Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

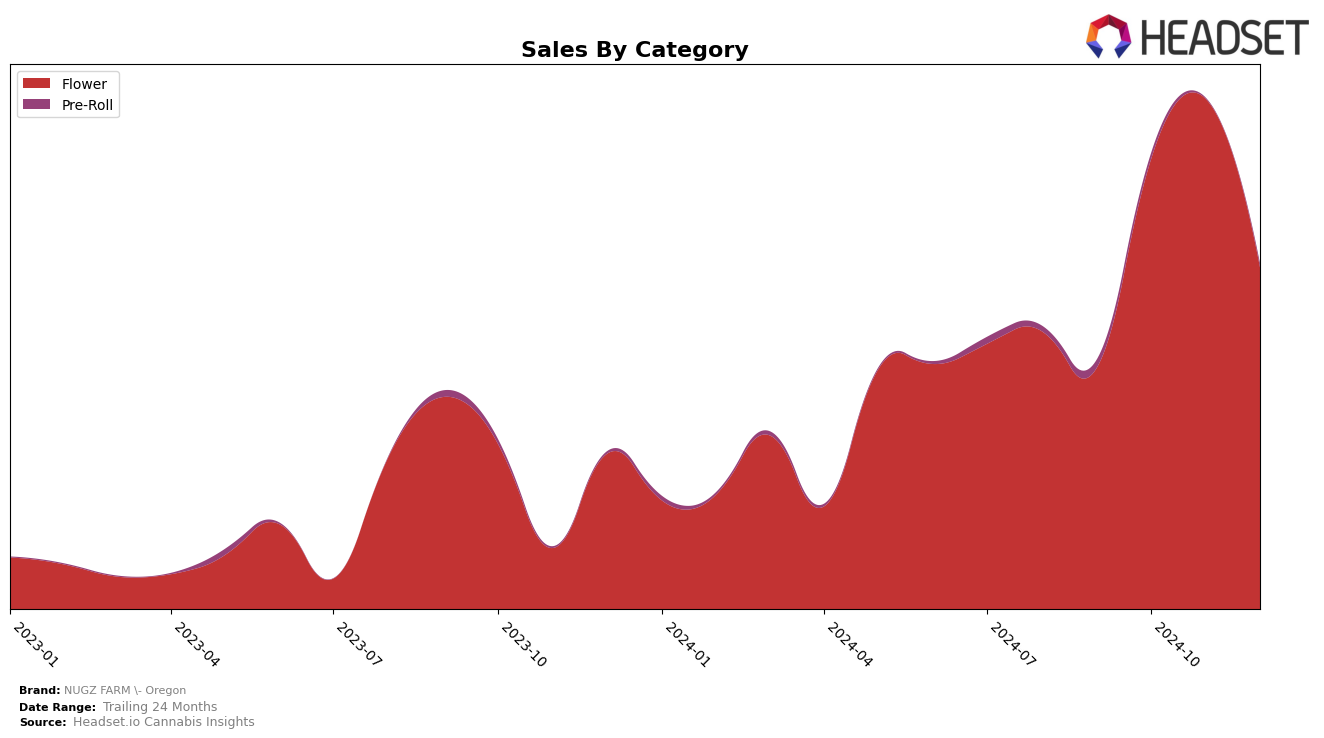

NUGZ FARM - Oregon has demonstrated a noteworthy performance trajectory in the Flower category within the state of Oregon. Over the last few months of 2024, the brand has shown significant fluctuations in its rankings. Starting from a position outside the top 30 in September, NUGZ FARM made a substantial leap to rank 21st in October and further improved to 18th in November. However, December saw a decline back to the 28th position. This movement highlights the brand's ability to capture market attention, although sustaining that momentum appears challenging, as evidenced by the drop in December.

The sales data for NUGZ FARM - Oregon reflects these ranking changes, with a notable increase from September to November, peaking in November before a dip in December. Such trends suggest that while the brand can achieve growth, maintaining a consistent presence in the top rankings is an area for potential improvement. It's important to note that being outside the top 30 in September indicates a possible previous lack of visibility or market penetration, which was effectively addressed in the subsequent months. However, the December ranking suggests that while initial gains were made, there is still work to be done to stabilize and sustain their market position.

Competitive Landscape

The competitive landscape for NUGZ FARM - Oregon in the Oregon flower category reveals dynamic shifts in brand rankings and sales performance. Notably, NUGZ FARM - Oregon experienced a significant rise in rank from 42nd in September 2024 to 18th in November 2024, before dropping to 28th in December 2024. This fluctuation highlights the competitive pressure from brands like Sugarbud, which improved its position from 77th to 30th over the same period, indicating a strong upward trend in sales. Meanwhile, The Heights Co. saw a decline from 9th to 27th, suggesting a potential opportunity for NUGZ FARM - Oregon to capture market share from a previously stronger competitor. Additionally, Excolo and Bald Peak showed varying performances, with Excolo maintaining a relatively stable rank and Bald Peak experiencing a notable improvement in December. These insights underscore the importance of strategic positioning and market responsiveness for NUGZ FARM - Oregon to sustain and enhance its competitive edge in the Oregon flower market.

Notable Products

In December 2024, the top-performing product for NUGZ FARM - Oregon was Santa's Secret (Bulk) in the Flower category, securing the number one rank with notable sales of 1522 units. Detroit Muscle (1g), also in the Flower category, followed closely in the second position. Detroit Muscle (Bulk) experienced a slight drop from its consistent second-place rank in October and November to third place in December. Black Maple (Bulk) maintained its fourth-place ranking from November to December. Banana Conda #4 (Bulk) re-entered the top five in December, moving up to fifth place after not being ranked in November.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.