Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

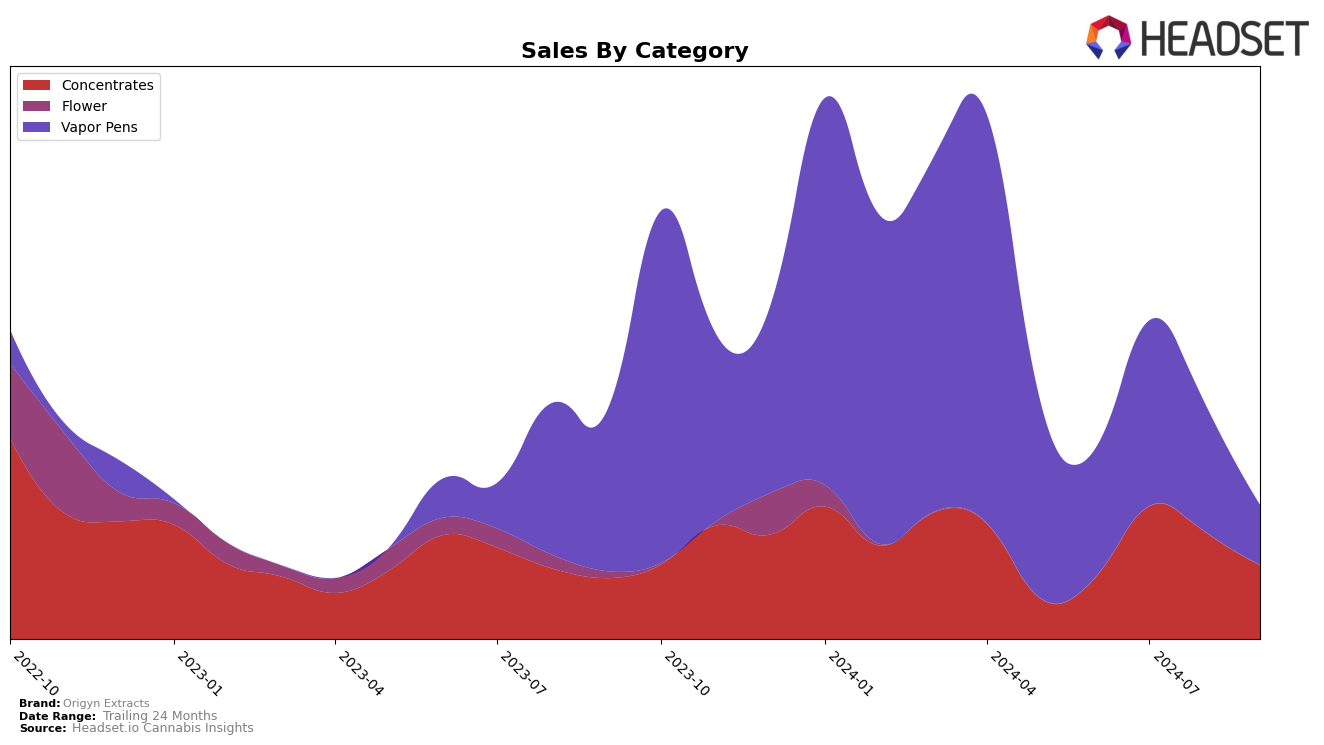

Origyn Extracts has shown varied performance across different states and product categories over recent months. In the Vapor Pens category within Massachusetts, the brand has struggled to maintain a consistent presence in the top rankings. Starting at 71st in June, they improved to 58th in July, but then fell back to 71st in August and further down to 77th in September. This fluctuation, coupled with a steady decline in sales from July to September, indicates a challenging market environment for Origyn Extracts in this particular category and state. The absence from the top 30 brands throughout these months highlights the competitive landscape they are facing.

Conversely, in the Concentrates category in Ohio, Origyn Extracts has demonstrated a more promising trajectory. They began the summer ranked 24th in June, climbed to 15th in July, and although they slipped back to 28th by September, they consistently remained within the top 30 brands. This indicates a relatively stable market presence compared to their performance in Massachusetts. The sales figures reflect this trend, showing a significant peak in July, which suggests a strong consumer response during that period. Despite the drop in subsequent months, maintaining a top 30 position indicates resilience and potential for growth in Ohio's concentrates market.

Competitive Landscape

In the Ohio concentrates market, Origyn Extracts has experienced notable fluctuations in its rankings and sales over the past few months, which may impact its competitive positioning. In June 2024, Origyn Extracts was ranked 24th, but it saw a significant improvement in July, jumping to 15th place. However, this momentum was not sustained, as it fell back to 24th in August and further down to 28th in September. This volatility contrasts with competitors like Avexia, which maintained a relatively stable presence, ranking 18th in June and July, peaking at 16th in August, before dropping to 24th in September. Meanwhile, Standard Farms showed a downward trend, starting at 16th in July and slipping to 27th by September. The sales data reflects these ranking shifts, with Origyn Extracts experiencing a peak in July but declining thereafter, indicating potential challenges in maintaining market share amidst strong competition. Understanding these dynamics can help Origyn Extracts strategize to stabilize and improve its market position.

Notable Products

In September 2024, the Champagne Kush Distillate Cartridge (1g) from Origyn Extracts maintained its top position in the Vapor Pens category, continuing its lead from August. The Jealousy Cold Cure Rosin Badder (0.5g) emerged as a strong performer, securing the second rank in the Concentrates category, with sales reaching 221 units. The Parma Delight Cold Cure Rosin Badder (0.84g) improved its position to third in the same category, moving up from fourth place in August. The Tahoe OG Distillate Cartridge (1g) dropped to fourth place in Vapor Pens from its previous second position in August. Meanwhile, the Motorhead #15 Wax (0.5g) saw a decline, falling to fifth place in Concentrates from its third-place ranking in August.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.