Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

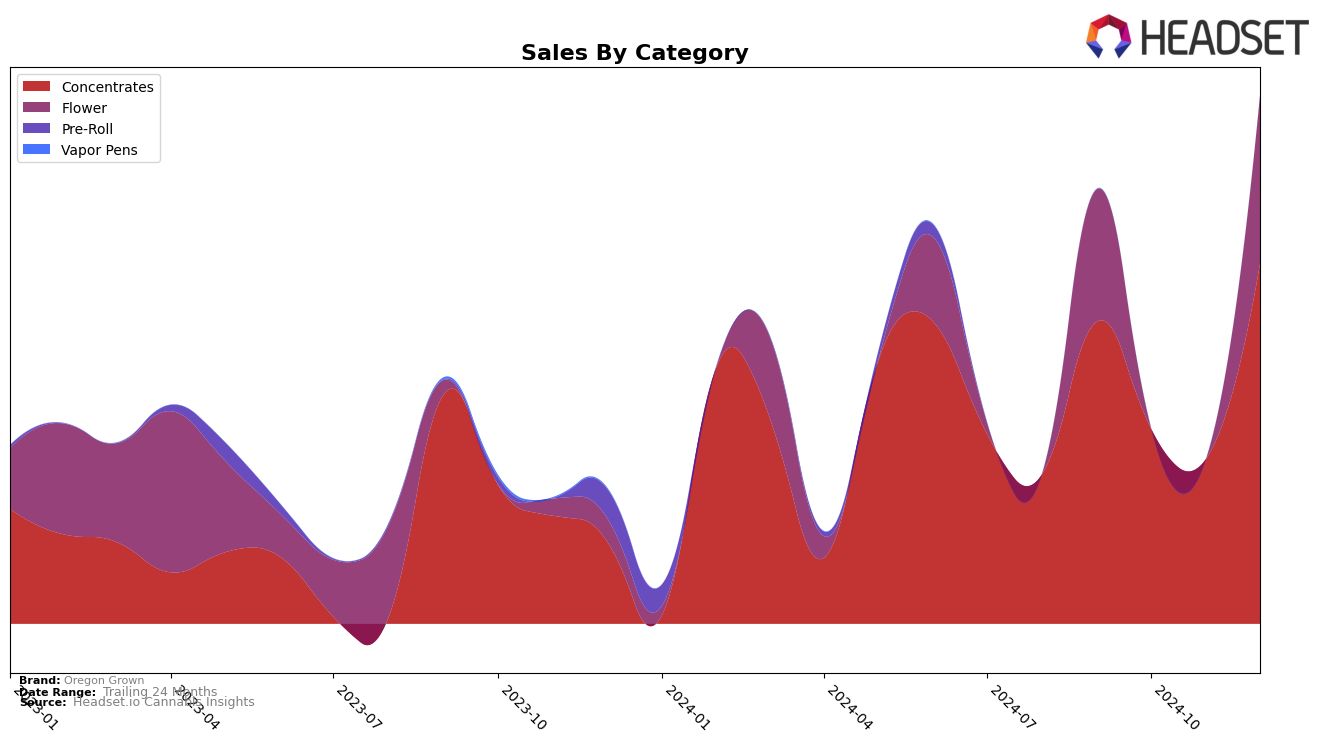

Oregon Grown has shown a dynamic performance across various states and categories, with notable fluctuations in its ranking over the last few months. In the Concentrates category within Oregon, the brand experienced a significant drop from a rank of 23 in September 2024 to 32 in October, and further down to 38 in November. However, December saw a remarkable recovery as the brand climbed back to the 21st position. This rebound in December, alongside a sales increase to $92,061, indicates a potential strategic adjustment or seasonal demand that favored Oregon Grown's offerings in this category.

Interestingly, the absence of Oregon Grown from the top 30 in October and November suggests challenges in maintaining consistent market presence during those months. This could be attributed to increased competition or shifts in consumer preferences. Despite these challenges, the brand's ability to re-enter the top 30 in December highlights its resilience and adaptability in the competitive landscape of cannabis concentrates. Observing such trends provides valuable insights into market dynamics and the brand's strategic positioning within Oregon's cannabis industry.

Competitive Landscape

In the highly competitive Oregon concentrates market, Oregon Grown has experienced notable fluctuations in its rankings and sales over the last few months. Despite a challenging period from September to November 2024, where its rank slipped from 23rd to 38th, Oregon Grown made a significant recovery in December, climbing back to 21st. This rebound coincided with a substantial increase in sales, suggesting effective strategic adjustments. In comparison, Higher Cultures maintained a relatively stable position, consistently ranking within the top 20, which could indicate a strong customer base or effective marketing strategies. Meanwhile, Elysium Fields also saw an impressive jump in December, moving from 30th to 20th, potentially posing a renewed competitive threat. Interestingly, High Tech experienced a dramatic drop from 7th to 22nd, which may reflect market volatility or shifts in consumer preferences. These dynamics highlight the importance for Oregon Grown to continue innovating and adapting to maintain its upward trajectory in this competitive landscape.

Notable Products

In December 2024, Oregon Grown's top-performing product was High Desert Sour Sage (Bulk) in the Flower category, maintaining its position as the number one ranked product with sales of 930.0 units. Dream Lotus Sugar (2g) in the Concentrates category saw a significant rise in its ranking, climbing from fifth place in November to second place in December, with sales reaching 739.0 units. GMO Berry Sugar Wax (2g), also in the Concentrates category, dropped from second place in November to third place in December, showing a slight decrease in sales. Platinum Kush Sugar (2g) held steady at fourth place, while Strawberry Cheesecake Sugar (2g) entered the rankings at fourth place as well. Overall, December sales saw a dynamic shift in rankings, particularly among Concentrates, indicating a competitive market for these products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.