Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

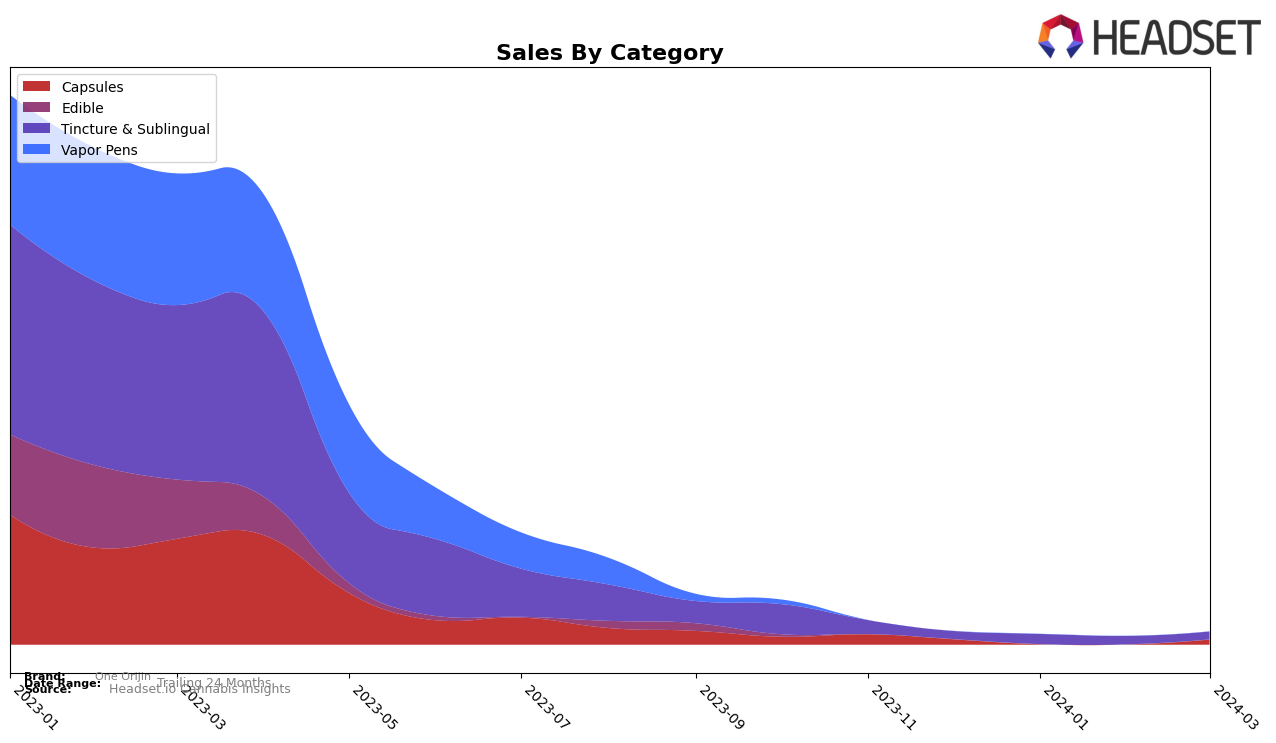

In the Ohio market, One Orijin has demonstrated a notable presence across different cannabis product categories, specifically in Capsules and Tincture & Sublingual. For Capsules, the brand experienced a slight decline in ranking from December 2023 to January 2024, moving from 9th to 11th place, and notably did not place in the top 30 for February 2024, which could suggest a temporary setback or increased competition. However, it's worth mentioning that they made a comeback to the 9th position by March 2024, indicating a potential recovery or effective strategic adjustments. This fluctuation in rankings, alongside a significant drop in sales from December 2023 to January 2024, followed by an absence of sales data for February, and a rebound in March, paints a picture of volatility but also resilience in the Capsules category for One Orijin.

Similarly, in the Tincture & Sublingual category within the Ohio market, One Orijin has shown consistency in its performance, maintaining a presence within the top 15 brands from December 2023 through March 2024. The rankings slightly fluctuated, moving from 12th to 11th and back to 12th place, which suggests a stable demand for their Tincture & Sublingual products among Ohio consumers. The sales data follows a more consistent upward trend from December 2023 to January 2024, indicating growing consumer interest or successful marketing efforts, before slightly declining in the following months. This consistent performance, despite minor dips, highlights One Orijin's solid standing in the Tincture & Sublingual category, suggesting a loyal customer base and effective brand positioning in Ohio's competitive cannabis market.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in Ohio, One Orijin has shown a consistent performance, maintaining its position in the middle of the pack from December 2023 through March 2024. Notably, Click has made a significant leap from not being in the top 20 in December to securing the 10th position by March, indicating a rapid increase in popularity and sales, surpassing One Orijin in the rankings. Meanwhile, Mary's Medicinals and Lighthouse Sciences have shown fluctuations in their rankings, but both have experienced moments of outperforming One Orijin, especially Lighthouse Sciences, which jumped ahead in March. Stanley Brothers, despite a slight drop in March, have consistently held a higher rank than One Orijin, showcasing stronger sales performance. This competitive analysis suggests that while One Orijin maintains a steady presence, it faces significant competition from both established brands and emerging players, highlighting the need for strategic initiatives to enhance its market position and sales trajectory.

Notable Products

In March 2024, One Orijin saw THC Full Spectrum Capsules 11-Pack (220mg) leading the sales with 131 units, marking its position as the top-selling product for the month. Following closely, the 8 Day THC Rich Tincture (880mg) made a notable entry, securing the second rank despite not being listed in the previous months. The CBD/CBG/THC 2:2:1 Relief Tincture (440mg CBG 440mg CBD 220mg THC, 30ml), consistently performing well, ranked third in March, dropping from its first-place position in February 2024. This shift indicates a dynamic change in consumer preferences within One Orijin's product range. Notably, the rankings reveal a growing interest in tinctures, with two products from this category making it to the top three for March 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.