Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

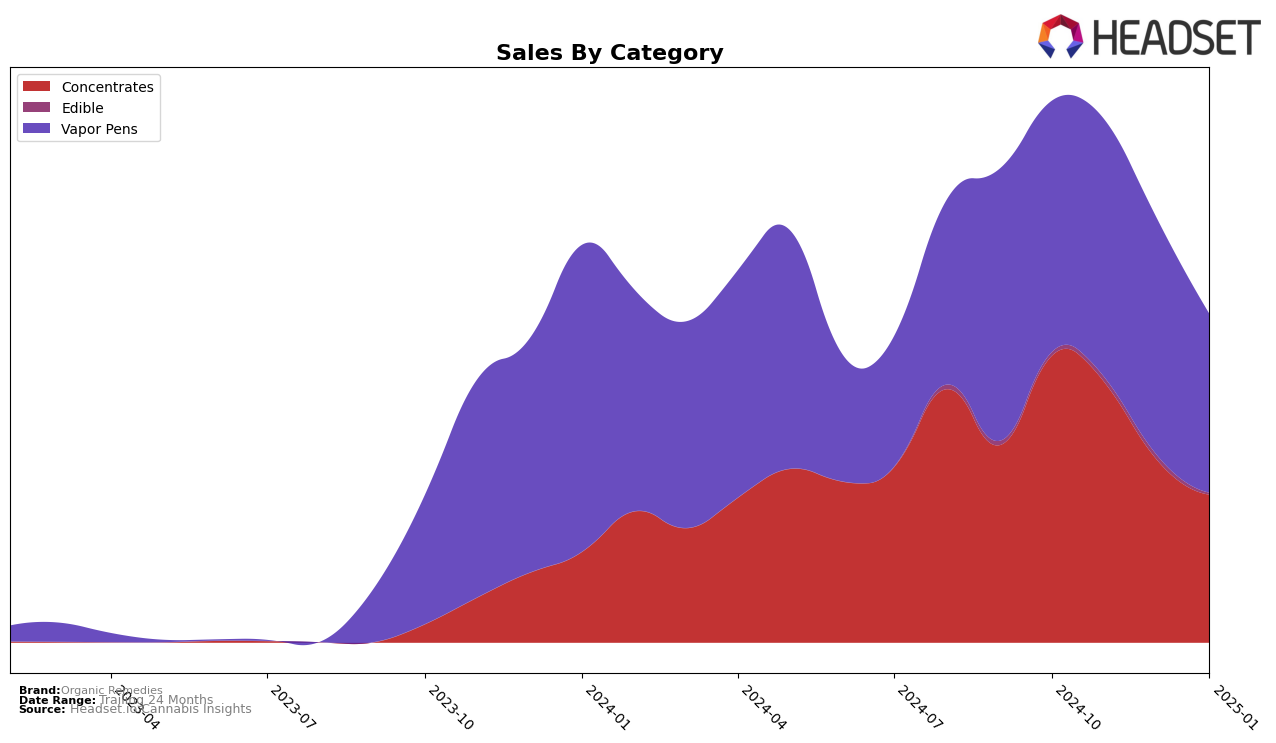

Organic Remedies has shown varied performance across different product categories in Maryland. The brand's ranking in the Concentrates category has seen a decline from 6th place in October 2024 to 13th place by January 2025. This downward trend is reflected in the sales figures, which have decreased steadily over the months. Despite this, Organic Remedies maintained a consistent presence in the top 30 for this category, illustrating its continued relevance in the market. In contrast, their performance in the Vapor Pens category has been relatively stable, with minor fluctuations in rankings from 21st to 23rd place over the same period. However, it is noteworthy that they did not fall out of the top 30, which could be seen as a positive aspect of their market strategy.

The data highlights that while Organic Remedies has managed to sustain its presence in the Vapor Pens category, the drop in rankings for Concentrates suggests potential challenges. The brand's ability to remain within the top 30 in both categories in Maryland is commendable, yet the decline in sales indicates possible areas for strategic improvement. This mixed performance across categories suggests that while Organic Remedies has a solid foundation, there are opportunities for growth and adaptation to regain higher rankings, particularly in the Concentrates segment. The brand's ability to navigate these challenges will be crucial for its future positioning in the market.

Competitive Landscape

In the Maryland vapor pens category, Organic Remedies has experienced fluctuations in its competitive standing, reflecting a dynamic market landscape. From October 2024 to January 2025, Organic Remedies saw its rank shift from 21st to 23rd, indicating a slight decline in its market position. This change is notable when compared to competitors like Flower by Edie Parker, which maintained a relatively stable rank around the mid-20s, and Equity Extracts, which improved its rank from 31st to 21st, surpassing Organic Remedies by January 2025. Despite these shifts, Organic Remedies' sales figures remained competitive, although they saw a decrease in January 2025, aligning with its drop in rank. Meanwhile, Black Label Brand showed a significant improvement in rank, moving from 32nd to 22nd, which might suggest increased competition for Organic Remedies in the coming months. These trends highlight the importance of strategic positioning and market responsiveness for Organic Remedies to maintain and potentially improve its standing in the Maryland vapor pens market.

Notable Products

In January 2025, the top-performing product for Organic Remedies was Gushers OG x Melonatta Cured Sugar in the Concentrates category, securing the number one rank with sales of $804. Sunset Octane x Grand Daddy Purps Distillate Cartridge, a Vapor Pens product, followed closely in the second position. The Papaya x Strawnana HTFSE Cartridge and Hash Solo Burger FSE Distillate Cartridge, both from the Vapor Pens category, claimed the third and fourth ranks respectively. Frosted Zin x Skywalker Live Badder, another Concentrate, rounded out the top five. Notably, these products were not ranked in the previous months, indicating a significant surge in their popularity and sales for January 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.