Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

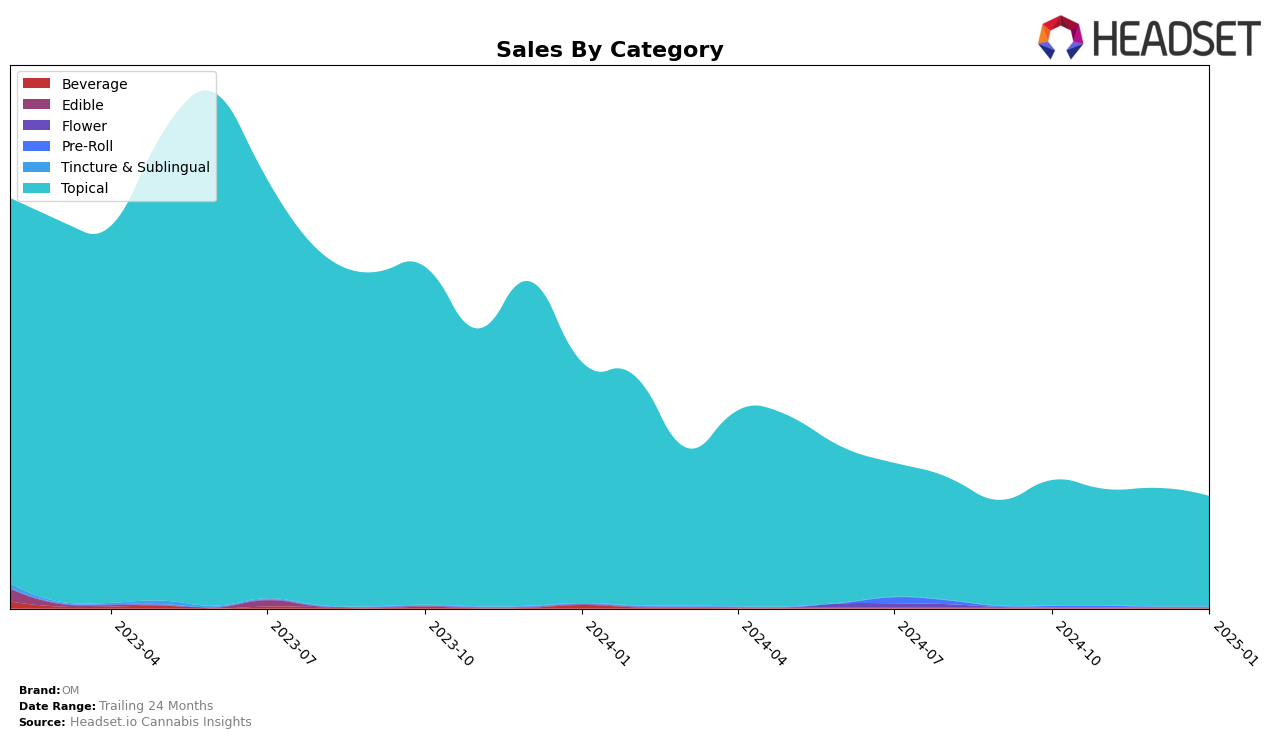

OM has shown a consistent presence in the Topical category in California, maintaining its rank at 11th place from October through December 2024, before slipping slightly to 12th place in January 2025. This stability indicates a steady demand for their products in the Topical segment, despite a minor decline in sales from $20,142 in October to $17,702 in January. Such consistency in ranking suggests that OM has a solid foothold in the market, although the slight drop in rank and sales could be an area to watch for potential challenges or market competition.

Interestingly, OM's absence from the top 30 rankings in other states or categories beyond California's Topical segment highlights both a potential area for growth and a challenge in expanding their market presence. The lack of rankings in other states could imply that OM's brand recognition or product distribution is more concentrated in California, which may limit their overall market expansion. However, this also opens up opportunities for strategic growth and diversification, should they choose to explore new markets or categories. Observing how OM navigates these possibilities could provide insights into their future market strategies and adaptations.

Competitive Landscape

In the competitive landscape of the California topical cannabis market, OM has maintained a steady presence, consistently ranking 11th from October to December 2024, before a slight drop to 12th in January 2025. This stability in rank suggests a loyal customer base, although there is a noticeable downward trend in sales, from October's peak to January's figures. In contrast, Autumn Brands consistently outperformed OM, holding the 9th position in October and November, and only dropping to 10th by January, despite a significant decline in sales over the same period. Meanwhile, Proof showed a notable improvement, climbing from 13th to 11th place by January, with a corresponding increase in sales, potentially posing a growing threat to OM's market share. Wild Bill's and Blue Sage also present interesting dynamics; Wild Bill's entered the top 20 in November and maintained its position, while Blue Sage appeared in December, indicating emerging competition that could impact OM's future standings.

Notable Products

In January 2025, the top-performing product for OM was CBD/THC 1:1 Arnica Pain Relief Epsom Bath Salts, reclaiming the number one rank with sales figures reaching 197 units. CBD/THC 1:1 Recovery Epsom Bath Salts rose to the second position, showing a significant improvement from its fifth rank in December 2024. Arnica Relief Bath Bomb climbed to third place, marking a steady ascent in the rankings since its introduction. Just Peachy Rosin Bath Bomb maintained its position at fourth, while CBD/THC 1:1 Lavender Epsom Bath Salts experienced a notable drop to fifth place from its consistent top rank in previous months. This shift indicates a dynamic market with changing consumer preferences within OM's product lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.