Apr-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

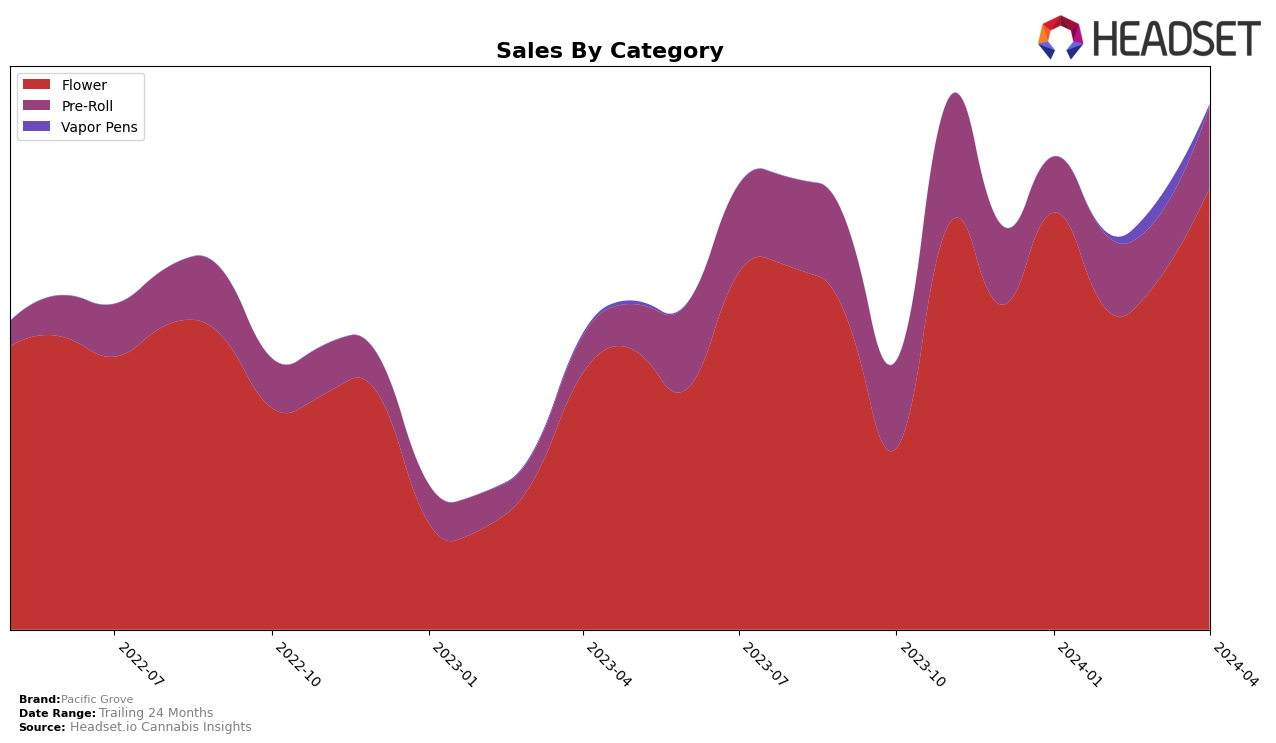

In Oregon, Pacific Grove has shown a fluctuating yet promising performance in the cannabis market, particularly in the Flower and Pre-Roll categories. For the Flower category, Pacific Grove managed to maintain its position within the top 30 brands from January to April 2024, even though there was a dip in February and March, ranking 36th and 35th respectively, before climbing back up to 27th in April. This rebound is indicative of a resilient brand strategy, capable of recovering from short-term setbacks. Notably, in January 2024, Pacific Grove's sales in the Flower category were reported at $243,786, highlighting a significant market presence. However, their performance in the Pre-Roll category tells a different story, with rankings consistently outside the top 30, peaking at 50th in February and April, which suggests a need for strategic adjustments to improve their market share in this segment.

Despite the challenges in the Pre-Roll category, the overall trend for Pacific Grove in Oregon shows a brand that is maintaining its foothold in the competitive cannabis market, especially within the Flower category. The fluctuation in rankings, particularly the improvement in April for the Flower category, could be attributed to various factors such as marketing efforts, product quality improvements, or changes in consumer preferences. The absence from the top 30 in the Pre-Roll category throughout the observed period, however, highlights a potential area for growth and development. Pacific Grove's ability to navigate the competitive landscape in Oregon, combined with strategic adjustments, could potentially lead to improved rankings across more categories in the future.

Competitive Landscape

In the competitive landscape of the Oregon flower cannabis market, Pacific Grove has shown a fluctuating yet promising performance in terms of rank and sales from January to April 2024. Initially ranked 26th in January, Pacific Grove experienced a slight dip in February and March, falling to ranks 36 and 35, respectively, before climbing back up to the 27th position in April. This trajectory indicates a resilience and potential for growth amidst fierce competition. Notably, Pacific Grove's competitors have had mixed fortunes. SugarTop Buddery made a significant leap from rank 50 in January to 25 in April, showcasing a remarkable improvement in market position. Conversely, Tao Gardens and Herbal Dynamics have shown volatility in their rankings but remained in closer contention to Pacific Grove, with Herbal Dynamics notably securing a higher rank by April. TH3 Farms, despite starting from a lower base, closely trails Pacific Grove in April, hinting at a competitive edge that could challenge Pacific Grove's position. This dynamic suggests that while Pacific Grove is maintaining a competitive stance, the brand must strategize effectively to capitalize on its gains and mitigate the risks posed by the upward trajectories of its competitors.

Notable Products

In April 2024, Pacific Grove saw Megaladon (Bulk) from the Flower category rise to the top spot, marking a significant increase in sales to 2898 units. Following closely was Moon Stone (Bulk), also in the Flower category, which moved down to the second rank after leading in the previous months. Love Affair (Bulk) maintained a steady performance, securing the third position, showing consistent popularity among consumers. Blood Bath #2 (Bulk) made its debut in the rankings at the fourth position, indicating a growing interest in new Flower category products. Lastly, Georgia Apple Pie Pre-Roll (1g) from the Pre-Roll category entered the rankings at fifth, highlighting the diversity in consumer preferences within Pacific Grove's product range.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.