Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

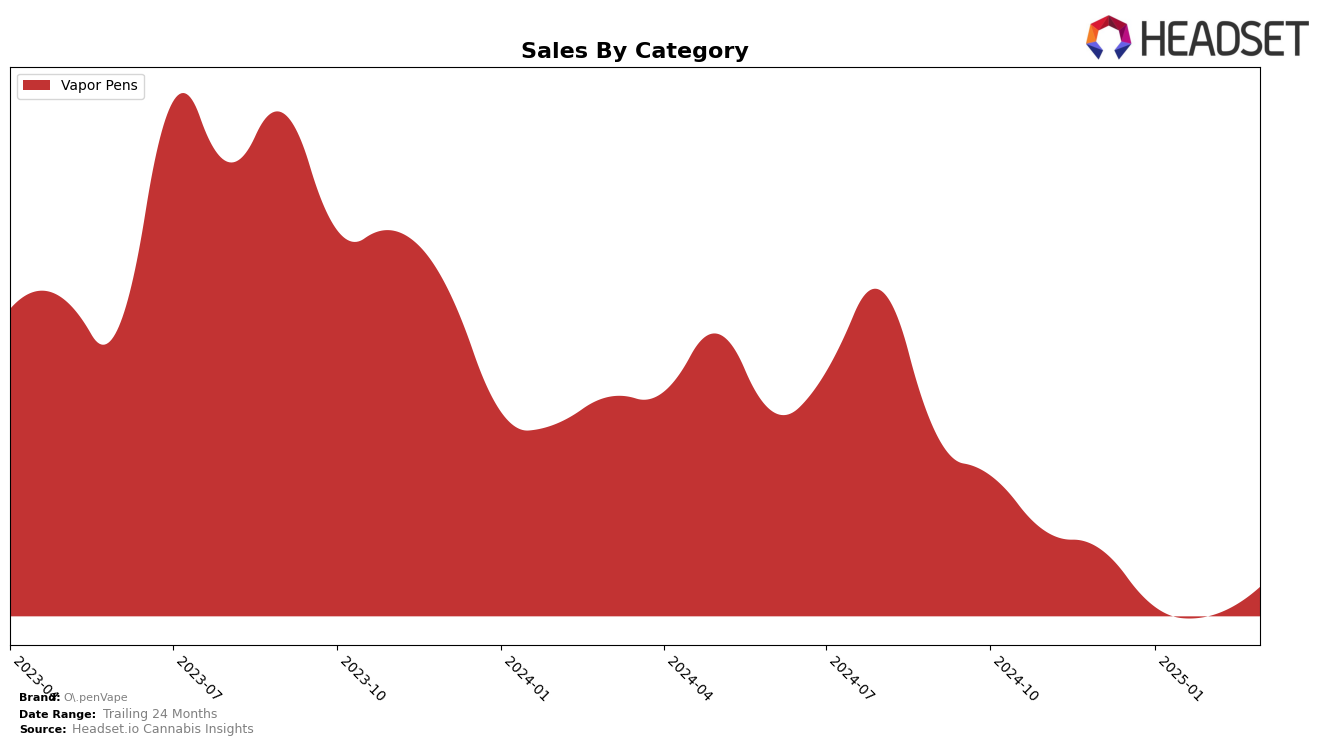

O.penVape has shown a consistent presence in the Colorado vapor pen market, maintaining a position within the top ten brands over the observed months. Starting at rank 8 in December 2024, the brand experienced a slight dip to rank 9 in January 2025 but quickly recovered to rank 7 in February and March 2025. This demonstrates a resilience and ability to bounce back in a competitive market. Despite a decrease in sales from December to February, the brand managed to increase its sales in March, which could suggest effective strategic adjustments or seasonal factors at play.

Interestingly, the data highlights that O.penVape did not appear in the top 30 rankings for any other state or category besides vapor pens in Colorado. This absence in other markets could indicate a focus on strengthening their position in Colorado or a potential area for growth if they choose to expand their presence. The lack of visibility in other categories may also suggest a specialization or strategic decision to concentrate efforts on their core product line. This focus could be a double-edged sword, offering both a stronghold in one area while potentially missing out on broader market opportunities.

Competitive Landscape

In the competitive landscape of vapor pens in Colorado, O.penVape has demonstrated resilience and adaptability amidst fluctuating market dynamics. As of March 2025, O.penVape holds the 7th rank, showing a slight improvement from its 9th position in January 2025. This upward trend is noteworthy, especially considering the competitive pressure from brands like Eureka, which has experienced a decline from 6th to 9th place over the same period. Meanwhile, Packs (fka Packwoods) consistently maintains its 6th position, indicating stable performance. Another significant competitor, Batch Extracts, remains strong at 5th place, highlighting the competitive challenge for O.penVape. Despite these challenges, O.penVape's sales have shown a recovery from a dip in January, suggesting effective strategies in regaining market share. The brand's ability to climb ranks amidst strong competitors underscores its potential for continued growth in the Colorado vapor pen market.

Notable Products

In March 2025, the top-performing product for O.penVape was the Cereal Milk Distillate Cartridge (1g) in the Vapor Pens category, maintaining its first-place ranking from February. The Daily Strains - Maui Wowie Cured Resin Cartridge (1g) secured the second position with notable sales of 1231 units, up from its absence in February's ranking. The Daily Strains - Tigers Blood Cured Resin Cartridge (1g) dropped one spot to third place. Craft Reserve - Strawberry Cheesecake Distillate Cartridge (1g) held steady at fourth, while Daily Strains - Ice Cream Cake Cured Resin Cartridge (1g) entered the top five for the first time. These shifts highlight dynamic changes in consumer preferences, with some products rebounding strongly after a dip in previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.