens experienced fluctuations, dropping from 23rd in May to 33rd in June, but recovering to 21st by August. Similarly, Herbal Dynamics maintained a more stable rank, hovering around the mid-20s. Derby's Farm showed a decline in June but rebounded to 24th in August. Interestingly, Kaprikorn, which started strong in the top 10, saw a significant drop to 22nd by August. These dynamics suggest that while Noble Farms is gaining ground, the competition remains fierce, with brands like Meraki Gardens and Derby's Farm also showing resilience and potential for recovery.

Notable Products

In August 2024, the top-performing product from Noble Farms was Jack Herer x Silver Lining (Bulk) in the Flower category, securing the number one rank with sales of $2,455. Durban Poison (1g) followed closely in the second spot, showing a significant rise from its fourth position in June 2024. Jack Herer (3.5g) maintained a strong presence, ranking third, up from fifth in May 2024. Cap Junky (1g) experienced a decline, dropping to the fourth position from its peak as the top product in June and July 2024. Durban Poison (3.5g) rounded out the top five, indicating a consistent performance despite not being ranked in May and July 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.