Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

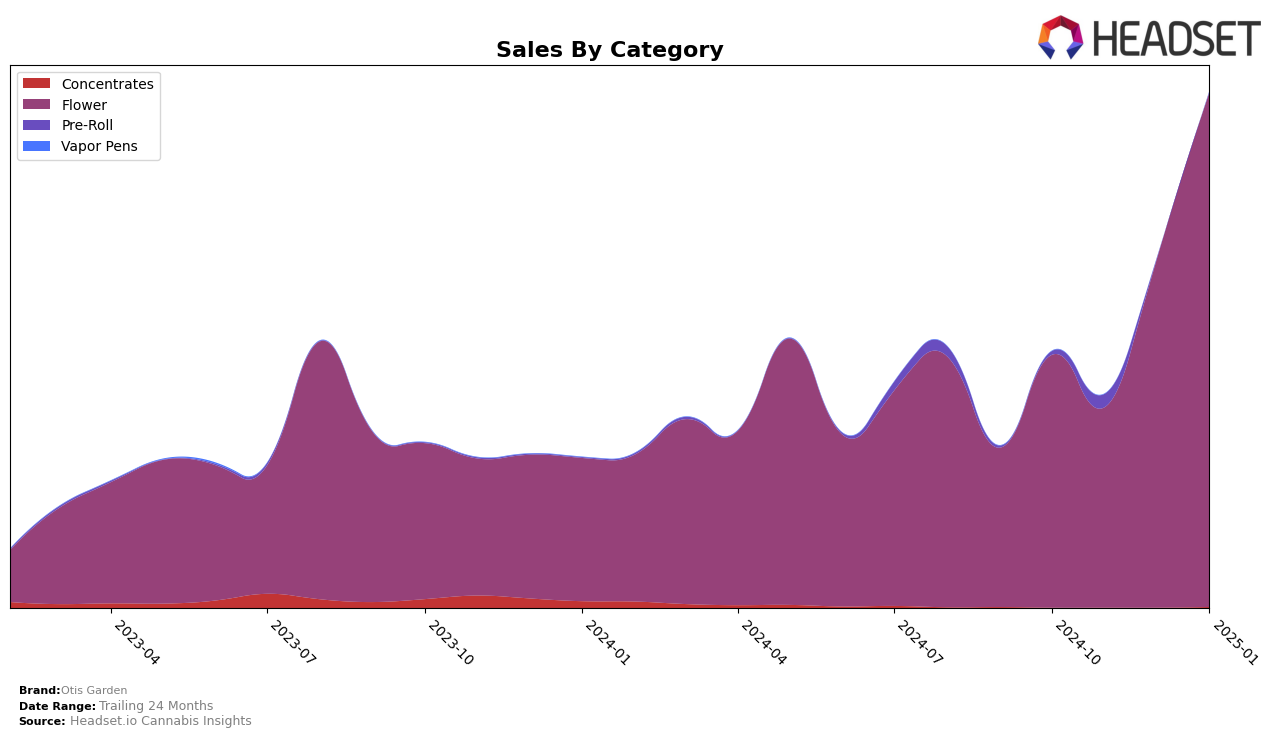

Otis Garden has demonstrated a notable performance trajectory in the Oregon market, particularly within the Flower category. Over the span from October 2024 to January 2025, the brand has shown a remarkable ascent, moving from the 9th position to clinching the top spot by January 2025. This upward movement is indicative of a strong brand presence and increasing consumer preference in the Flower category. The sales figures reflect this trend, with a substantial increase from $453,274 in October 2024 to $923,742 in January 2025, showcasing a robust growth trajectory. However, Otis Garden's presence in the Pre-Roll category is less prominent, as evidenced by its absence from the top 30 rankings in most months, except for a brief appearance at the 74th position in November 2024, highlighting an area for potential growth or strategic reevaluation.

While Otis Garden has made significant strides in Oregon, the data suggests there are opportunities for further market penetration and category expansion. The absence from the top 30 in the Pre-Roll category for most of the observed period suggests a potential gap in their product line or market strategy that could be addressed to enhance their overall market share. This contrast between their strong performance in the Flower category and their limited visibility in Pre-Rolls could guide future strategic decisions. The brand's capacity to leverage its Flower category success could be pivotal in exploring and capturing new growth opportunities across other categories and possibly other states or provinces.

Competitive Landscape

In the competitive landscape of the Oregon flower category, Otis Garden has demonstrated a remarkable upward trajectory in brand ranking and sales performance. Starting from a rank of 9th in October 2024, Otis Garden surged to claim the top spot by January 2025. This dramatic rise is particularly notable when compared to competitors such as Grown Rogue, which experienced a decline from 1st to 3rd place over the same period, and PRUF Cultivar / PRŪF Cultivar, which maintained a strong presence but slipped to 2nd place in January 2025. Otis Garden's sales growth trajectory, with a significant increase from November to January, underscores its growing market influence and consumer preference, positioning it as a formidable contender in the Oregon flower market.

Notable Products

In January 2025, Candied Oranges (Bulk) emerged as the top-performing product for Otis Garden, achieving the number one rank with notable sales of 11,604 units. Heir Heads (Bulk) followed closely as the second-ranked product, while Blueberry Muffin (Bulk), which had previously ranked fourth in December 2024, improved its position to third. Oops All Berries (Bulk) secured the fourth spot, maintaining a consistent performance. Cap'n Jack (Bulk), which held the top rank in December 2024, dropped to the fifth position in January 2025, indicating a shift in consumer preferences within the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.