Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

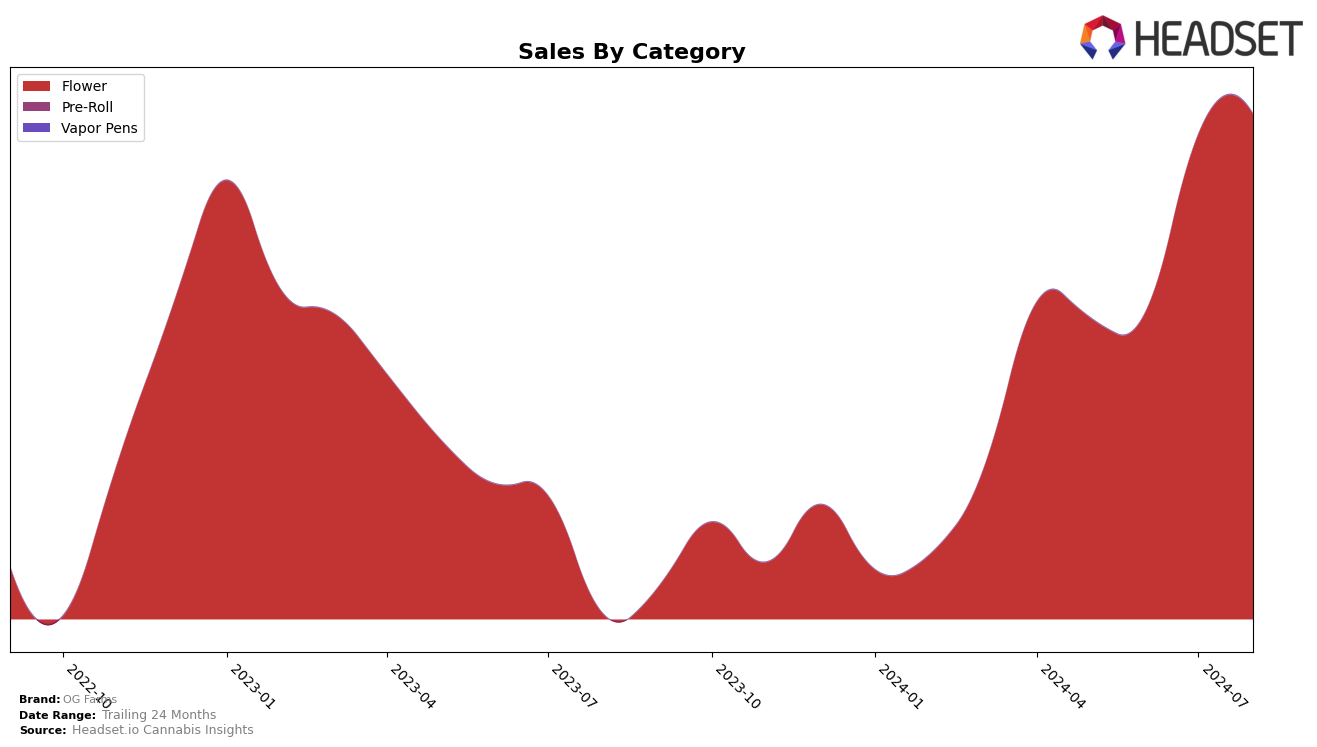

OG Farms has shown a notable upward trajectory in the Michigan market, particularly in the Flower category. Starting from a position outside the top 30 in May, the brand has gradually climbed the ranks, reaching the 18th spot by August. This consistent improvement highlights a positive trend for OG Farms, indicating growing consumer preference and market penetration. The sales figures also reflect this upward movement, with a significant increase from $1,019,186 in May to $1,705,351 in August. The brand's ability to break into the top 20 is a strong indicator of its rising popularity and competitive positioning within the state.

However, OG Farms' performance in other states and categories remains less clear, as they did not make it into the top 30 rankings in any other regions or product segments during the same period. This absence suggests that while the brand is gaining traction in Michigan, it may be facing challenges in expanding its footprint or achieving similar success elsewhere. The focus on Michigan could be a strategic move, but it also highlights areas where OG Farms might need to enhance its efforts to replicate its Michigan success in other markets. The data underscores the importance of regional strategies and the potential for targeted growth.

Competitive Landscape

In the Michigan Flower category, OG Farms has shown a notable upward trend in its rankings and sales over the past few months. Starting from a rank of 32 in May 2024, OG Farms climbed to 18 by August 2024, indicating a significant improvement in market position. This rise is accompanied by a substantial increase in sales, reflecting growing consumer preference. In contrast, LivWell experienced a decline from rank 8 in June and July to rank 16 in August, suggesting potential challenges in maintaining its market share. Meanwhile, Skymint and Redbud Roots have shown fluctuating but generally improving ranks, with Skymint stabilizing around rank 17 and Redbud Roots rising from 68 in May to 20 in August. Carbon also demonstrated strong performance, peaking at rank 12 in June before settling at rank 19 in August. These movements highlight a competitive landscape where OG Farms' consistent rise suggests effective strategies and growing consumer loyalty, positioning it favorably against its competitors.

Notable Products

In August 2024, the top-performing product for OG Farms was SFV Sunset (1g) in the Flower category, maintaining its first-place rank from July with notable sales of 13,651 units. SFV Sunset (Bulk) also held steady in second place, showing consistent performance with 13,537 units sold. GMO (Bulk) retained its third-place position from the previous month, demonstrating strong demand with 10,036 units sold. Donkey Butter (Bulk) experienced a decline, dropping from first place in May to fourth in August, with sales decreasing to 5,032 units. Kosher Kush (Bulk) remained in fifth place, continuing its steady performance with sales of 4,290 units.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.