Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

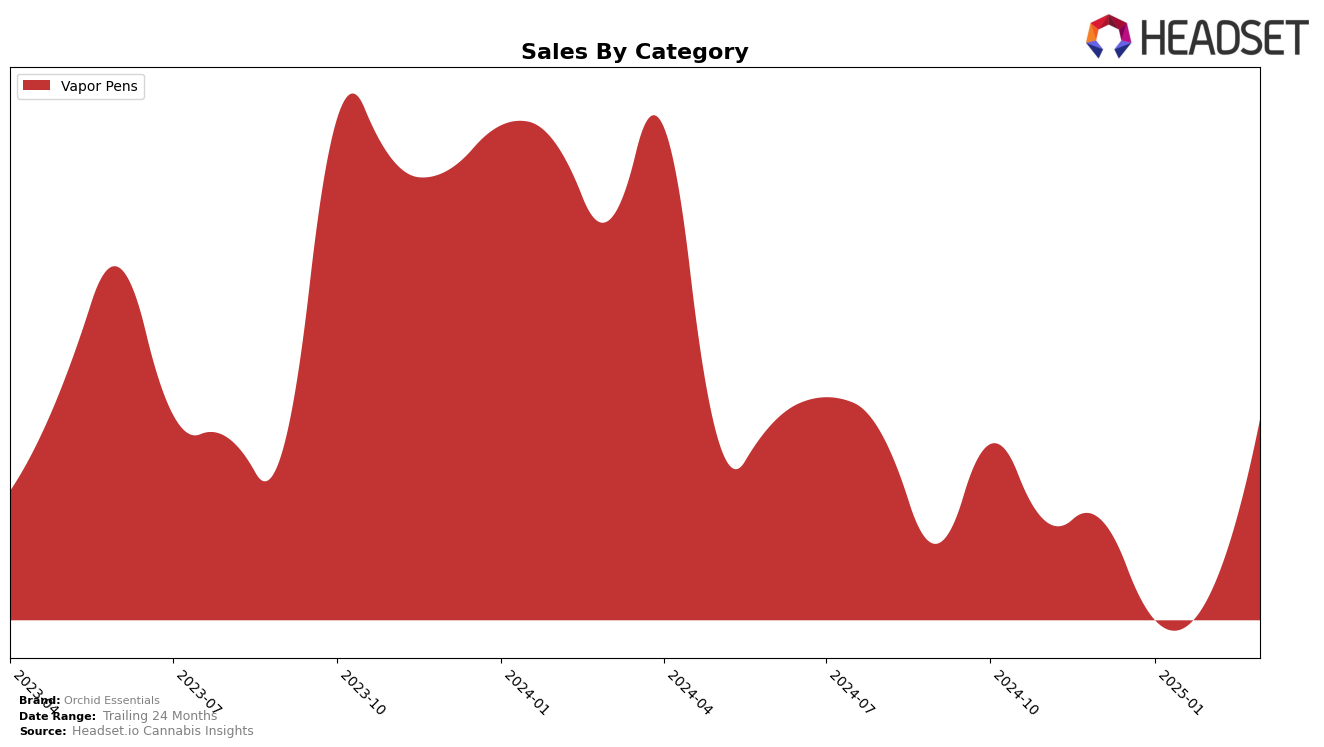

Orchid Essentials has shown varied performance across different states and categories, with notable movements in the vapor pen category. In Oregon, the brand experienced fluctuations in its rankings over the first quarter of 2025. Specifically, Orchid Essentials was ranked 29th in December 2024, dropped out of the top 30 in January 2025, re-entered at 28th in February, and concluded March at 30th. This inconsistency in ranking highlights a competitive market environment, where Orchid Essentials is striving to maintain a foothold. Despite these ranking shifts, the brand saw a positive uptick in sales from February to March, indicating a potential recovery or strategic adjustment that could be worth watching in the upcoming months.

While the vapor pen category in Oregon presents challenges, Orchid Essentials' situation in other states remains less clear due to the absence of rankings in the top 30. This absence could suggest either a strategic focus on specific markets or a need for increased brand penetration in those areas. The sales figures in Oregon, however, provide a glimpse into the brand's resilience and ability to bounce back, with March sales surpassing those of December. As Orchid Essentials navigates the competitive landscape, its performance in Oregon could serve as a bellwether for its strategies and potential growth in other regions. Observers might find it beneficial to keep an eye on how the brand adapts and maneuvers through the market dynamics in the coming months.

Competitive Landscape

In the competitive landscape of Oregon's Vapor Pens category, Orchid Essentials has shown a fluctuating performance in recent months, with its rank oscillating between 28th and 31st from December 2024 to March 2025. Despite a dip in sales in January 2025, Orchid Essentials saw a notable recovery by March 2025, surpassing its December sales figures. Meanwhile, Altered Alchemy experienced a decline in rank, dropping to 31st in March 2025, which may present an opportunity for Orchid Essentials to capitalize on its recovery momentum. Sessions Supply Co. (CA) showed a significant improvement, climbing from 41st to 29th, even surpassing Orchid Essentials in March, indicating a competitive threat. Disco Dabs maintained a relatively stable position, while Loot Bar consistently ranked higher than Orchid Essentials, suggesting a need for strategic adjustments to improve market positioning and capture greater market share.

Notable Products

In March 2025, the top-performing product from Orchid Essentials was the Classic - Blue Dream Distillate Cartridge (1g) in the Vapor Pens category, maintaining its first-place rank from February with a notable sales figure of 838 units. The Granddaddy Purple Distillate Cartridge (1g) climbed to the second position, showing a significant improvement from its absence in February's rankings. The Classic - Bubblegum Distillate Cartridge (1g) held steady in third place, despite a slight decrease in sales compared to previous months. The Classics - Acapulco Gold Distillate Cartridge (1g) consistently ranked fourth, showing steady sales growth. A new entry, Mango Super Silver Haze Distillate Cartridge (1g), debuted at fifth place, indicating a promising start in its category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.