Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

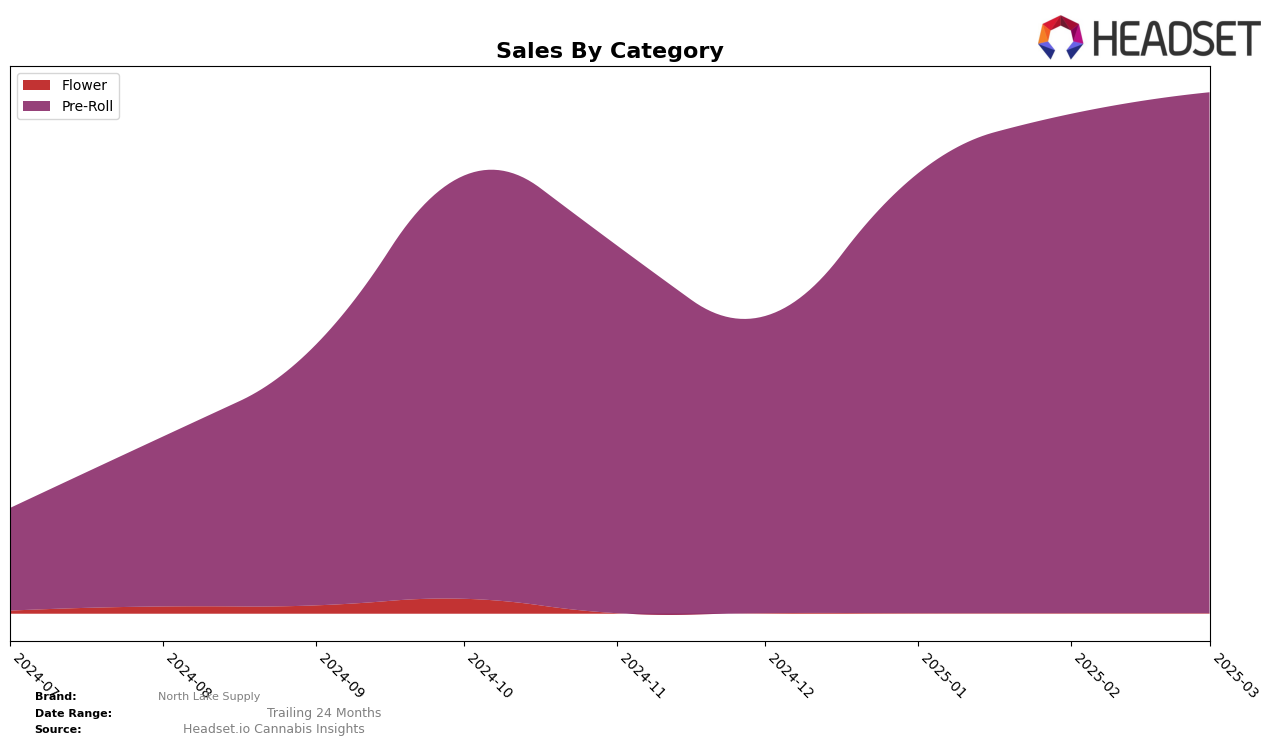

North Lake Supply has shown notable progress in the Pre-Roll category within the state of New Jersey. Starting from December 2024, where the brand was ranked just outside the top 30, they made a significant leap to position 23 by January 2025. This upward trajectory continued into February, with a further climb to rank 19, before stabilizing at rank 20 in March. This consistent performance improvement is reflected in their sales figures, which saw a steady increase from $79,255 in December to $139,008 by March. The brand's ability to break into the top 20 in New Jersey's competitive Pre-Roll market suggests a strong consumer reception and effective market strategies.

However, the absence of North Lake Supply from the top 30 rankings in December 2024 highlights the brand's initial struggle to establish a foothold in the New Jersey market. Their subsequent rise in rank indicates a successful strategic pivot or increased market penetration. While the brand's performance in New Jersey is commendable, further insights into other states or categories could provide a more comprehensive view of North Lake Supply's overall market standing. The data suggests that North Lake Supply is on an upward trend in New Jersey, but more information is needed to assess their performance across other markets and categories.

Competitive Landscape

In the competitive landscape of the New Jersey pre-roll category, North Lake Supply has shown a consistent upward trajectory in its rankings, moving from 31st place in December 2024 to 20th by March 2025. This improvement is indicative of a positive sales trend, as seen in the steady increase in sales figures over the months. In contrast, Doinks experienced fluctuating rankings, dropping out of the top 20 in January 2025 and only slightly recovering by March. Meanwhile, Flower by Edie Parker maintained a relatively stable position, consistently ranking within the top 20, although its sales showed a decline in February. Revelry Herb Company made a notable comeback in March, jumping from 43rd to 23rd, suggesting a potential resurgence. However, Legend emerged as a strong competitor, consistently improving its rank to match North Lake Supply by March. These dynamics highlight the competitive pressure in the market, with North Lake Supply needing to maintain its growth momentum to stay ahead of emerging and recovering competitors.

Notable Products

In March 2025, the top-performing product for North Lake Supply was Gummibears Pre-Roll 2-Pack (1g) in the Pre-Roll category, reclaiming the number one spot with sales reaching 2125 units. Turtle Taffy Pre-Roll 2-Pack (1g) held the second position, showing a notable decrease from its previous top rank in January 2025. Heavy Cream Pre-Roll 2-Pack (1g) debuted in the third position, indicating strong initial performance. Garlic Jam Pre-Roll 2-Pack (1g) dropped to fourth place after leading in February 2025. Lastly, Durban Poison Pre-Roll 2-Pack (1g) rounded out the top five, experiencing a decline from its third-place ranking in February 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.