Jul-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

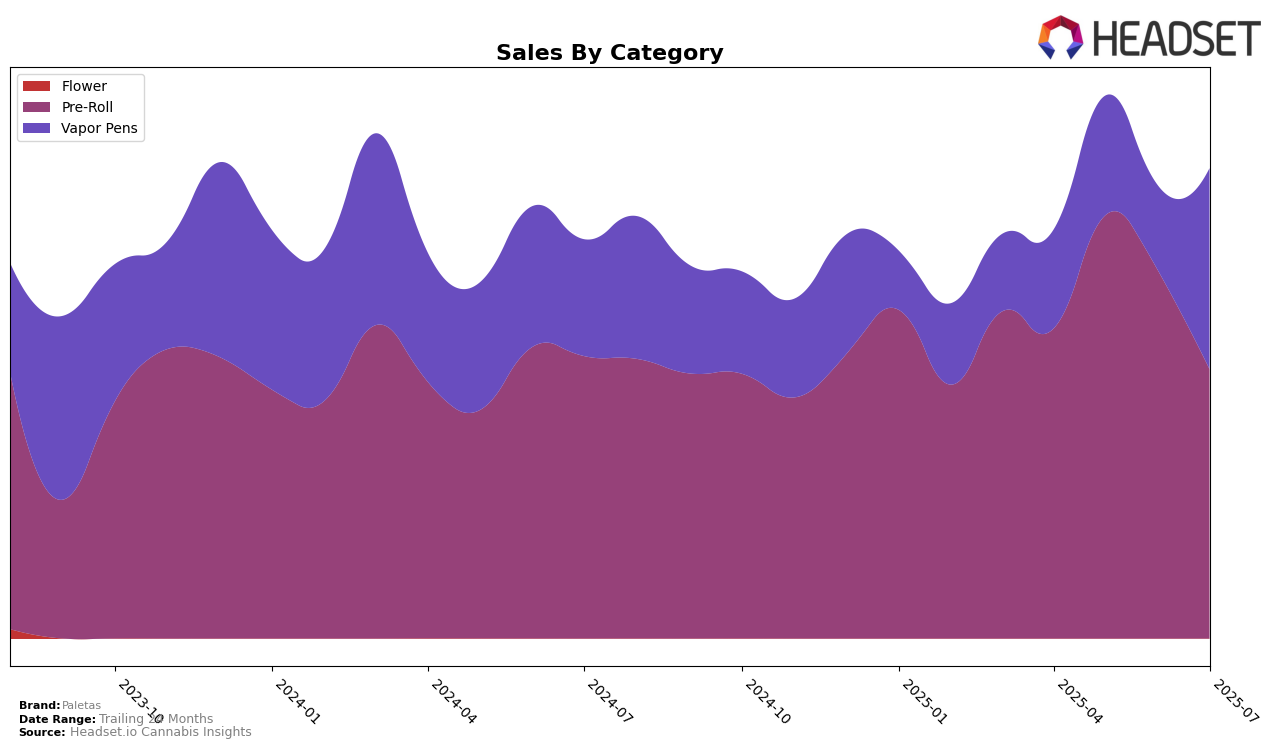

In the California market, Paletas has shown a dynamic performance across different categories. In the Pre-Roll category, the brand experienced notable fluctuations in its rankings, starting at 20th place in April 2025, climbing to 15th in May, and then slightly dropping to 16th in June, before falling to 25th in July. This suggests a competitive environment where Paletas has managed to maintain a presence in the top 30, although the downward trend in July indicates potential challenges. Meanwhile, in the Vapor Pens category, Paletas was not in the top 30 in April but improved its position from 56th in May to 45th in July, showcasing a significant upward trajectory, particularly with a substantial increase in sales in July.

While Paletas has maintained a foothold in the California Pre-Roll market, its performance in Vapor Pens highlights an area of growth potential. The brand's improvement in rankings from 56th to 45th over the months suggests that Paletas is making strategic gains in this category. However, the sales figures indicate that despite a dip in June, there was a remarkable recovery in July, which could point to successful brand strategies or market conditions favoring their products. The absence of Paletas from the top 30 in April in Vapor Pens emphasizes the progress made over the subsequent months, marking a positive development for the brand in this segment.

Competitive Landscape

In the competitive landscape of the California pre-roll category, Paletas has experienced notable fluctuations in its market position over the past few months. Starting in April 2025, Paletas was ranked 20th, but it climbed to 15th in May, showcasing a significant improvement in its competitive standing. However, by July, it had slipped to 25th, indicating a potential challenge in maintaining its upward momentum. This decline in rank coincided with a drop in sales from June to July. In comparison, Sunset Connect maintained a relatively stable presence, hovering around the 20th position, while CAM showed a progressive climb from 35th in April to 27th by July, reflecting a steady increase in sales. Meanwhile, Selfies experienced a decline in rank from 21st in April to 26th in July, despite a sales rebound in the latter month. Quiet Kings also demonstrated a positive trend, improving from 37th to 24th over the same period. These dynamics suggest that while Paletas has shown potential for growth, it faces stiff competition from brands like CAM and Quiet Kings, which are gaining traction in the market.

Notable Products

In July 2025, the top-performing product for Paletas was the Strawberry Shortcake Distillate Disposable (1g) in the Vapor Pens category, which ascended to first place with sales reaching 2930 units. The Grape Ape Moonrock Infused Mini Pre-Roll 5-Pack (2.5g) held a strong position, ranking second, though it dropped from its previous first place in April and May. The Jolly Apple Distillate Disposable (1g) debuted at third place, showcasing a notable entry into the rankings. Blueberry Pie Distillate Disposable (1g) and Watermelon OG Distillate Disposable (1g) rounded out the top five, ranking fourth and fifth respectively. This month marked a significant shift in the Vapor Pens category, with new entries and changes in rankings compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.