Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

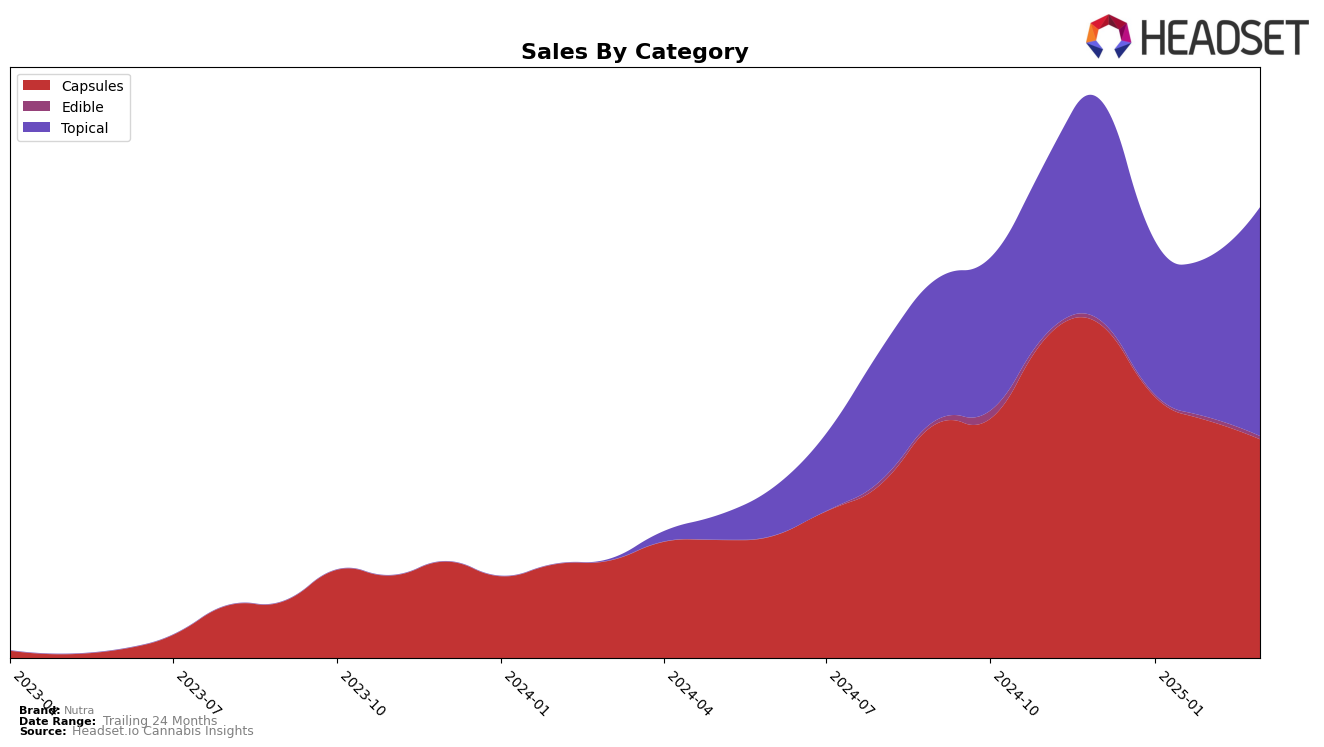

Nutra has demonstrated a consistent performance in the British Columbia market, particularly in the Capsules and Topical categories. In the Capsules category, Nutra maintained a steady 9th place ranking from December 2024 through February 2025, before improving slightly to 8th in March 2025. This indicates a stable presence and slight upward momentum in the market. In the Topical category, Nutra's ranking fluctuated between 4th and 5th place over the same period, ending March 2025 in 4th place. This suggests a strong foothold in the Topical category, with an ability to maintain a top-tier position.

In Ontario, Nutra's performance in the Capsules category shows a slight decline, moving from a consistent 13th place from December 2024 to February 2025, down to 14th in March 2025. This drop could indicate increased competition or a need for strategic adjustments. Conversely, in the Topical category, Nutra improved its standing significantly, climbing from 9th place in December 2024 to 6th by March 2025, despite not being ranked in January 2025. This upward trend in the Topical category highlights Nutra's potential for growth and adaptability in the Ontario market.

Competitive Landscape

In the competitive landscape of cannabis capsules in Ontario, Nutra has experienced a slight decline in its market position from December 2024 to March 2025. Initially ranked 13th, Nutra slipped to 14th by March 2025. This change in rank is indicative of a broader trend of decreasing sales, as seen from the drop from December's sales to March's figures. Notably, Pennies maintained a strong position, consistently ranking 11th until a minor dip to 12th in March, while Frank showed a positive trajectory, improving its rank from 15th in December to 13th by March. Meanwhile, Spring Hill Cannabis Co. remained stable at 15th, and Mood Ring entered the top 20 in March at 17th. These shifts suggest that Nutra faces increasing competition, particularly from brands like Frank, which are gaining traction, potentially impacting Nutra's sales and necessitating strategic adjustments to regain its competitive edge.

Notable Products

In March 2025, Nutra's top-performing product was the CBD Peppermint Lavender + MAG + Hyaluronic Acid Balm (3000mg CBD) in the Topical category, maintaining its first-place rank from previous months with sales of 836 units. The CBD Hemp Isolate Capsules 30-Pack (3000mg CBD) secured the second position, showing a slight improvement from its fourth-place ranking in January. The CBD Isolate Capsules 15-Pack (1500mg CBD) consistently held the third rank since February. The CBD:CBG 5:1 Sunbeam Capsules 30-Pack (3000mg CBD, 600mg CBG) experienced a drop in ranking from second in December to fourth in March. Lastly, the CBD Isolate Capsules 60-Pack (6000mg CBD) remained steady at fifth place throughout the analyzed period.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.