Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

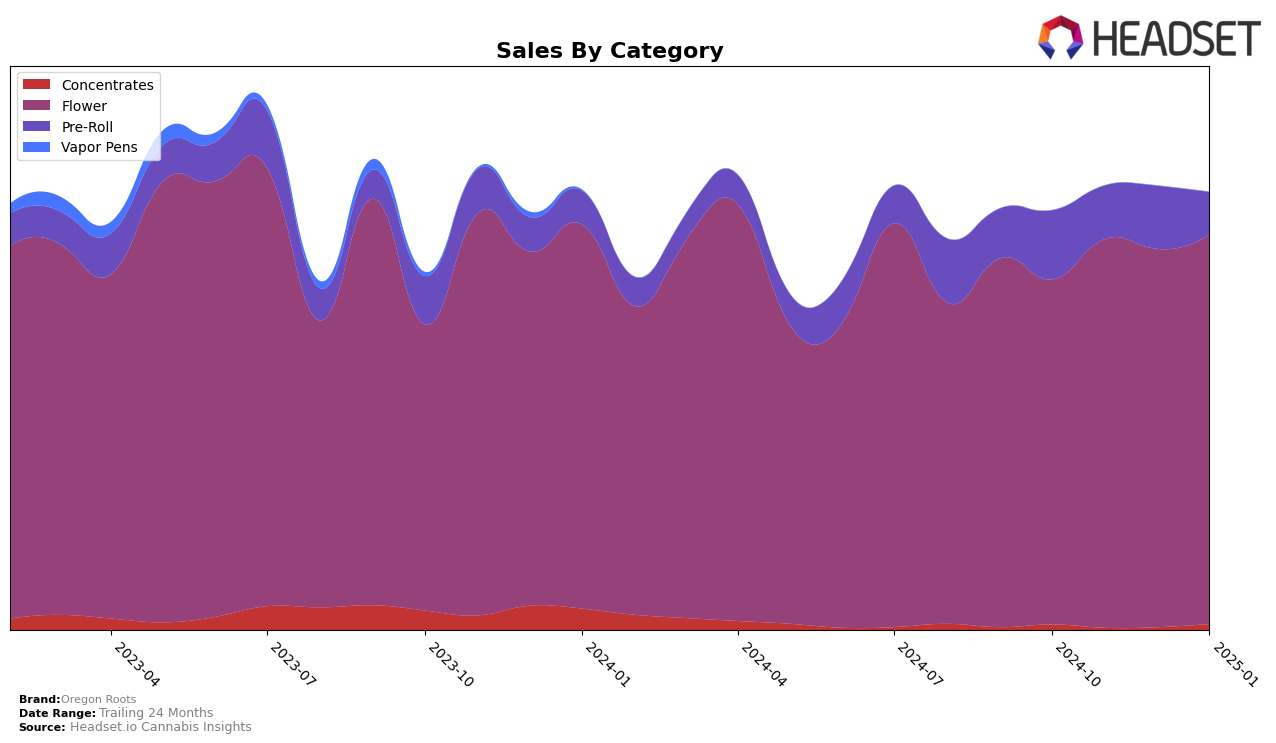

Oregon Roots has shown notable performance in the Flower category within the state of Oregon. Over the four-month period from October 2024 to January 2025, the brand has steadily improved its ranking, moving from 14th position in October to 11th by January. This upward trend in rankings is complemented by a positive trajectory in sales, with a notable increase from $365,222 in October to $412,393 in January. Such consistent improvement suggests a strengthening position in the Flower market, potentially due to product quality or increased consumer demand. However, the Pre-Roll category tells a different story, with rankings consistently outside the top 30, indicating a need for strategic adjustments in this segment.

In the Pre-Roll category, Oregon Roots has faced challenges in maintaining a competitive position in Oregon. The brand's ranking has fluctuated, starting at 42nd in October and dropping to 54th by January. This decline is mirrored in sales figures, which have decreased from $72,730 in October to $44,530 in January. Not being in the top 30 for this category suggests that Oregon Roots may need to reassess its offerings or marketing strategies to better capture consumer interest. The contrast in performance between the Flower and Pre-Roll categories highlights the brand's varying success across different product lines, underscoring the importance of targeted improvements in weaker areas to bolster overall market presence.

Competitive Landscape

In the highly competitive Oregon flower market, Oregon Roots has shown a steady upward trajectory in its rankings, moving from 14th place in October 2024 to 11th by January 2025. This consistent improvement in rank is indicative of a strong performance in sales, which have also seen a positive trend over the months. In contrast, William's Wonder Farms has made a remarkable leap from 78th to 13th place, suggesting a significant surge in their market presence, although still trailing slightly behind Oregon Roots. Meanwhile, Dog House experienced fluctuations, dropping to 27th in December before rebounding to 10th in January, indicating a volatile but ultimately successful strategy. Deep Creek Gardens maintained a strong position, consistently ranking within the top 10, which highlights the competitive pressure Oregon Roots faces from established players. Lastly, Focus North showed a similar pattern of improvement, peaking at 10th in December before settling at 12th in January, closely aligning with Oregon Roots' performance. These dynamics underscore the competitive landscape in Oregon's flower category, where Oregon Roots' steady climb in rank reflects its growing market strength amidst both emerging and established brands.

Notable Products

In January 2025, Oregon Roots saw the Bettie Page Pre-Roll (1g) emerge as the top-performing product, securing the number one rank with sales reaching 2682 units. Jaeger OG B-Buds (Bulk) followed closely in the second position, showing a slight improvement from its third place in December 2024. Dosi Sherbet (Bulk) entered the top rankings for the first time, claiming the third spot. The Blue Magoo Pre-Roll 2-Pack (1g) and Purple Punch (1g) completed the top five, ranking fourth and fifth respectively. Notably, January marked a significant reshuffling in product rankings, with several entries making their debut in the top positions compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.