Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

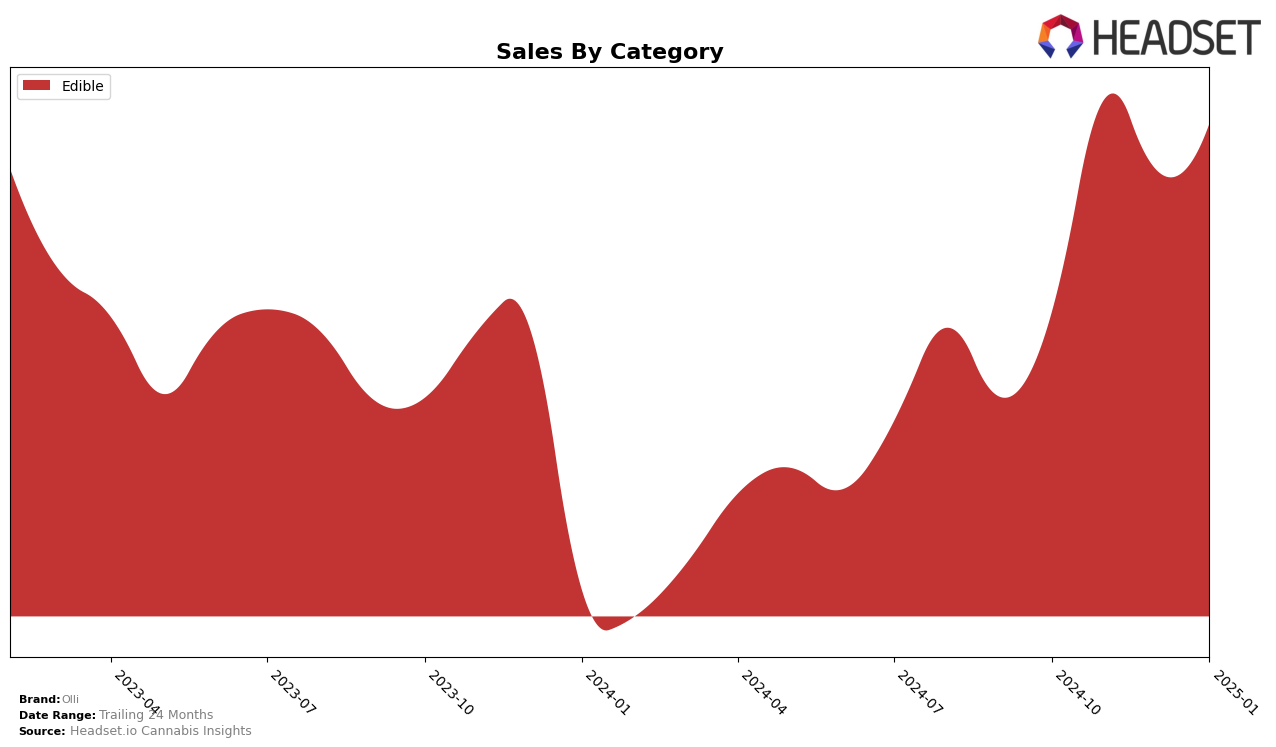

Olli's performance in the Edible category has shown varied results across different provinces. In Alberta, Olli has demonstrated a strong upward trajectory, climbing from the 21st position in October 2024 to the 10th by January 2025. This significant improvement is mirrored in their sales figures, which saw a substantial increase during the same period. Conversely, in British Columbia, Olli's rankings have remained relatively stable, hovering around the 18th to 20th positions. While this consistency suggests a steady presence in the market, it also indicates a potential area for growth as they have not broken into the top 15 in recent months.

In Ontario, Olli has maintained a solid performance, consistently ranking between 13th and 15th from October 2024 to January 2025. This stability in one of the largest markets reflects a strong consumer base and brand recognition in the province. The sales figures in Ontario also support this, showing a healthy volume, though there was a slight dip in January 2025. The absence of Olli in the top 30 rankings in other states or provinces highlights areas where the brand might focus on expanding its market presence or improving its competitive edge. Overall, while Olli shows promising growth and stability in certain regions, there remains potential for further expansion and market penetration.

Competitive Landscape

In the competitive landscape of the edible cannabis category in Ontario, Olli has shown a consistent yet modest improvement in its rankings over the past few months, moving from 15th place in October 2024 to 13th place by January 2025. This upward trajectory suggests a positive reception in the market, although Olli remains behind several key competitors. For instance, 1964 Supply Co has demonstrated a stronger performance, climbing from 13th to 9th place over the same period, indicating a more robust growth in consumer demand. Similarly, Bhang has maintained a steady position around the 10th rank, reflecting stable sales figures. Meanwhile, Fly North experienced a decline from 9th to 15th place, which could present an opportunity for Olli to capitalize on shifting consumer preferences. Despite the competitive pressure, Olli's gradual rise in rankings suggests potential for further growth, especially if it can leverage insights from these market dynamics to enhance its product offerings and marketing strategies.

Notable Products

In January 2025, the top-performing product from Olli was the CBG/THC 3:1 Razzy Pink Lemonade Soft Chew 4-Pack, reclaiming its number one rank with impressive sales of 16,596 units. The CBD/CBG/CBN/THC 1:1:1:1 Fizzy Peach Lemonade Soft Chew 4-Pack climbed to second place, showing a consistent upward trend from its fifth place in October 2024. The CBN/THC 3:1 Berry Dreamy Limeade Soft Chew 4-Pack, which held the top spot in December 2024, dropped to third place. The CBD:THC 2:1 Chocolate Brownie 2-Pack maintained its fourth position since November 2024. Meanwhile, Bursts- Feelin' Blue Raspberry Gummies 2-Pack experienced a decline, falling to fifth place from its third position in October 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.