Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

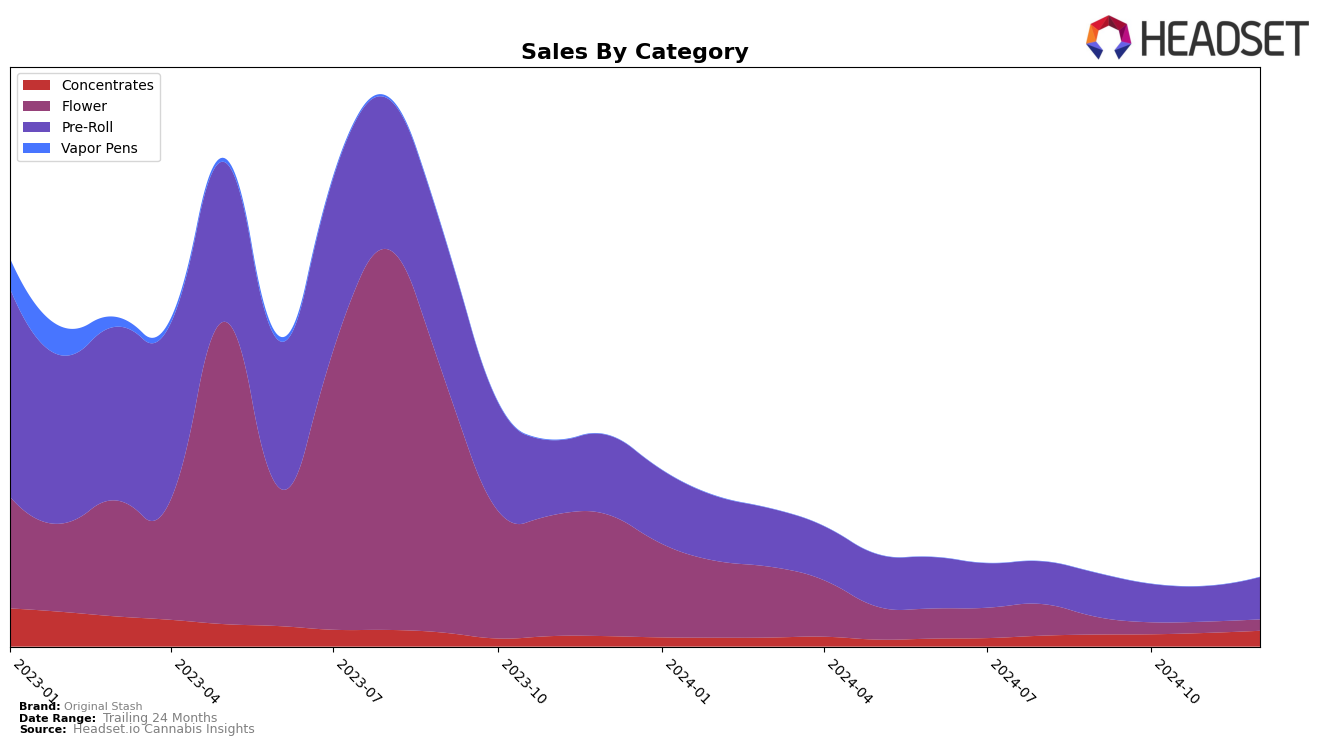

Original Stash has demonstrated notable performance in the Ontario market, particularly in the Concentrates category. Over the last few months of 2024, the brand has shown a positive trajectory, moving from a rank of 32 in September and October to breaking into the top 30 by December. This upward movement is indicative of a strengthening position, supported by a steady increase in sales from CAD 48,933 in September to CAD 64,540 by December. The consistent improvement in rank and sales suggests that Original Stash is gaining traction and potentially capturing more market share in the Concentrates category within Ontario.

In contrast, Original Stash's performance in the Pre-Roll category in Ontario presents a more challenging picture. The brand did not rank within the top 30 in any of the months analyzed, with rankings hovering in the low 70s. Despite this, there was a slight improvement in December, moving up to rank 69, accompanied by a rebound in sales to CAD 154,243. This suggests some recovery or strategic adjustments that may be starting to pay off. However, the lack of a top 30 ranking underscores the competitive nature of the Pre-Roll category and highlights the potential for further growth and strategic focus for Original Stash in this segment.

Competitive Landscape

In the Ontario Pre-Roll category, Original Stash has experienced fluctuations in its ranking over the last few months, with notable competition from brands like Nugz and Holy Mountain. Original Stash's rank improved from 73rd in November 2024 to 69th in December 2024, indicating a positive trend in sales performance. However, it remains behind Nugz, which consistently maintained higher ranks, peaking at 59th in November before slightly dropping to 67th in December. Meanwhile, Holy Mountain saw a decline from 54th in September to 71st in December, which may have provided an opportunity for Original Stash to improve its position. Despite these shifts, Original Stash's sales in December surpassed its October and November figures, suggesting a recovery and potential growth trajectory amidst the competitive landscape.

Notable Products

In December 2024, the top-performing product for Original Stash was OS Funk Fuel Pre-Roll 2-Pack from the Pre-Roll category, which ascended to the first rank with notable sales of 3135 units. Sativa OS Hash from the Concentrates category held the second position, maintaining a strong presence after leading in November. OS Rainbow Cake Pre-Roll 2-Pack secured the third place, showing consistent upward movement from the fifth position in September. The Sativa Pre-Roll 12-Pack dropped to fourth place, indicating a decline from its leading position in September. Lastly, the Indica Pre-Roll 12-Pack experienced a downward trend, falling to the fifth position after topping the charts in October.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.