Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

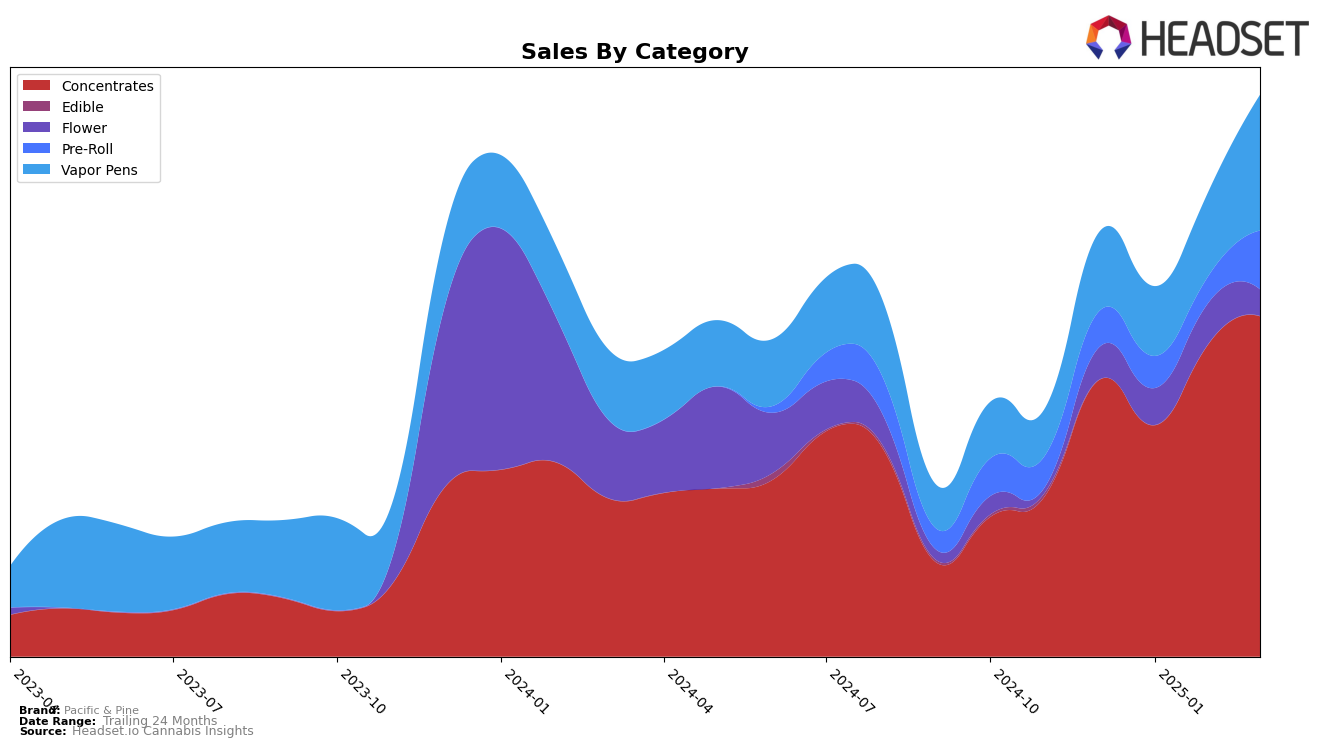

Pacific & Pine has demonstrated notable performance in the Washington market, particularly within the Concentrates category. Over the four-month period from December 2024 to March 2025, the brand has shown significant upward movement, improving its rank from 26th in December to 21st by March. This positive trend in rankings is accompanied by a steady increase in sales, with March 2025 sales reaching $96,205, marking a substantial recovery from the dip observed in January. Such a trajectory suggests a strengthening presence in the Concentrates category, highlighting Pacific & Pine's ability to capture market share in a competitive landscape.

In contrast, Pacific & Pine's performance in the Vapor Pens category within Washington is less prominent, as the brand did not secure a position within the top 30 brands for the months leading up to March 2025. This absence in the rankings indicates potential challenges or a lack of focus in this particular category, contrasting with their achievements in Concentrates. However, the brand did manage to achieve a rank of 85 in March, suggesting initial efforts to penetrate this segment. The disparity between the two categories highlights areas of opportunity for Pacific & Pine to explore strategic initiatives to enhance their presence in the Vapor Pens market moving forward.

Competitive Landscape

In the Washington concentrates market, Pacific & Pine has shown notable fluctuations in its rank and sales performance over the past few months. Starting from December 2024, Pacific & Pine was ranked 26th, and despite a dip to 27th in January 2025, it climbed to 20th in February before slightly dropping to 21st in March. This upward trend in February indicates a positive reception of their products, although the slight decline in March suggests a competitive market environment. In comparison, Dab Dudes has demonstrated a remarkable rise, moving from 60th in December to 22nd by March, showcasing a significant increase in consumer preference. Meanwhile, Slab Mechanix and Hitz Cannabis have maintained relatively stable positions, indicating consistent performance. The competitive landscape suggests that while Pacific & Pine is gaining traction, it faces stiff competition from brands like Dab Dudes, which are rapidly ascending the ranks.

Notable Products

In March 2025, Pacific & Pine's top-performing product was Blueberry Diesel Solventless Live Hash Rosin (1g) in the Concentrates category, achieving the number one rank with sales of 568 units. Super Boof Solventless Hash Rosin (1g) slipped to second place after consistently holding the top spot in previous months. Gorilla Cookies Live Hash Rosin (1g) entered the rankings at third place, showing a strong debut. Meanwhile, Orange Fruit Snax Live Rosin Cartridge (0.5g) secured fourth place in the Vapor Pens category. Hells Angels Live Hash Rosin (1g) maintained its fifth-place position, consistent with its February ranking.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.